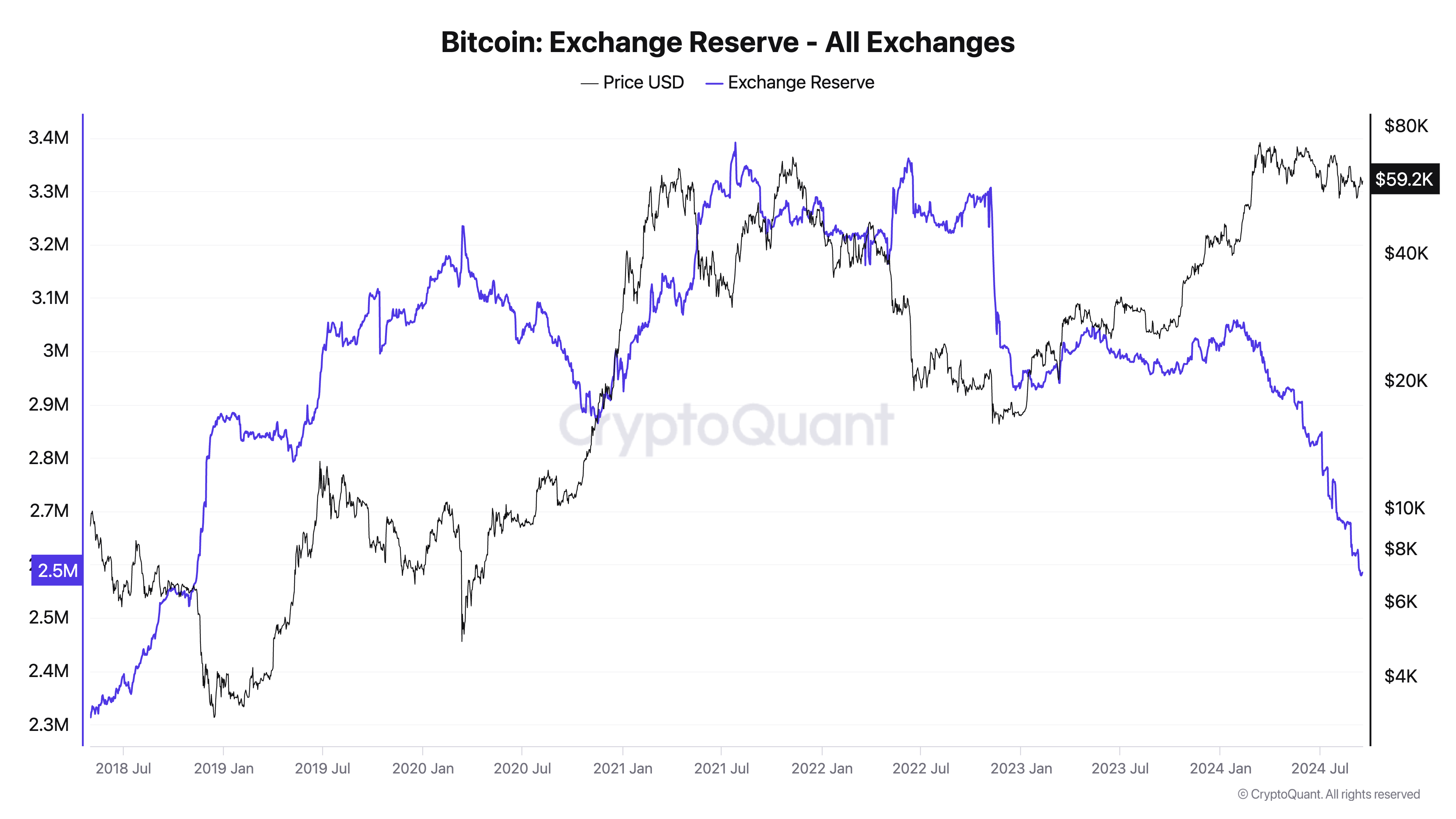

The number of Bitcoin held on exchanges significantly declined in September, dropping to levels last seen in mid-November 2018.

