Although the market is attempting to rebound from its weak September start, some altcoins – including Aptos (APT) – continue to freefall despite the bulls’ attempts to make a return. According to CoinGecko, APT’s current performance is lackluster with the token falling 15% since last week.

Meanwhile, Korea Blockchain Week has generated quite a lot of buzz for Aptos. During this event, several on-chain developments have been revealed. Although positive developments on-chain are a great sign of long-term growth for the platform, investors and traders are still struggling to overcome the market’s fear, uncertainty and doubt.

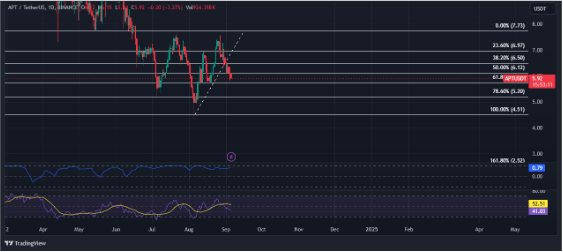

Aptos Continues Drive Down Towards $5.74

As of writing, APT bulls have been aiming to wrestle control of the token’s momentum in the short term. However, the bears are pressing their advantage, targeting $5.74 in the short-term timeframe after flipping the $6.12 support to resistance.

The market’s continuous downward trajectory is the primary reason for APT’s underperformance. Driven by FUD from the broader financial market that bled to the crypto market, APT might face continued losses in the coming weeks.

APT’s relative strength index (RSI) suggests that the token’s downward trajectory will continue well below the $5.74 support level. If this occurs, it might lead to a bigger sell-off localized on APT’s market.

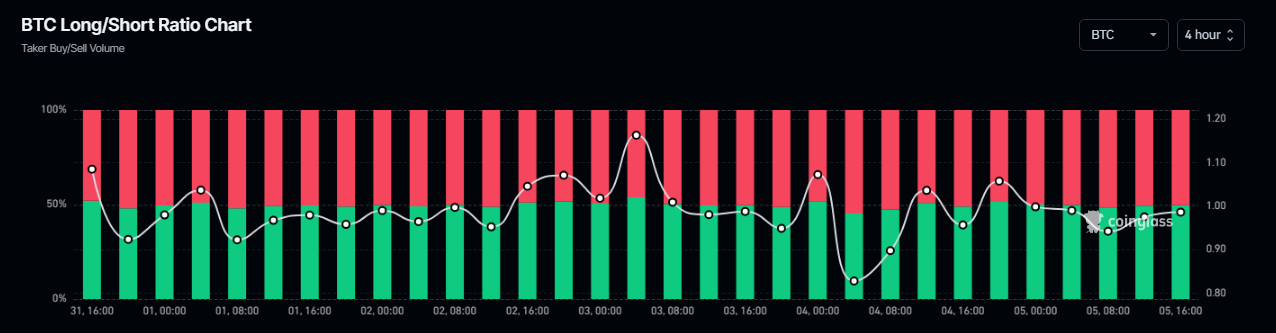

This thesis has a larger possibility to occur as CoinGlass notes that short positions outnumber long positions in the past 24 hours further strengthening the token’s bearish trajectory.

Investors and traders should monitor the coming release of macro indicators due today. As the markets continue to price in a broader downturn, positive macros will provide the needed boost for both the traditional markets and the crypto market in the long term.

Korea Blockchain Week Reveals New Developments On Aptos

The Aptos Experience in Korea Blockchain Week continues to garner the attention of the community. Arculus, a digital security platform, has partnered with Aptos for the platform’s Aptos card. This has made tap-to-pay on Aptos possible, improving the utility of the token and the platform itself.

On-chain, Aptos has also expanded since the start of the year. According to the Head of Ecosystem of Aptos Labs Neil Harounian, the platform has recorded $2 billion in bridged volume with the total value locked (TVL) on chain ballooning 3x since the end of 2023.

This panel on stablecoin and payments at @Aptos Experience is

with panelists from:

– @Visa on enabling payments cross-border

– @PayPal on the speed and finality of digital payments on Aptos

– @IDAfi24 on building regional regulated stablecoin on AptosStablecoin summer &… pic.twitter.com/R5aeRKMTVn

— JC | TowneSquare ❏

(@realjcz) September 5, 2024

The Aptos Experience also hosted a talk about stablecoins and payments on Aptos. Market giants like Visa and PayPal joined in, providing insight into how stablecoins might be implemented to solve real-world problems.

With the ecosystem continuing to innovate and expand through on-chain development, Aptos could still grab a spot in the long-term side of the market.

Featured image from Medium, chart from TradingView