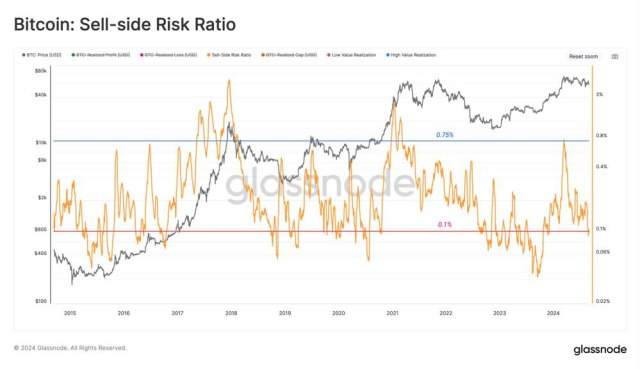

Several Bitcoin metrics lately are seeing negative performances as evidenced by the recent significant decline in its sell-side risk ratio in light of persistent price swings, which has triggered speculations within the crypto community about the digital asset’s potential in the long term.

Significance Of Bitcoin’s Sell-Side Risk Ratio Crash

As the market continues to experience heightened volatility, recent data shows that the sell-side ratio of Bitcoin has sharply plummeted in the past few days. Popular market expert and host of the Crypto Banter show, Kyle Doops, pointed out the negative development on the X (formerly Twitter) platform on Tuesday.

It is important to note that the ratio of realized profit and loss to market size is determined by the Bitcoin Sell-Side Risk Ratio. Furthermore, low numbers imply equilibrium, while high values show notable gains or losses, indicating volatility.

According to the market expert, given that most coins appear to be close to break-even, the latest drop into the lower band suggests that profit-taking is nearing its end and that there may be more future volatility akin to 2019.

Even though BTC’s sell-risk ratio has dropped indicating potential future volatility, many crypto experts in the community are still optimistic about its price growth, with some predicting a new all-time high in the short term.

A cryptocurrency expert who recently forecasted a new all-time high for the largest digital asset is Mags. Mags bases his optimistic prediction on a possible bullish crossover for BTC from its current consolidation phase, signaling a major upward move in the coming months.

The expert highlighted that the present consolidation phase bears a striking resemblance to the months-long range that BTC saw last year. Although there was a brief surge following the initial positive MACD crossover, the price was unable to break out of the range. However, there was a breakout and a significant price gain after the second bullish crossover.

Mags is confident that Bitcoin will reach a new price peak if this pattern repeats. “The first signal was weak and created a short-term bottom, but the second one might lead to a real breakout and a new all-time high,” he added.

BTC’s Price Performance Turns Bearish

Currently, BTC’s performance has turned bearish after a few days of positive gains, falling to about $56,000. This drop is mostly attributed to the crypto asset’s negative trend witnessed during the month of September over the years.

While September may be bearish for BTC, it could also oversee a positive Q4 for the coin due to past occurrences cited by well-known market expert and trader, Rekt Capital.

According to the analyst, all investors have to do is make it through the month because if past performances hold true, the value of the digital asset might be on track to see positive monthly returns for the next three months.