In a video analysis delivered to his 368,000 YouTube subscribers, Dan Gambardello explains why he believes that ADA remains fundamentally bullish despite the -17% price drop over the past 10 days. Gambardello emphasizes several key developments and technical setups within the Cardano ecosystem, particularly focusing on its recent transition to on-chain governance through the “Chang” hard fork.

Why Cardano Is ‘Fundamentally Bullish’

The core of Gambardello’s analysis began with the implementation of the Chang hard fork, which he describes as a monumental step for Cardano, placing control directly in the hands of ADA token holders. This upgrade allows token holders to elect governance representatives and vote on development proposals, marking a significant shift toward true decentralization.

“Cardano is officially a top 10 crypto, completely powered by the people,” Gambardello enthused, highlighting the shift away from the foundational control by Cardano’s three founding entities—IOHK, the Cardano Foundation, and Emurgo—over network upgrades and hard forks.

Gambardello passionately conveyed the broader implications of such decentralization, arguing that it not only solidifies trust and resilience within the Cardano community but also sets a new standard for blockchain governance. He referenced a critic of Cardano, Justin Bons (founder and CIO of Cyber Capital), who despite previous skepticism, recognized the significance of this milestone in blockchain technology, offering his congratulation.

Congratulations to the ADA community for implementing on-chain governance today!

A critical milestone that most have not achieved yet

As true decentralization at scale is impossible without governance

Others pretend to be decentralized but are still controlled at the center!

— Justin Bons (@Justin_Bons) September 1, 2024

Gambardello further suggests that these foundational changes align well with broader financial movements and may signal robust growth for Cardano in the future. “If we don’t break out here, we can start to categorize this whole run as an extended 2019 and from a charting standpoint […] would mean a very very extended cycle which means we go higher for longer than we ever really hoped, maybe deep into 2026 AKA super cycle.”

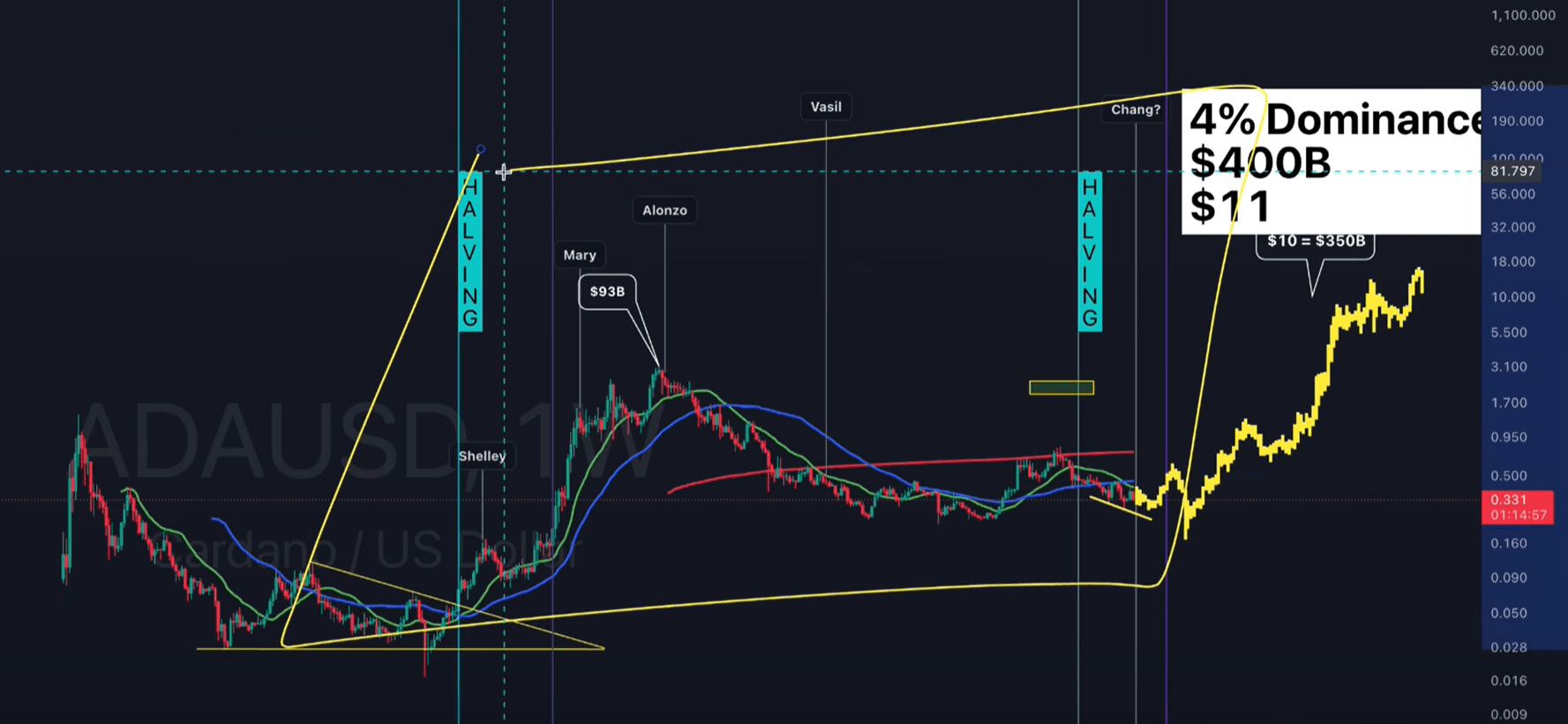

Gambardello also analyzed various price charts, including weekly, daily, and six-hour frames, to discuss ADA’s potential price trajectory. He applied a macro super cycle analysis, which is a method of identifying long-term financial cycles that include several smaller cycles.

