Bitcoin has made some recovery over the past 24 hours, which may have prevented this deep fall that the asset was previously at risk of.

Bitcoin Has Recovered Back Towards The $57,000 Level

Bitcoin witnessed a plunge a few days ago, but it has started this new week with bullish momentum, seemingly rejuvenated as its price has recovered to $57,000.

The below chart shows what the coin’s recent performance has looked like.

This 4% jump in the last 24 hours has completely retraced the price above plummet. Perhaps more importantly, the surge has helped the asset gain some distance over an important pricing level of an on-chain model.

BTC Hasn’t Yet Lost This MVRV Pricing Band Support Level

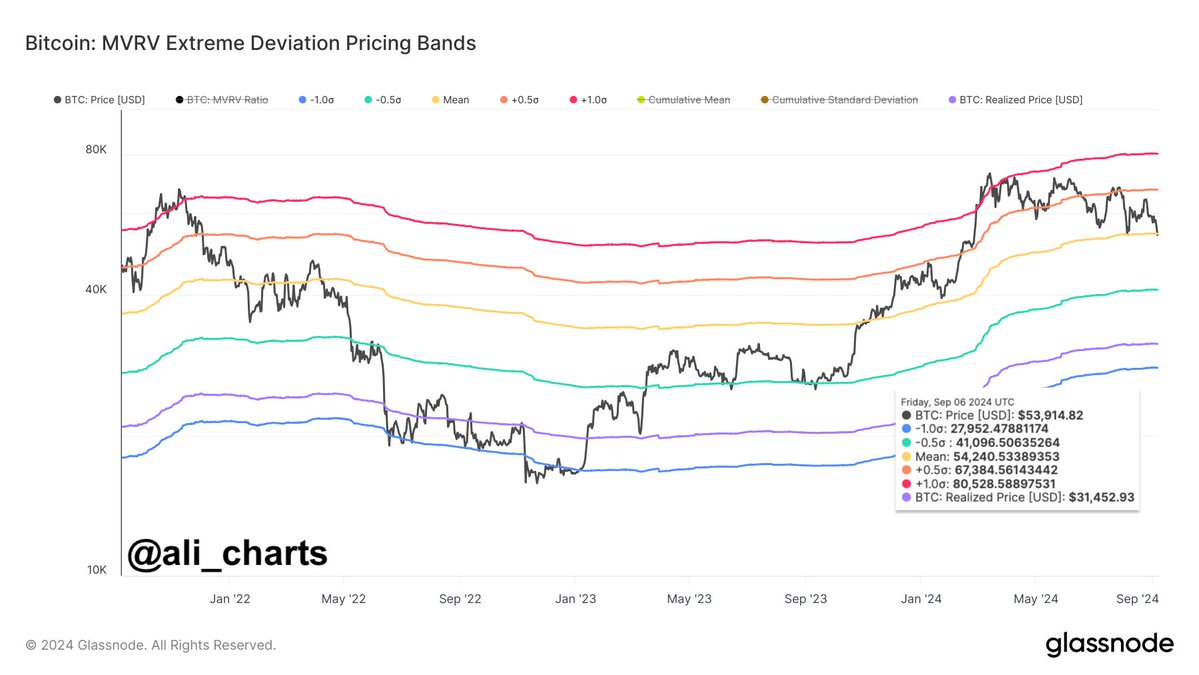

In a post on X, analyst Ali Martinez had yesterday discussed how BTC was retesting a support level part of the MVRV Extreme Deviation Pricing Bands model.

As its name suggests, the model is based on the popular Market Value to Realized Value (MVRV) ratio. This indicator tells us how the value held by the Bitcoin investors (that is, the market cap) compares against the value they put into the asset (the realized cap).

When the ratio has a value greater than 1, the investors are in a state of net profit. On the other hand, it being under the threshold implies the dominance of loss in the market.

The MVRV Extreme Deviation Pricing Bands model takes this metric’s mean value and relates standard deviations (SDs) to the price of the cryptocurrency. Below is the chart for the model that the analyst shared yesterday.

As displayed in the graph, Bitcoin had been retesting the $54,200 level yesterday, which corresponded to the price at which the MVRV ratio would attain the same level as its historical mean.

In the scenario that BTC had found rejection at this level and had dropped under it, the next important level from the perspective of the model would have been $41,100. At this level, BTC’s MVRV ratio would assume a value of -0.5 SD from its mean.

Ali had noted that BTC could have, therefore, been at risk of facing a correction to this level. With the recovery in the last 24 hours, though, the immediate threat of such a drop may no longer loom over the cryptocurrency’s head.

In terms of potential resistance levels ahead, the next Bitcoin MVRV Pricing Band is located at around $67,400, so there is still quite a while to go before a retest of it can happen.