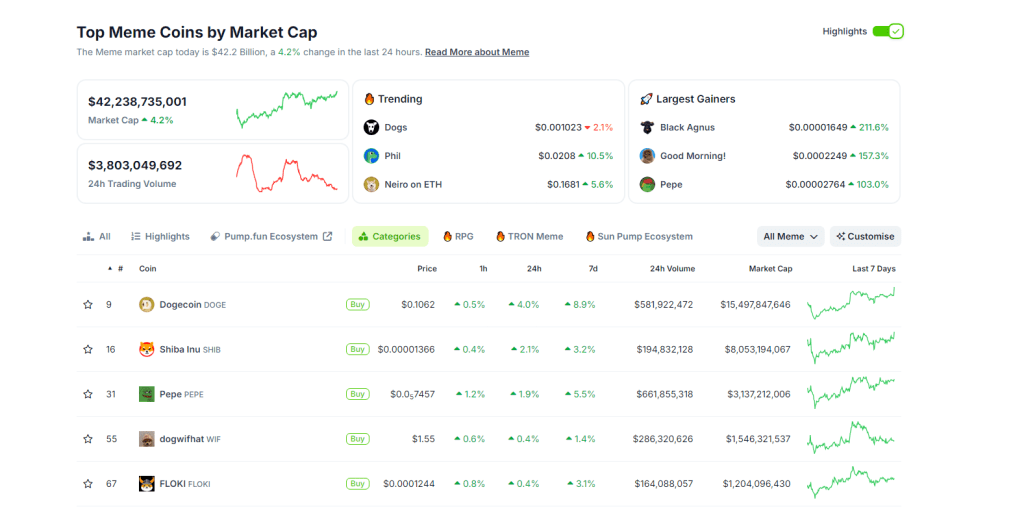

Meme coins have been sliding in recent weeks. According to Coingecko, all meme coins’ total market cap is around $42 billion.

Dogecoin remains the most valuable, with a market cap of over $15.4 billion, followed by Shiba Inu, which has a market cap of around $8 billion. It has been a turbulent few trading months for meme coins, whose valuation is down from over $65 billion in Q2 204.

WIF Struggling, Is This The “Most Bearish Meme Coin”?

Though Bitcoin is turning the corner, a development that can yank top altcoins like Solana and meme coins higher, one analyst is bearish on DogWifHat (WIF). According to Coingecko, WIF is one of the top meme coins on Solana, commanding a market cap of over $1.5 billion and a slot in the top 5.

While WIF might be up over 98,000% after dropping to all-time lows of $0.00155 in December 2023, the token is down 68% from recent all-time highs. WIF prices exploded, riding on Solana expansion and the meme coin fever that swept across the industry in the first half of the year.

The analyst now thinks WIF will likely dump in the coming sessions. Driving this outlook is the state of the chart pattern, which points to weakness all through. From how the WIFUSDT chart is aligned, the token, the analyst claims, could be the “most bearish of all major meme coins.”

Bulls Have A Chance If Bitcoin Recovers, DogWifHat Finds Resistance At $2

While there is optimism that WIF could bounce and benefit from the market-wide recovery, the current bearish structure damps optimism. From the analyst’s assessment, buying the meme coin at spot prices is risky. The only time traders can consider loading WIF is once it breaks out from the descending wedge, as is evident in the daily chart.

In summary, WIF is down nearly 50% from July highs. Although prices recovered after the bounce in early August, buyers didn’t build sufficient momentum to reverse losses. The immediate resistance is $1.99, while support is $1.30.

For the uptrend to take shape, WIF bulls must break above $2, ideally with rising trading volume. In turn, this may set the momentum for another leg up that could see the token expand to as high as $3–or July highs in a bull bar continuation formation.