“I really want to point this out. If this is true, notice the patients involved in just the entire bear market and the entire sideways waiting for an altcoin season that takes longer than previous cycles. Because remember historically altcoin season starts around now, maybe the macroeconomic landscape of things is making us wait longer,” he stated. Based on this assumption, Gambardello predicts that the Cardano price could hit $10 to $11 in this cycle.

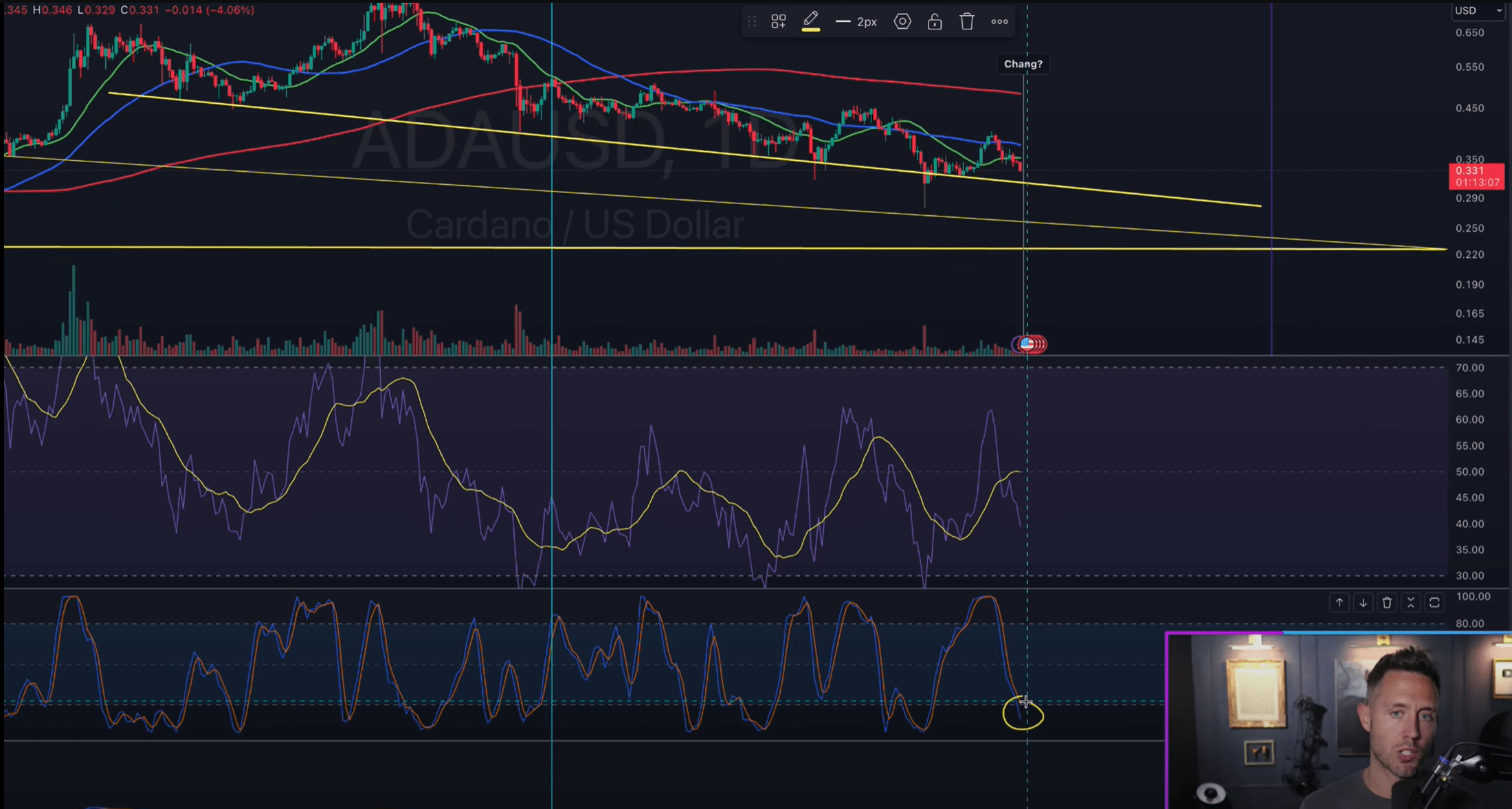

He attributes the current ADA downtrend to global economic shifts such as interest rate cuts. Based on the daily chart, Gambardello suggests that ADA is nearing a potential bottom, providing a buying opportunity for long-term investors. Speaking on what needs to happen for a bullish reversal, the crypto analyst states:

“You want the breakout, you want the flip to happen, the 20 [day EMA] crossing above the 50 [day EMA] and then just up, higher highs, higher lows above those moving averages […] I’m just waiting for that right now – the 20-day moving average around $0.35, the 50-day moving average at $0.37.”

Moreover, Gambardello is also the RSI which is close to the oversold territorium. “[It’s] nice to see stoch RSI falling into oversold. We want to see that even if it’s going to hang out there for a while and ADA goes lower. It’s just good to see that it’s finally approaching oversold. We might be getting close to the bottom. It could be a painful week before that happens but we’re getting there,” Gambardello concluded.

At press time, ADA traded at $0.3350.