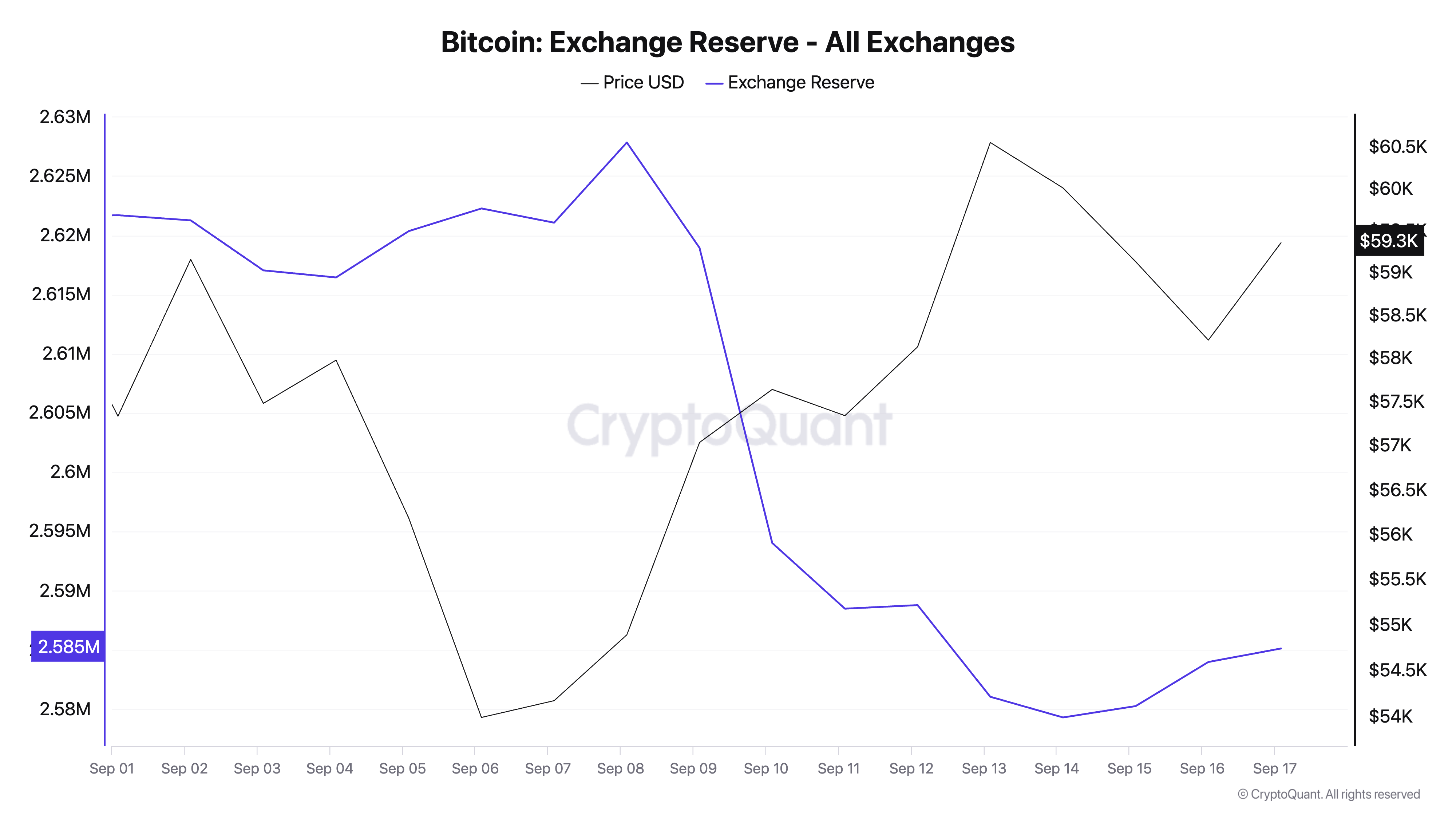

Since the beginning of the month, Bitcoin exchange reserves have dropped from approximately 2.62 million BTC to 2.58 million BTC. This decline of nearly 38,000 BTC in just over two weeks follows a continued trend of Bitcoin flowing out of exchanges at an accelerated pace.

