The world of cryptocurrency is abuzz. Traders are reporting an explosive increase in the number of crypto millionaires. A new report indicates that the number of people holding more than $1 million in crypto holdings has jumped 95% in the past year. The main reason: Bitcoin ETFs and surges in the value of many types of cryptocurrency.

A New Wave Of Millionaires

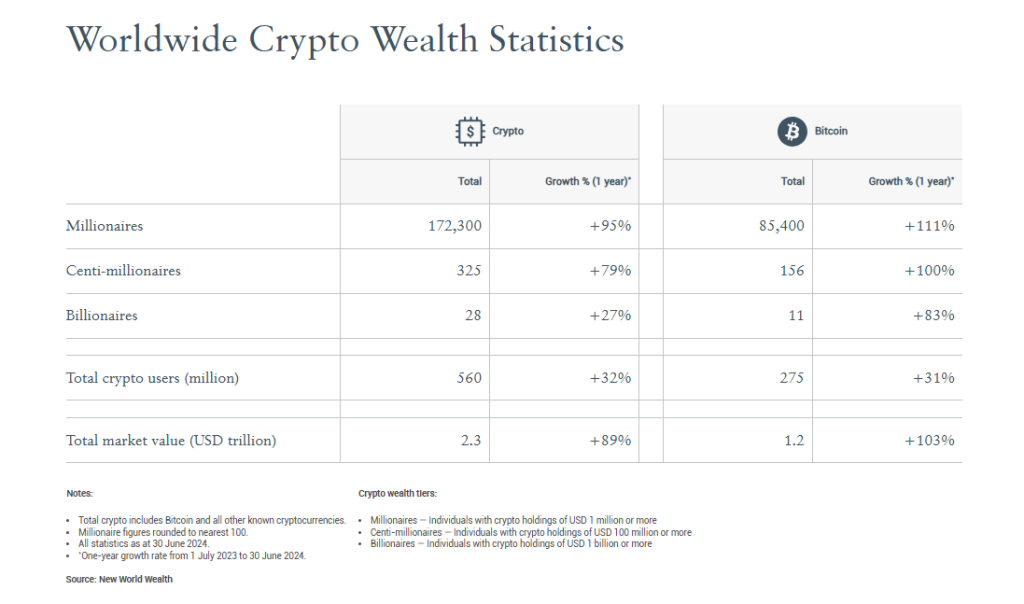

Crypto Wealth Report 2024 estimates that there are now about 172,300 crypto millionaires in the world, from 88,200 last year. Among those, Bitcoin millionaires increased even more drastically, doubling to 85,400.

The total market value of cryptocurrencies has also scaled to $2.3 trillion, up 89% from the previous year. It cited 325 crypto centi-millionaires with holdings of $100 million or more and an increase in the ranks of crypto billionaires to 28.

As the report explains, all this growth is a result of the recent approval of the spot Bitcoin ETFs in significant markets, bringing a sizable amount of institutional investment into Bitcoin.

Even though launched in January 2024, these ETFs have already accumulated over $50 billion, consequently firing up retail and institutional interest in Bitcoin. All the more crucial has been the consequent price rise of Bitcoin—by 142% in the last year alone to touch a peak of $73,000 in March.

The Changing Landscape Of Wealth

As the crypto market grows, so does the wealth demographic landscape. Many of these newly minted crypto millionaires seek to relocate to tax-friendly jurisdictions.

Analysts at Henley & Partners note that recently there is a meaningful increase in their clients seeking alternative residence and citizenship options. Singapore, Hong Kong, and the United Arab Emirates have become the favorite destinations for crypto investors due to supportive regulatory environments and favorable tax structuring.

The index lists and ranks the countries in terms of their approach to cryptocurrencies. He places the country at the top by mentioning the complete regulation and harmony with international standards in the city-state.

This is part of a broader trend wherein high-net-worth individuals are not only accumulating wealth but also making strategic moves into jurisdictions that will better position them to benefit from their wealth.

Institutional Interest And The Road Ahead

The reasons for this are manifold, not least of which is that the growth in the number of crypto millionaires, among other things, speaks not just to individual wealth but to a new disposition of the global financial landscape.

Big asset management companies like BlackRock have now accepted cryptocurrencies among their financial products, just like Fidelity. This institutional interest is quite likely to augment significant additional wealth generation for important crypto stakeholders.

Experts such as head of research at New World Wealth, Andrew Amoils, express that Bitcoin is still the principal leader to attract long-term investors. Of the six new crypto billionaires last year, five of them became such because of Bitcoin. This shows Bitcoin still captures a store of value and investment theme.

Whereas the crypto millionaires are still on the rise, the doors of the cryptocurrency market open towards yet another incomparable future. As more and more people get into this space and as the institutional adoption goes up, so is the potential to create wealth going to go up.

Featured image from Pexels, chart from TradingView