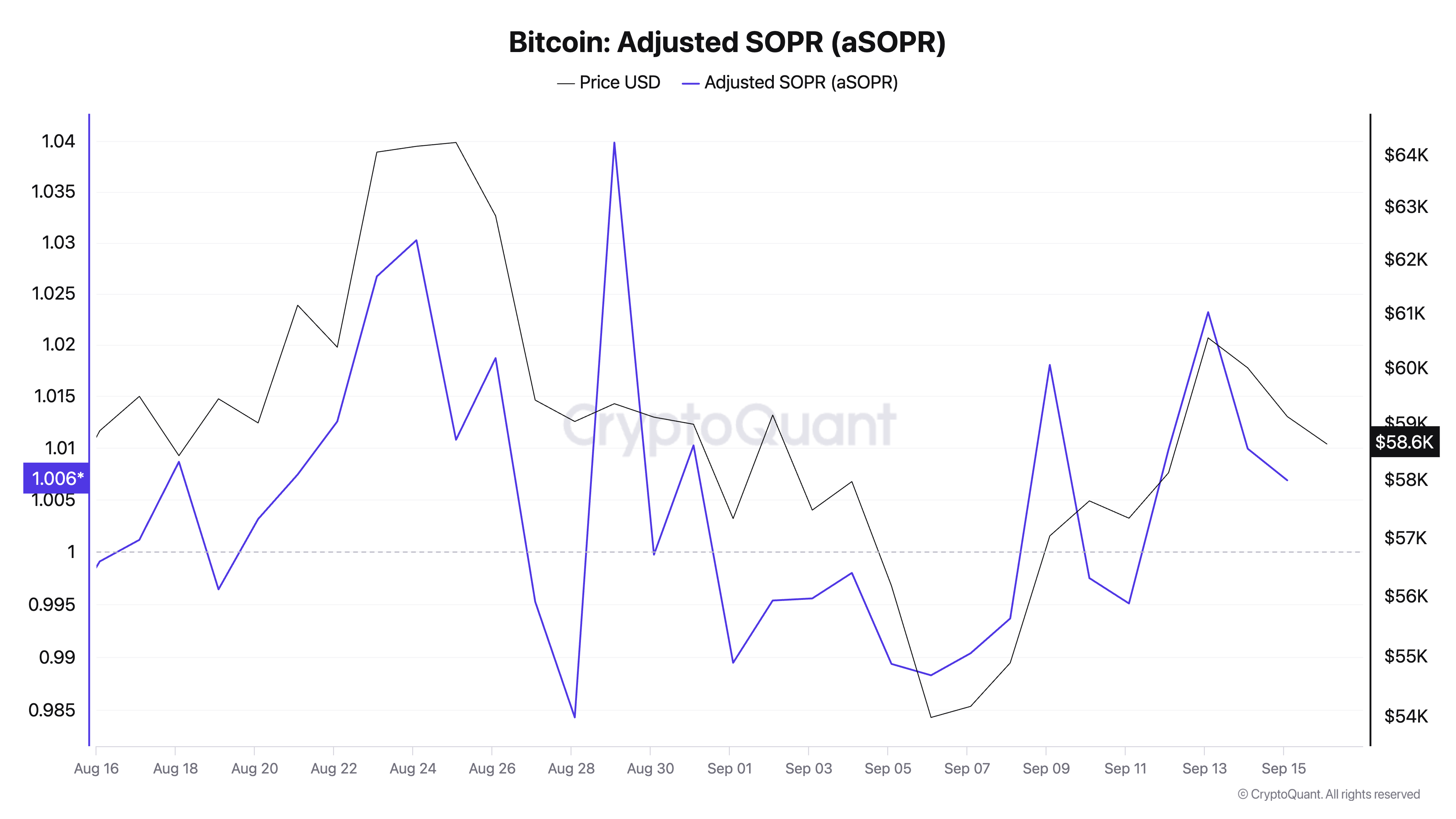

In the past week, spent output profit ratio (SOPR) data showed the market was in a profit-taking phase, influenced mainly by long-term holders. Between Sept. 6 and Sept. 13, Bitcoin’s spike from $53,900 to $60,500 was accompanied by an increased adjusted SOPR (aSOPR), indicating that coins spent during this period were sold at a profit.

