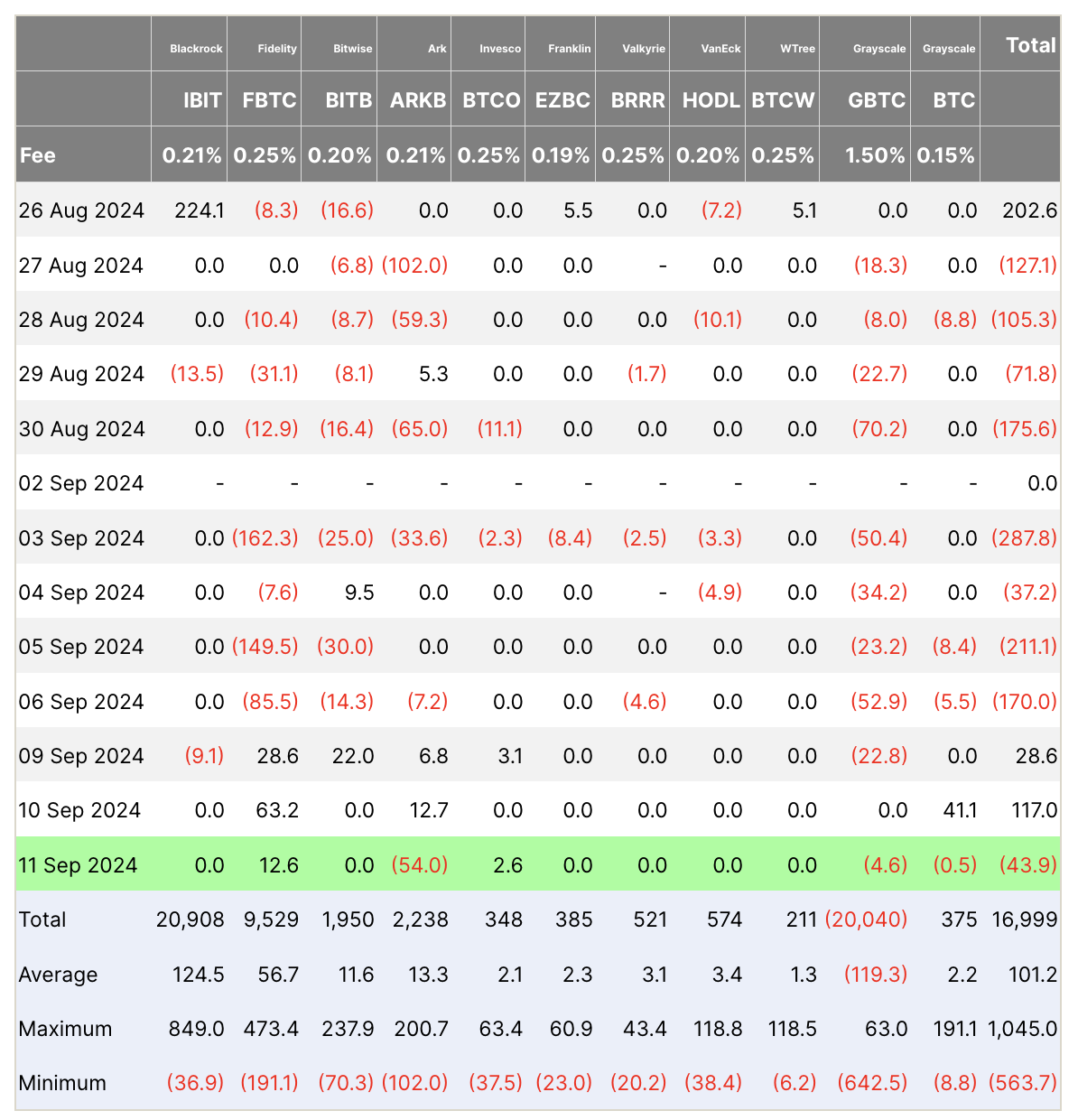

On September 11, Bitcoin ETFs experienced notable outflows, with total flows amounting to a net negative of $43.9 million. Ark’s ARKB ETF recorded the most significant single movement, with outflows of $54 million. Fidelity’s FBTC ETF saw inflows of $12.6 million, partially offsetting the losses. Invesco’s BTCO ETF added $2.6 million, while Grayscale’s GBTC and BTC funds registered outflows of $4.6 million and $0.5 million, respectively.

Other major Bitcoin ETFs, including those from BlackRock, Bitwise, Franklin, Valkyrie, VanEck, and WisdomTree, saw no inflows or outflows and remained flat.

