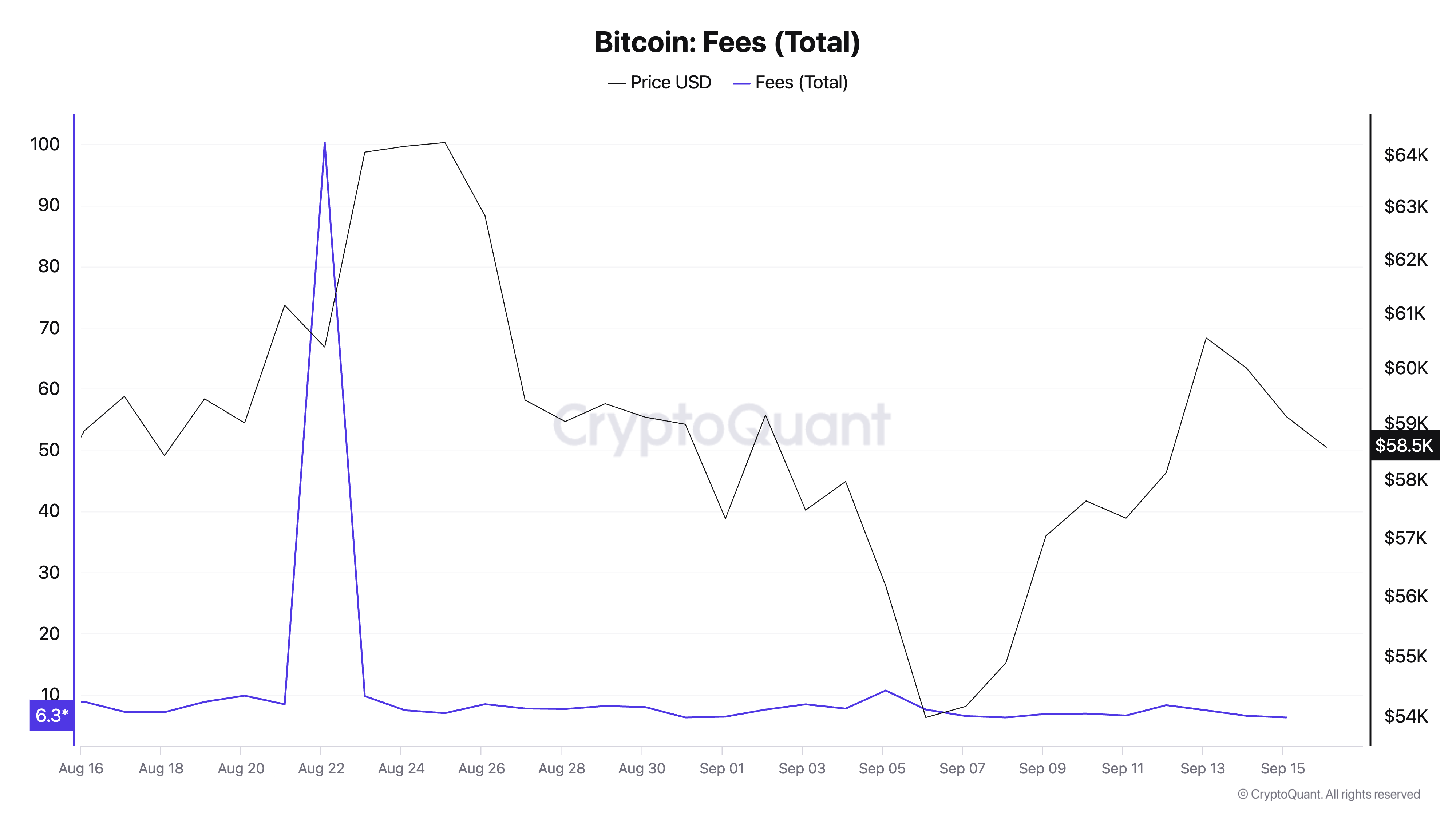

Bitcoin fees have been remarkably stable throughout September, given the sharp spike they experienced in late August. On Aug. 22, fees spiked to 100 BTC ($6.086 million), a significant departure from the typical range of 6 to 9 BTC established in the past two months.

This sudden increase pushed the fees-to-reward ratio from 0.018 to 0.167, indicating a brief surge in network activity.

This anomaly suggests a temporary event—a sudden rush in transaction volume or network congestion—causing users to pay higher fees to prioritize their transactions. The sharp spike contrasts the otherwise steady fee market we’ve seen since July, indicating that the event was an outlier rather than a sign of changing market trends.

After Aug. 22, transaction fees quickly reverted to their usual range, signaling a rapid correction in the market. Even amid price volatility, this return to stability shows that a longer-term shift in transaction demand did not sustain the spike.

In September, fees remained low and stable despite fluctuations in Bitcoin’s price. This divergence suggests that the price movements were driven by factors external to on-chain activity, such as derivative markets or broader macroeconomic influences. The data implies that the market might be focused on holding rather than transacting during this period, with on-chain activity playing a limited role in influencing price.

The post Bitcoin fees stabilize in September after August spike appeared first on CryptoSlate.