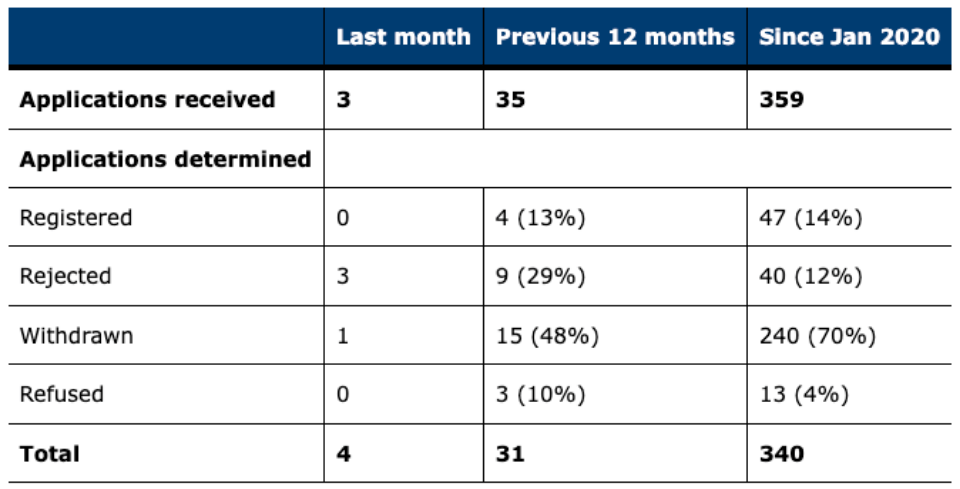

The turbulent UK cryptocurrency landscape sees the Financial Conduct Authority report that 87% of crypto registration applications failed in the last fiscal year.

This is a staggering fact that brings up very serious questions concerning the effectiveness of anti-money laundering controls in the industry. Only four out of 35 applications were approved, underlining how tough the regulatory environment remains.

Struggling To Meet Standards

The FCA has been acting as the regulator for crypto businesses since January 2020, overseeing compliance with the Money Laundering, Terrorist Financing, and Transfer of Funds Regulations.

Overall, the report states that this high number of firms falls short of the required standard. This was because most applications were refused on the grounds of unsatisfactory fraud and AML controls necessary for assurance that illicit funds do not penetrate the financial system.

FCA Chair Charles Randell commented:

“Although some firms have shown adequate systems, too many have failed to meet acceptable standards of risk management and controls to date, leading to this wave of rejections and withdrawals.”

But the new European Union regulations, including Markets in Crypto-Assets, or MiCA framework, have made things even more complex. While these rules aim at better regulating crypto assets, they also add further layers of complexity to UK firms already battling local compliance issues.

With rules yet to be implemented, many are wondering if the UK will still be a viable market for crypto operations.

Why the FCA rejected almost 90% of crypto firms’ applications https://t.co/4BgWSipEXw

— DL News (@DLNewsInfo) September 5, 2024

A New Era Of Regulation

The FCA report contributes to the larger initiative aiming at increasing regulatory control of the crypto sector. This also entails the building of a new “Crypto Cell” at the National Crime Agency with more authority to handle crimes connected to cryptocurrencies.

This division will be responsible for investigations and law enforcement support; this therefore reinforces the government’s commitment to stamping out financial crime in this fast-changing sector.

However, the FCA has been so strict in its stance that crypto firms are growing frustrated. Many have complained of months of delays and inadequate feedback within the registration process.

Some firms have decided to go overseas in search of easier legal environments for their operations, nonetheless serving UK clients. This issue raises questions about UK competitiveness in the crypto space, at least for companies seeking friendlier regimes for their activities.

The Future Of Crypto In The UK

Under the incoming Labor government, the future of crypto legislation rests in the balance; the UK government has put plans involving cryptocurrencies on the sidelines.

Although the FCA intends to assist companies through the registration procedure, the significant failure rate indicates a long way to go for establishing confidence and system clarity.

Pressure is mounting for authorities and companies to strike a suitable balance between compliance and creativity as only 44 companies effectively registered since the FCA started supervising the sector.

While incoming rules under MiCA could provide a path towards improved governance, the UK’s crypto scene is probably going to stay problematic until then.

Featured image from Pexels, chart from TradingView