A lot has been made of the Bitcoin price history in September, putting extra spotlight on the largest cryptocurrency by market capitalization. Despite the somewhat wobbly start and generally bearish expectations, the premier cryptocurrency has not exactly had a woeful stint in this historically negative month.

The price of BTC has been on quite a run in the last seven-day period, breaking the psychological $60,000 level to close the week. A popular crypto pundit, however, has come forward with an interesting prognosis for the Bitcoin price over the coming days.

BTC Price Approaching Key Resistance — Here’s The Level

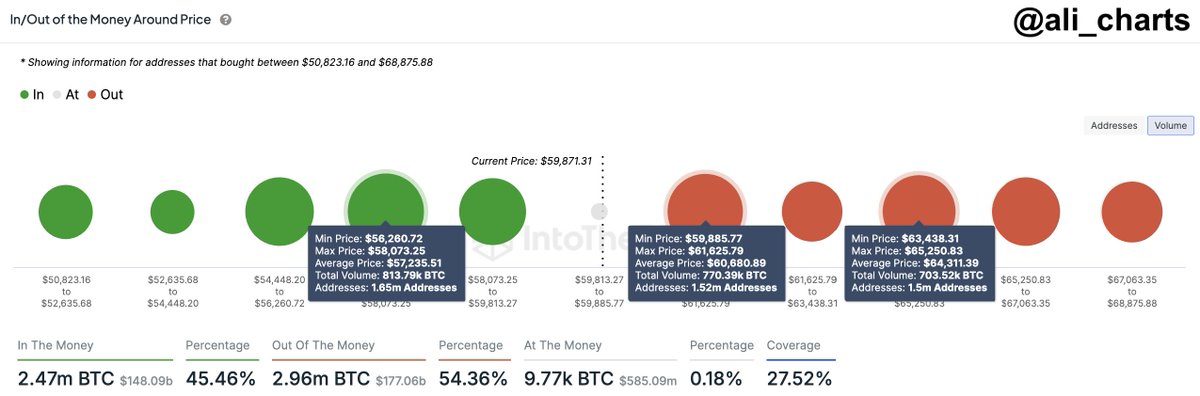

In a new post on the X platform, prominent crypto analyst Ali Martinez revealed that Bitcoin’s latest price surge could face major on-chain resistance around the $60,680 zone. This analysis is based on the cost-basis distribution of the BTC supply around the current spot value of the flagship cryptocurrency.

In cost-basis analysis, a level’s potential to act as support or resistance depends on the total amount of coins last acquired by investors at the level. As shown in the chart below, the size of the dot reflects and is directly proportional to the number of bitcoins purchased within the corresponding price range.

The chart above illustrates that the $59,885 – $61,625 price bracket is currently thick with investors. According to data from IntoTheBlock, 1.52 million addresses bought over 770,390 BTC (equivalent to about $40.6 billion) between the price range.

Martinez highlighted that this $59,885 – $61,625 price level could act as a major resistance zone because investors are likely to make a move when an asset returns to their cost basis. Typically, investors who were in the red before may want to quickly sell their holdings as soon as they enter profit, which could place a barrier on the Bitcoin price.

Martinez noted in his post that the Bitcoin price could climb to $64,300 if the $59,885 – $61,625 resistance zone is breached. However, if the price fails to break this resistance, a drawdown to the $57,235 level is possible.

Bitcoin Price At A Glance

As of this writing, the Bitcoin price stands at around $60,429, reflecting a 4.1% increase in the past 24 hours. The premier cryptocurrency’s performance is even more impressive in the larger timeframe. According to data from CoinGecko, the price of Bitcoin is up by more than 13% in the past seven days.