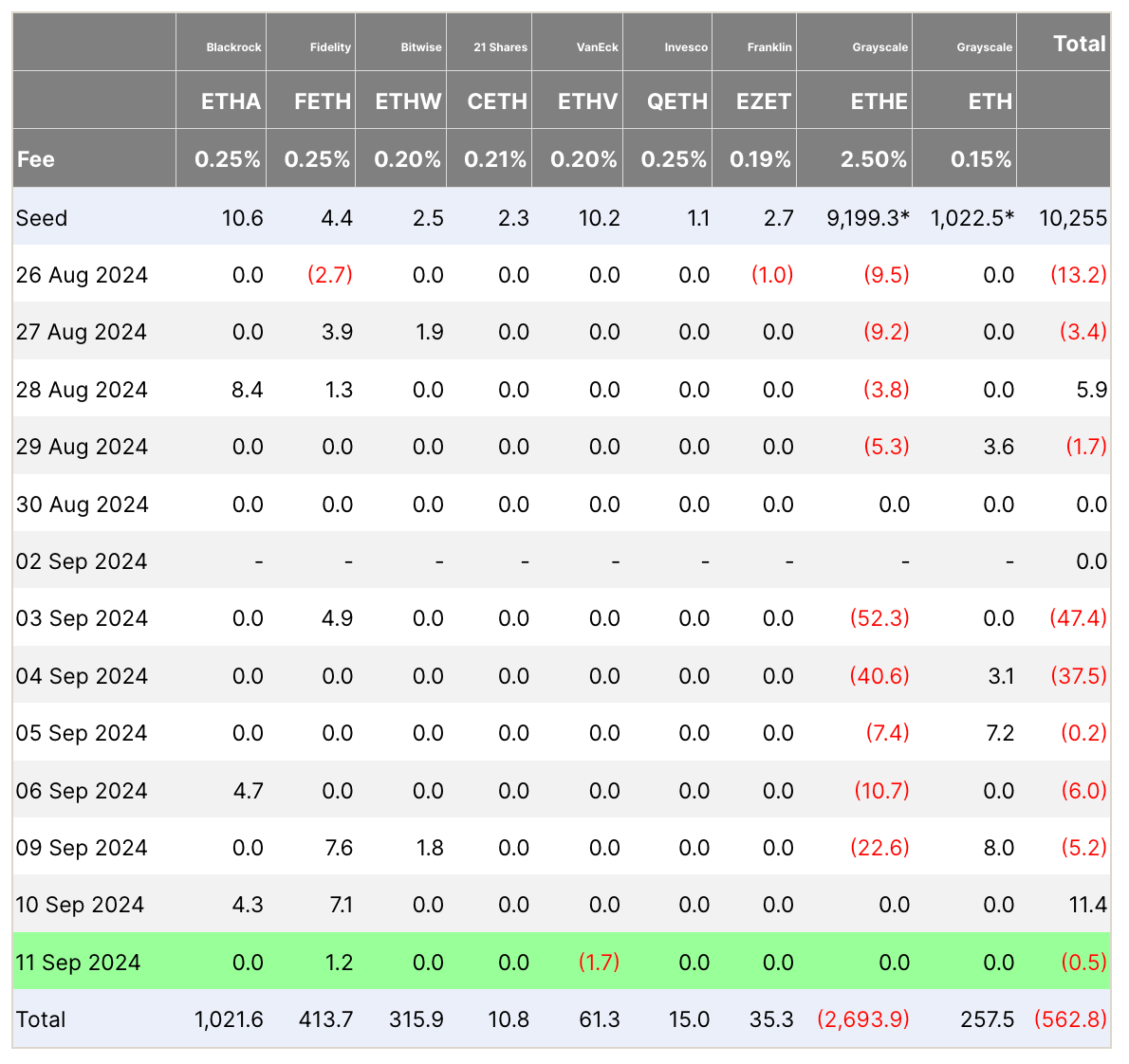

In Ethereum ETFs, the overall market saw a net outflow of $0.5 million. Fidelity’s FETH ETF reported a modest inflow of $1.2 million. However, this was countered by VanEck’s ETHV ETF, which experienced outflows of $1.7 million. No activity was recorded for ETFs from BlackRock, Bitwise, 21Shares, Invesco, Franklin, or Grayscale’s two Ethereum funds, ETHE and ETH.

The significant outflows in Bitcoin and Ethereum ETFs, particularly from Ark and VanEck, indicate returning investor sentiment to the outflows of previous days. Some funds reduced exposure, while others showed minor inflows.

The post Bitcoin and Ethereum ETFs experience net outflows, led by $54 million in Ark appeared first on CryptoSlate.