Bitcoin’s correlation with traditional financial markets has been a topic of significant interest and debate in recent months. The latest data suggests that Bitcoin is exhibiting behavior more closely aligned with tech stocks than gold, challenging its narrative as “digital gold” in the short term.

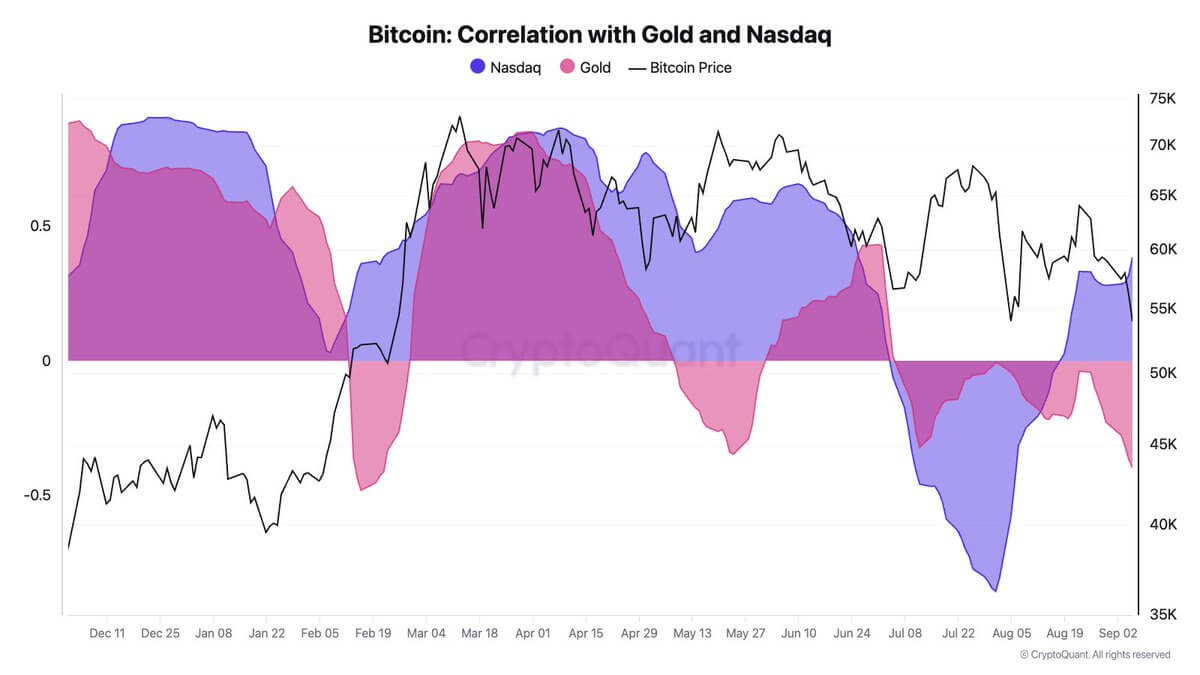

Julio Moreno from CryptoQuant shared data showing that Bitcoin currently indicates a positive correlation of +0.39 with the Nasdaq index while displaying a negative correlation of -0.40 with gold over 30 days. This data showcases Bitcoin’s increasing ties to risk assets like tech stocks rather than behaving as a safe-haven asset like gold. However, Bitcoin as an inflation hedge needs to be assessed on a longer timeframe, with its CAGR showcasing its outperformance of most assets over a 5-year timeline.

Bitcoin and gold both surged in Q1 2024, with Bitcoin gaining over 60% and trading above $70,000, while gold rose by over 7% to trade above $2,200. However, the current correlation data indicates a divergence in price movements in recent weeks.

The shifting correlation patterns reflect the complex and evolving nature of Bitcoin as both a digital currency and an asset class. As Bitcoin matures, it appears to incorporate certain qualities of gold while also assimilating traits from stocks and other risk assets.

The correlation between Bitcoin and traditional markets has fluctuated over time. As FXStreet reported, the correlation between Bitcoin and gold reached as high as 0.87 (or 87%) earlier, indicating a strong positive relationship. However, the recent data shows a significant shift in this dynamic.

The post Bitcoin’s correlation with Nasdaq rises to 0.39, diverges from gold at -0.40 appeared first on CryptoSlate.