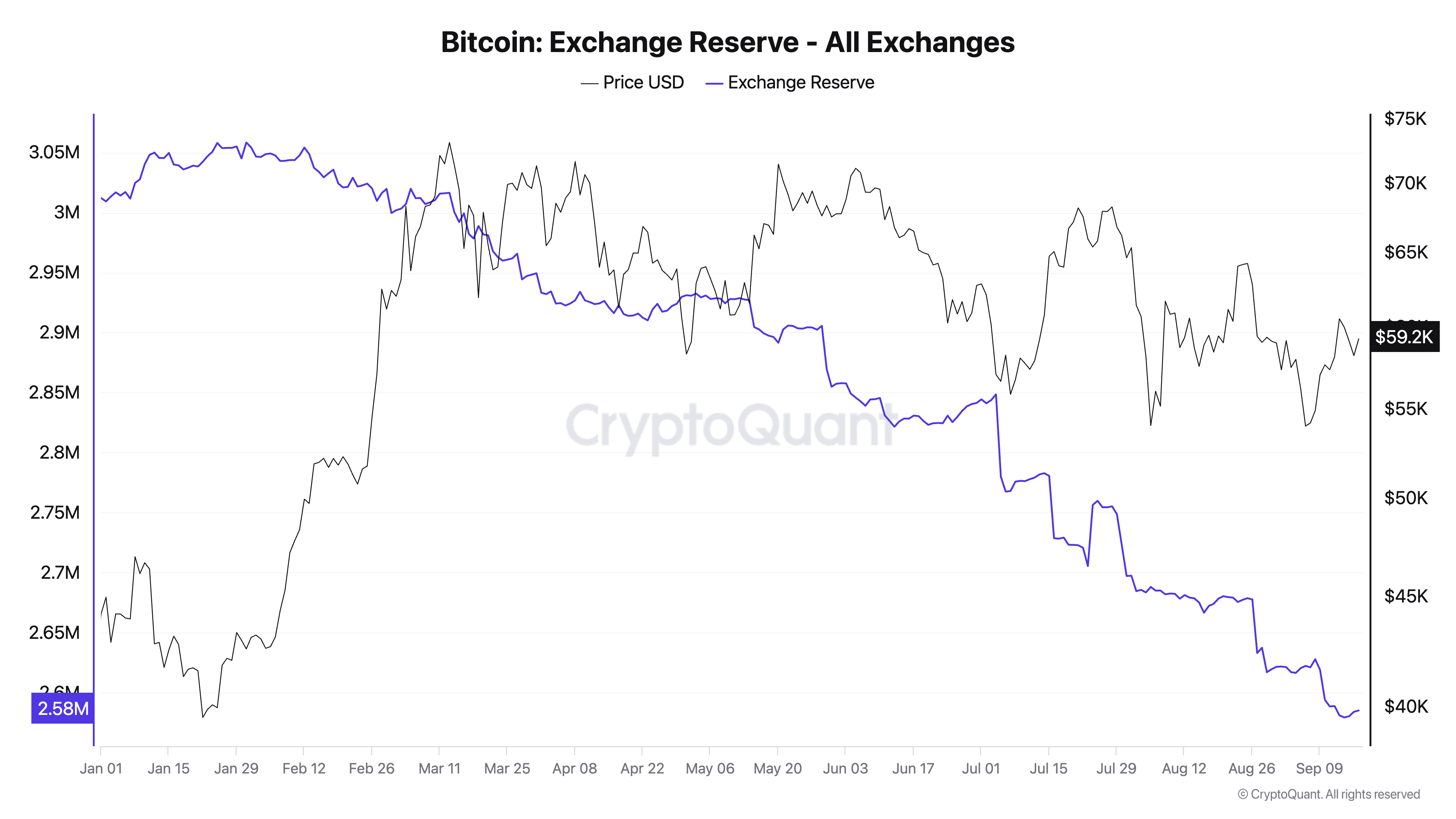

The yearly trend shows an even larger drop, with reserves having reduced by about 430,000 BTC since the beginning of the year.

A decrease in Bitcoin exchange reserves typically indicates that investors are moving their holdings off exchanges, opting for long-term storage in personal wallets. This action is often interpreted as a sign of confidence in Bitcoin’s future price potential, as it reduces the immediate supply available for trading, potentially setting the stage for a supply squeeze.

The return of exchange reserves to 2018 levels is particularly telling. In November 2018, Bitcoin emerged from a major bear market, and investors began accumulating Bitcoin in anticipation of future gains. Today, the parallel is clear: investors are withdrawing Bitcoin from exchanges again, possibly signaling an accumulation phase in the current market cycle. This move could imply that market participants are preparing for a significant price movement driven by the scarcity of available Bitcoin on exchanges.

The low levels of exchange reserves suggest a market leaning towards long-term holding rather than short-term trading. Such behavior can increase price volatility, especially if demand surges amidst a constrained supply.

The post Bitcoin exchange reserves drop to 2018 levels appeared first on CryptoSlate.