Bitcoin has recently seen a notable decline, dropping from a price above $64,000 on Monday to as low as $58,000 yesterday, marking a 10% decrease over two days.

This sharp downturn appears to have initiated concern among the crypto community, prompting various interpretations of the market’s behavior.

A recent report by CryptoQuant, an on-chain data provider platform, has illuminated the five key factors that might have contributed to this decline.

Short-Term Holders And Market Fragility

CryptoQuant’s analysis highlights five critical charts illustrating the market conditions before and during the recent price drop.

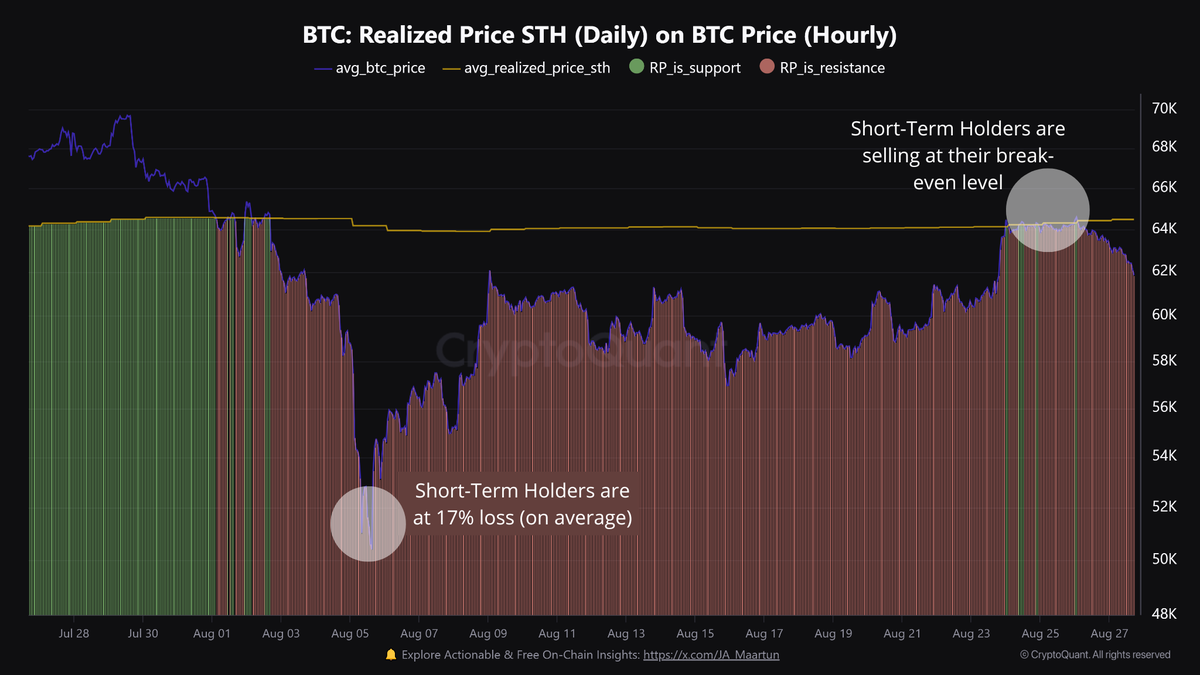

One of the primary factors identified by CryptoQuant is the role of short-term holders in creating a resistance level at their break-even price.

Earlier this month, Bitcoin’s price experienced another sharp drop, which left many short-term holders with an average loss of 17%. When the price recovered to its break-even point, these holders took the opportunity to sell, creating resistance that prevented further upward movement.

In addition to the behavior of short-term holders, the report also highlights the fragile environment created by traders speculating on higher prices. The open interest in Bitcoin futures rose from $13.5 billion to $17.9 billion, a 31% increase since August 5th.

Notably, positive funding rates indicated a premium on perpetual contracts, reflecting traders’ expectations of continued price increases. However, CryptoQuant revealed that this optimism created a precarious situation where any negative price movement could trigger significant instability in traders’ positions.

Spot Inflows And Market Liquidations

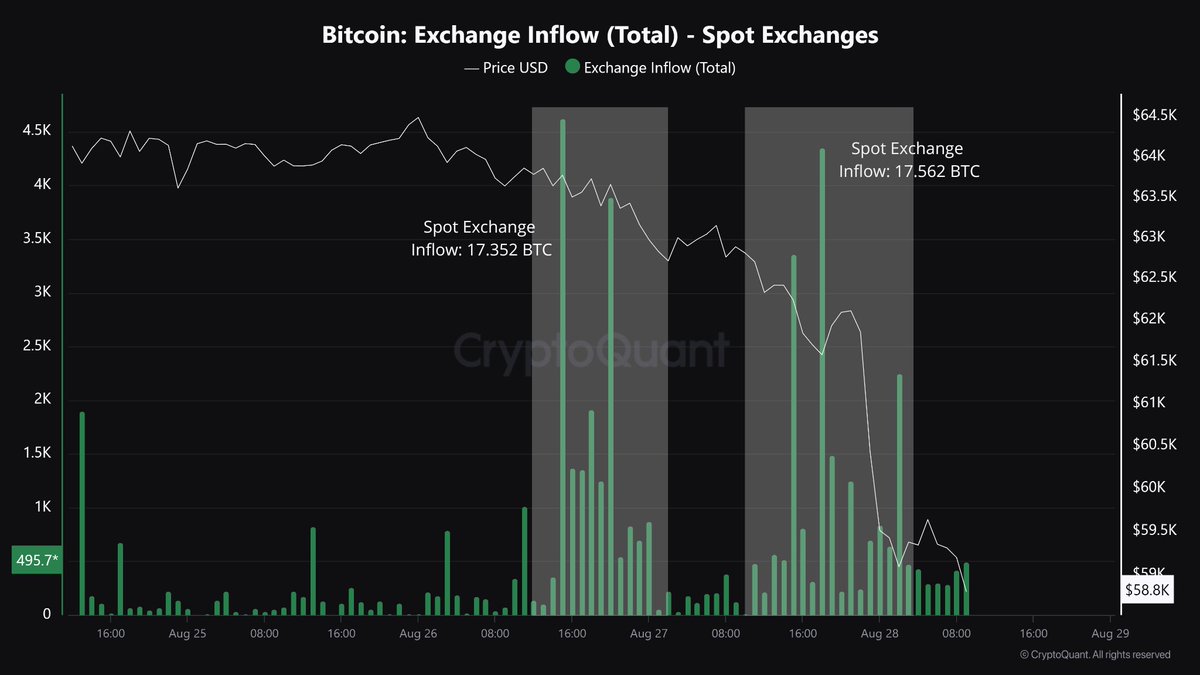

The report also notes an increase in spot inflows during the price decline, suggesting that large holders were moving their Bitcoin onto exchanges, potentially to sell. This added selling pressure exacerbated the fragile conditions in the futures market.

CryptoQuant disclosed that as the price continued to drop, long positions in both Bitcoin and Ethereum were liquidated at high levels—$90 million for Bitcoin and $55 million for Ethereum.

These liquidations, the highest since August 5th, reduced open interest by $2.2 billion, further destabilizing the market.

CryptoQuant concluded by noting:

That’s what happened with the recent price drop. For now, the market needs some time to stabilize, and we should monitor the on-chain data in the coming days.

Meanwhile, the past 24 hours haven’t been any different from the decline seen the days prior. Particularly, over this period, Bitcoin has continued to drop, currently down by 3.2% and with a current trading price of $59,841 at the time of writing.

Featured image created with DALL-E, Chart from TradingView