Chainlink is in a consolidation phase after weeks of volatility and selling pressure. The price currently holds above a support level of $10, a crucial liquidity level. The altcoin attracts the attention of analysts and investors who anticipate higher prices soon.

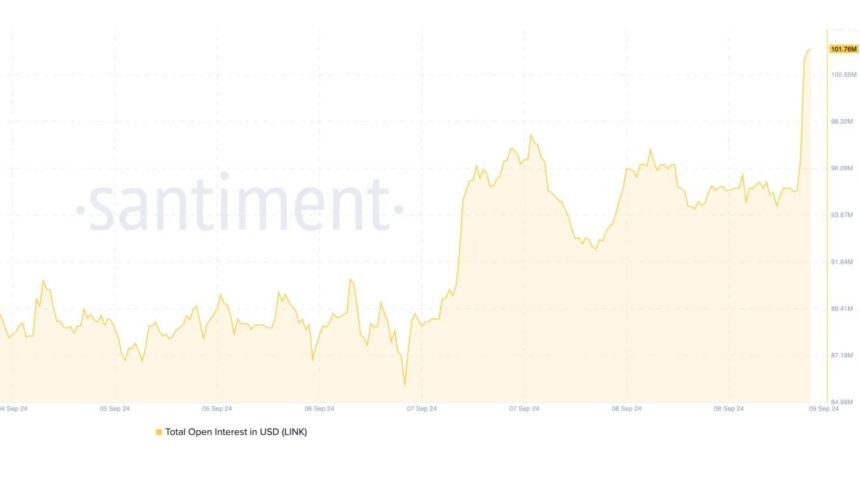

Data from Santiment reveals rising open interest, which signals sustained demand for Chainlink. As more traders and investors build positions, this increase in open interest suggests that a price rally could be on the horizon.

This stabilization around the $10 mark has given some confidence to those who believe LINK may be poised for a breakout. Many analysts see this as a potential turning point for Chainlink, with its current price action reflecting growing optimism for future gains. If the consolidation holds and momentum builds, LINK could potentially push past its recent resistance and aim for higher levels.

Chainlink Investors Showing Confidence

Chainlink is testing key supply at its current levels, and top traders and investors are confident in a potential rise for LINK in the coming weeks.

One significant indicator signaling strength is the rising Open Interest (OI), as revealed by Santiment. OI tracks the number of active contracts tied to a cryptocurrency, serving as a reflection of market engagement. When OI increases, it signals growing liquidity and interest in the market, while a decrease in OI typically points to reduced exposure.

From a price analysis perspective, a rise in OI combined with a price dip often confirms a continuing downtrend. On the other hand, if OI decreases while the price rises, it may signal a bearish reversal.

In Chainlink’s case, both OI and price are increasing, which suggests that the current uptrend could persist. As investors monitor the market, many are waiting for price confirmation above current levels to keep the momentum going and shift the overall negative sentiment that has clouded Chainlink in recent weeks.

LINK’s breakout could fuel a bullish run, as traders expect a more bullish trajectory in the short term. The rising OI serves as a strong indicator that market participants are increasingly confident in LINK’s potential for further gains.

LINK Price Testing Supply At $10.8

Chainlink (LINK) is trading at $10.40 after testing local resistance at $10.83, positioning for a potential breakout toward higher prices. The price is struggling to clear the 4-hour 200 moving average (MA) at $10.71, a key indicator that has acted as a resistance since late August.

For bulls to maintain momentum, LINK must reclaim the 4H 200 MA and target the next resistance at $12.70. Breaking past this level would signal a reversal and could lead to a more sustained uptrend, offering investors hope for further gains.

However, if LINK fails to break through the 4H 200 MA, the altcoin will likely face a pullback, with support anticipated at lower demand levels around $9.30. A failure to hold this support could result in even lower prices, reinforcing the downside risk for traders.

The coming days will be crucial for LINK’s price trajectory as the battle between bulls and bears intensifies.

Featured image from Dall-E, chart from TradingView