Data shows the crypto derivatives market has suffered a lot of liquidations in the past day as Bitcoin and others have plummeted.

Bitcoin Has Declined More Than 3% In The Last 24 Hours

Bitcoin has continued its recent bearish momentum in the past day as its price has observed a further plunge, coming down to the $56,600 level. The chart below shows what the asset’s latest performance has looked like.

During this plunge, Bitcoin briefly went down to the $55,600 level for the first time since the first-third of August. Despite the coin’s rebound, its price has been down more than 3% over the last 24 hours.

The rest of the crypto market has also not been spared, with the altcoins seeing similar or worse returns than the original digital asset. Given this latest market volatility, it would be expected that the derivatives side would have seen a shakeup.

Crypto Derivatives Market Has Just Witnessed High Liquidations

According to data from CoinGlass, the crypto derivatives market has registered a high amount of liquidations in the last 24 hours. A contract is said to be “liquidated” when its exchange has to forcibly shut it down due to it amassing losses of a certain degree (the exact percentage of which may differ between platforms).

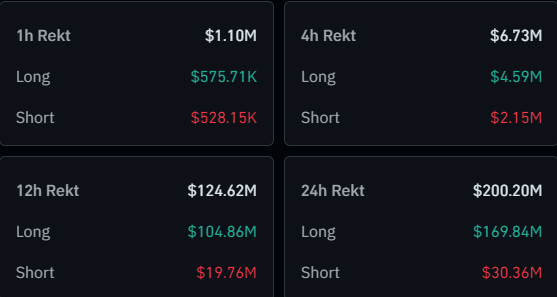

Below is a table that breaks down the latest liquidation data for the sector.

As is visible, the crypto derivatives market has seen $200 million in liquidations during the past day. Almost $170 million of the flush involved the long side, representing 85% of the total.

The liquidations being so lopsided towards these investors betting on a bullish outcome is naturally because the sector as a whole has plunged in this window.

Bitcoin has topped the charts regarding the individual share of the liquidations, with $55 million in contracts related to the coin taking a beating.

Ethereum (ETH), the second largest crypto by market cap, hasn’t been far, though, as it has seen over $50 million in liquidations. Solana (SOL) has seen the most liquidations at under $13 million.

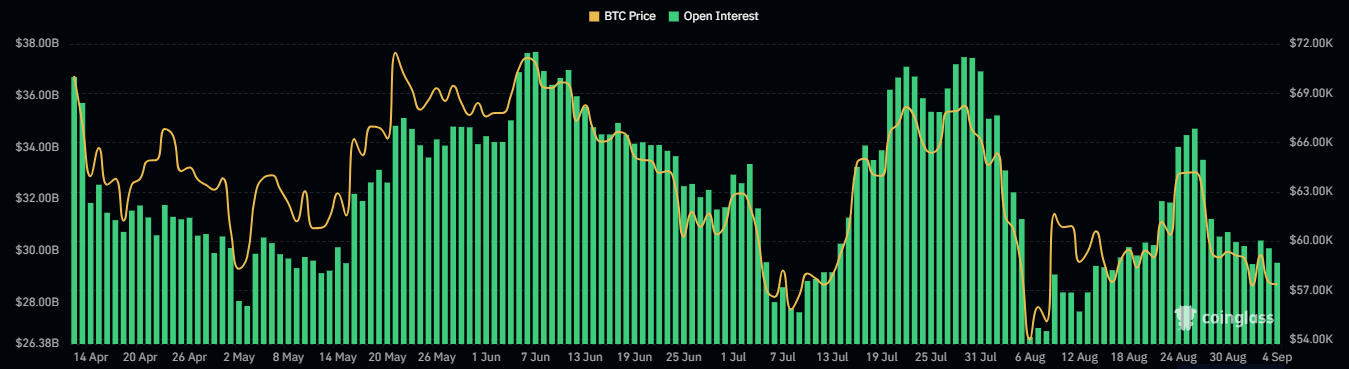

The Bitcoin Open Interest, a measure of the number of positions related to the currently open asset, has seen a cooldown alongside this mass liquidation event, suggesting new speculators haven’t jumped in just yet.

This trend could suggest that the market may have seen a healthy reset, leading to more stability for the asset’s price.