Bitcoin has suffered its second worst monthly close in the year 2024 after completing August with 8.6% losses. This falls short only to April losses when the price fell 14.76% in one month. As this red close has shaken investors, mixed feelings have followed the month of September. While some expect the Bitcoin price to recover during this time, others expect that the bearishness will continue, with one analyst expecting a significant drop in price.

September To Witness Another Bitcoin Price Drop?

A crypto analyst who goes username @thedefivillian on the X (formerly Twitter) platform outlined a possible price crash coming for Bitcoin. The crypto analyst points out that the last two months have seen massive drops in price for the pioneer cryptocurrency and September will not be any different.

More specifically, the crypto analyst points out that the 5th of each month has seen a price crash. The first was on July 5, when the Bitcoin price crashed below $55,000. Then again, on August 5, the Bitcoin price saw another major crash that pushed it below $50,000.

Now, with September expected to be bearish as well, the crypto analyst believes another crash could be coming. “September 5 is coming soon. Are you ready for another traumatizing event?” the X post read.

If this trend holds, then the Bitcoin price could see another major crash on September 5. Going by the last two months, when each crash has been worse than the last, a possible crash on September 5 could be worse from here, possibly pushing the BTC price below $40,000.

A Bearish Month To Reckon With

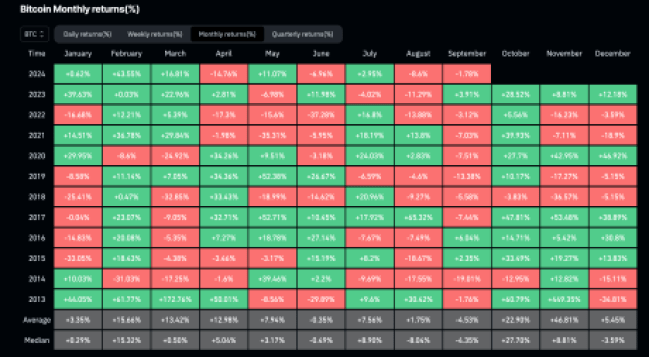

Historically, the month of September has been very bearish for the Bitcoin price. This fact is also made more prominent by the fact that the month has already started out in the red as the BTC price has failed to reclaim the $60,000 level again, according to data from Coinglass.

It is one of the most bearish months on average and one of only two months that maintains negative returns on both the average and median. Out of 12 years of historical price data, the month of September has come back negative for nine years for Bitcoin. If this trend continues, then September could be even worse than August.

However, there is light at the end of the tunnel for the Bitcoin price given that the month of September has often been the last bearish month before each bull market began. This means that investors may only have one month more to suffer losses before the bull run begins.