Bitcoin has faced significant price fluctuations marked by a notable crash on August 5 that saw its value dip to $49,000. This was followed by a rebound to approximately $65,000, only to experience another decline to around $52,000 last Friday.

Despite these challenges, the largest cryptocurrency by market capitalization is undergoing crucial support retests, reminiscent of the patterns observed in September 2023 before it soared to an all-time high of $73,700 in March.

Bitcoin May Hit New All-Time Highs

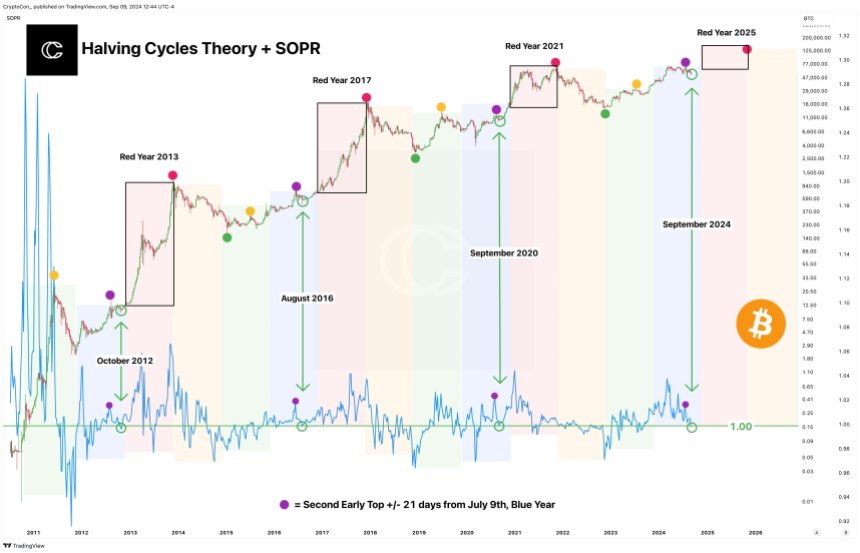

Crypto analyst Crypto Con highlighted this trend in a social media post, emphasizing Bitcoin’s spent output profit ratio (SOPR). According to Con, previous peaks have correlated with the 1.0 value line on the SOPR chart, where the cryptocurrency typically finds a bottom before entering a bull market phase.

This cyclical behavior has been consistent around specific months—October, August, and September—drawing parallels to the recession predictions that have emerged recently, much like in September 2023 and at the cycle bottom in November 2022 following crypto exchange FTX’s implosion.

The current indicators suggest that Bitcoin may be on the verge of a significant price uptick, potentially surpassing its previous all-time highs. This bullish sentiment is bolstered by historical data that show Bitcoin’s propensity to break through past peaks, as seen in the chart above.

Is September A ‘Fake-Breakdown Month’?

In a more granular analysis of short-term price action, fellow analyst Rekt Capital pointed out that Bitcoin’s weekly close above $53,250 is crucial for maintaining the support level within the bargain-buying range of $52,000 to $55,000.

This range forms beneath a downward-trending channel spotted by the analyst at $56,500 on Bitcoin’s weekly chart. Rekt emphasized that reclaiming $55,881 as support would be essential for Bitcoin to build momentum and attempt a recovery within the channel.

Furthermore, Rekt raised an interesting hypothesis about September potentially being a “fake-breakdown month.” Historical data indicate that September typically sees an average monthly return of -5%, while October averages 22.90%.

This pattern suggests that any support that the Bitcoin price appears to have lost during the past month could be swiftly reclaimed, especially as the cryptocurrency currently trades around $56,600. Should October follow its historical trend, a 22.90% increase would position Bitcoin below its all-time high at approximately $68,780.

At the time of writing, the largest cryptocurrency on the market records a 4% increase in the 24-hour time frame, resulting in its price regaining the $56,600 mark. However, over the last 30 days, BTC has recorded losses of over 7%.

Featured image from DALL-E, chart from TradingView.com