Avalanche (AVAX) has had a terrible Q2 2024 by several standards, going by a significant decline in market capitalization coupled with low revenue generation.

Messari’s recent report indicated that AVAX faced a fierce correction after two quarters of growth on the trot. Market capitalization dipped by 40% within the last quarter to stand at $11.6 billion. Well, despite this slump, the ecosystem is still sound as AVAX still has a market cap of $4.5 billion — that’s a 157% surge compared to the same period in 2023.

State of @avax Q2

Key Update: Several partnerships announced, notable ones include @stripe, @homium, and @konami.

QoQ Metrics

– Staked AVAX6%

– DeFi TVL (AVAX)11%

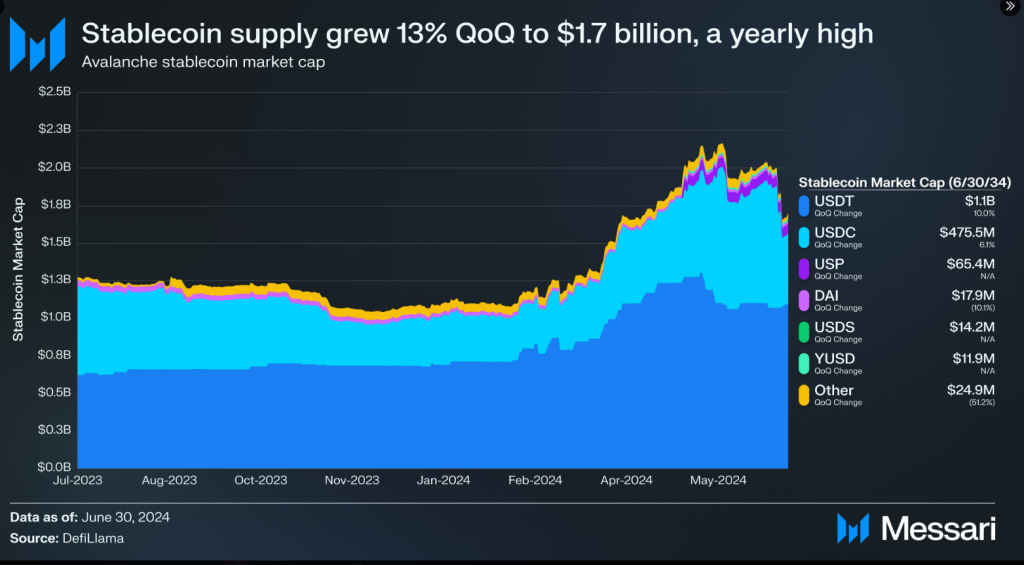

– Stables13%

Read the full report

https://t.co/7xsKIj1ml3 pic.twitter.com/0dSZnfXOVE

— Messari (@MessariCrypto) September 13, 2024

Price Forecast Shines Through The Dip

The slump is paining the larger ecosystem, but the future of AVAX seems brighter. In fact, the price forecast of the token will shine hope for investors. AVAX is seen going up 70.68% over the next three months, showing a bounce from the recent prices, analysis from CoinCheckup shows.

This bullish sentiment is bolstered by long-term projections that suggest a 166% growth over the next year. It seems AVAX is poised for recovery, making it an intriguing asset for traders keeping an eye on the market.

Revenue Plunge And On-Chain Activity

Revenue for the Avalanche ecosystem was another source of worry, as its value went down from 176,700 AVAX in Q2 2024 to 96,200 AVAX during the same period. In dollar terms, that translated into $7.5 million going down to $3.5 million.

Pullback is due to slowed activity across different on-chain platforms. However, some analysts believe that a renewed interest in on-chain-based transactions could help revive revenue growth in the short term.

Despite these drops, staking remains robust within the Avalanche ecosystem. There is a 6% increase in the number of staked AVAX tokens due to new measures to boost staking. Staking rewards continue to attract new investors despite a fall in active validator count by 7%. This reflects some unease among validators amidst these market conditions.

Network Stability

Average transaction counts remain mixed. With approximately 11,262 transactions and an average block time of 1.61 seconds, Avalanche is showing stability. More than 2% of the total coins have been sent from the Elliptic Curve Digital Signature Algorithm wallet. Despite the recorded drops, new initiatives are expected to boost staking and future coin balances.

Interestingly, where the network had an average transaction that depreciated by 57% from 495,000 to 201,500, some protocols on Avalanche refused to abide by this trend. Tether (USDT) and GMX increased transaction volumes, which indicated specific sectors in the system are doing well despite this broad slowdown for the crypto market.

Since AVAX is preparing for a potential rebound from the market, its investors may be able to see renewed interest in the asset in case such forecasted growth in price comes true.

The partial recovery in the transaction volumes for selected protocols also suggests something more is being involved under the surface–a sign that Avalanche might pick up fast once the crypto market picks up. For now, investors are keen enough to observe how AVAX acts in the short and medium terms.

Featured image from Durango.com, chart from TradingView