Amid Ethereum’s continuous free fall in price, renowned crypto analyst Michael Van De Poppe highlighted the asset’s current weakness in a post on X earlier today and when there could be a potential rebound.

Van De Poppe’s outlook comes at a time when Ethereum, the second-largest cryptocurrency by market capitalization, has continued to experience significant downward pressure, much like its counterpart, Bitcoin. In the past 24 hours, ETH has seen a decline of 3.7%, bringing its current trading price to $2,491.

Ethereum Outlook: When Will A Price Recovery Happen?

Van De Poppe noted in the post that Ethereum was rejected at the 0.046 BTC level and is now approaching high timeframe support areas.

The analyst mentioned the possibility of a bullish divergence forming, which could lead to a rally later this week or next. However, this potential recovery is contingent on ETH finding support and reversing its current trajectory.

$ETH is super weak, it remains to be the case.

Rejected at 0.046 BTC and is currently falling towards HTF support areas. There might be a case of a bullish divergence standing up, but then it should be rallying from later this week into next week. pic.twitter.com/liVwA7moSm

— Michaël van de Poppe (@CryptoMichNL) August 28, 2024

Another crypto analyst, Javon Marks, shared a more optimistic outlook for Ethereum, drawing parallels with Bitcoin’s recent performance. Marks suggested that Bitcoin’s earlier successful breakout above $67,000 hints at what’s next for ETH.

He speculated that if Bitcoin could continue to climb, it could pave the way for Ethereum to reach its target of $4,811 or higher. However, this potential recovery depends on Bitcoin’s ability to maintain its upward momentum and break above key resistance levels.

Marks noted:

Bitcoin climbing even more for ETH’s ‘following’ fulfillment to $4811.6 could result BTC breaking above $67,559, which opens up $116,000+ and much, much more room to lead the crypto market into heightened bullish phases. Simplicity.

Market Liquidations Surge As Traders Bet On Rising Prices

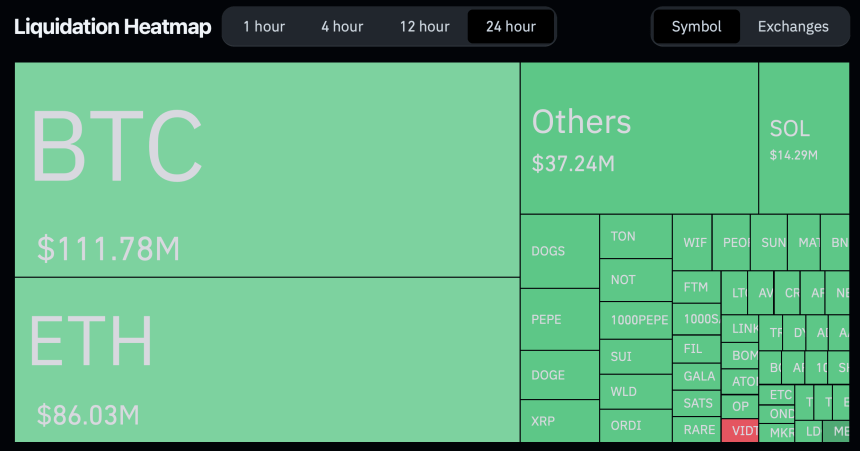

Meanwhile, the recent price drops in Ethereum and Bitcoin have significantly impacted traders, with many being caught off guard by the sudden downturn.

According to data from Coinglass, over 92,000 traders were liquidated in the past 24 hours, resulting in total liquidations of $325.03 million. Ethereum accounted for $86 million of these liquidations, with $67.90 million coming from long positions.

This suggests that many traders expected ETH to rise in price, only to be met with the opposite outcome. Bitcoin, too, saw substantial liquidations, accounting for $111.78 million of the total.

Similar to Ethereum, the majority of these liquidations were from long positions, indicating that many traders did not anticipate the price decline.

Featured image created with DALL-E, Chart from TradingView