During the weekend, BTC consolidated around $58,900, which led to a slight dip in aSOPR. This minor decrease indicates a pause in profit-taking rather than a shift towards loss realization. The market appeared to stabilize, hinting at a short-term equilibrium rather than a reversal in sentiment.

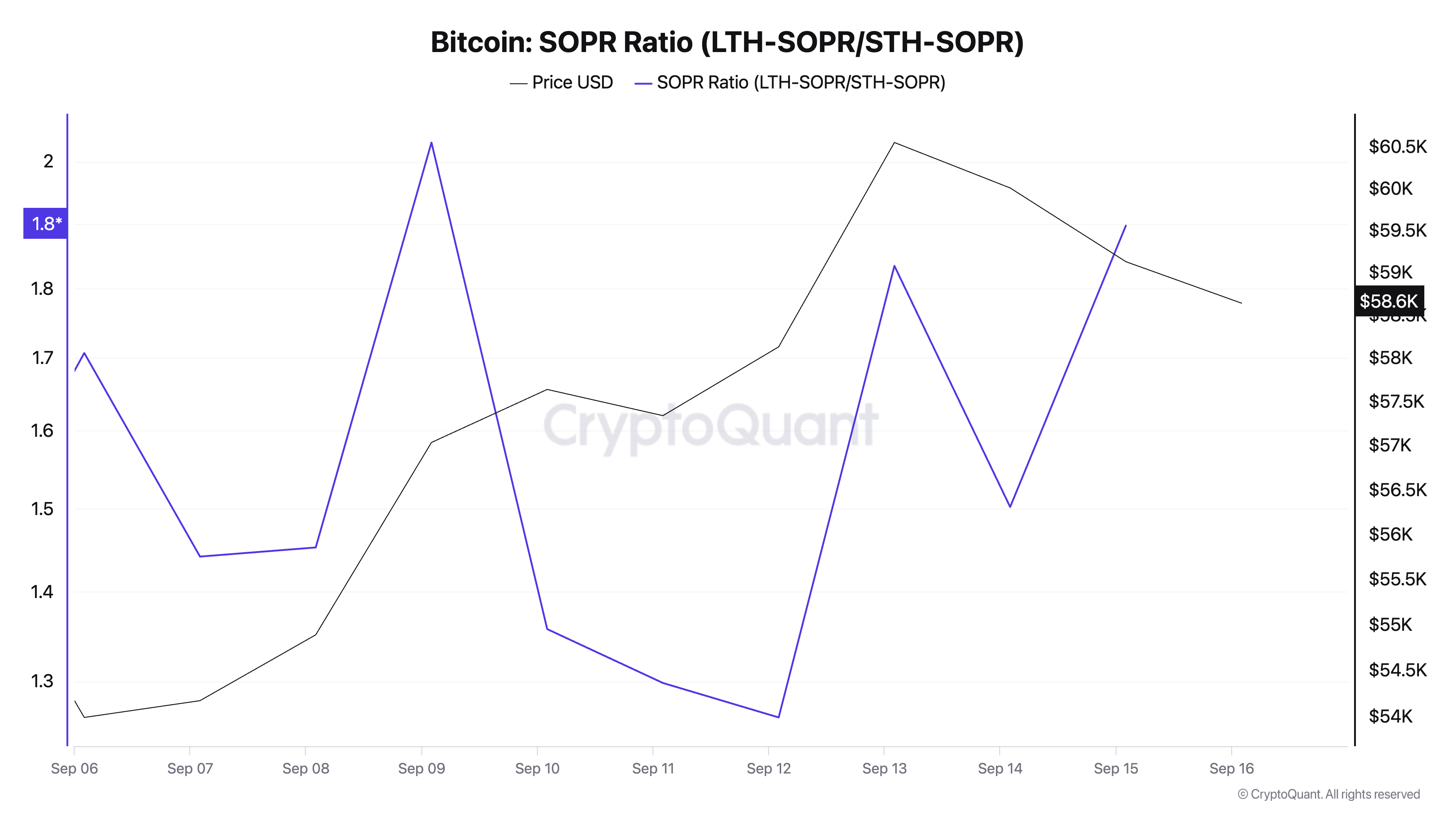

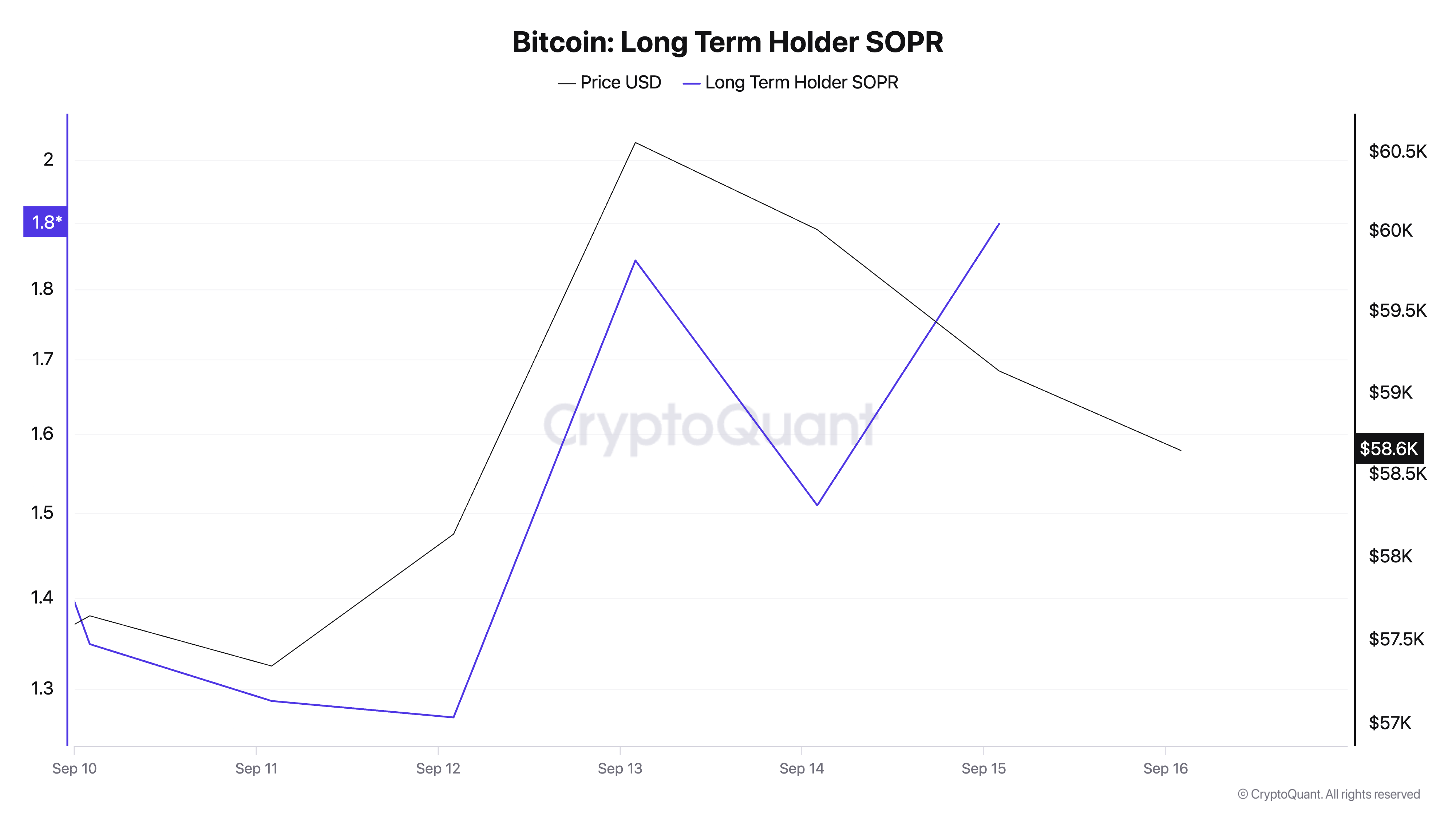

The SOPR Ratio, which compares the profitability of long-term holders to short-term holders, showed a sharp increase between Sept. 12 and Sept. 15. This rise points to substantial profit realization by long-term holders, a behavior that historically signals a potential market top or at least a period of consolidation.

During this time, the short-term holders’ SOPR increased marginally, suggesting a move from minor losses to break-even profits. In contrast, long-term holders realized significantly higher profits, showing their strategic exit during price rallies.

Overall, the data suggests a market in a profit-taking mode, particularly among long-term holders. While this indicates a strong bullish sentiment, the elevated SOPR Ratio could be an early indicator of a short-term peak or a period for further consolidation.

The post SOPR shows long-term holders are taking profits appeared first on CryptoSlate.