Analysts have taken notice of Shiba Inu (SHIB) recently, which sees an unusual strength even when the greater crypto market gets into chaos. Optimism for the massive upswing in price came after a recent breakout from a falling wedge pattern. This technical development could be a sign of a downtrend turning into a bull’s market and could see a heavy price rise.

Technical Analysis Signals Potential Upsurge

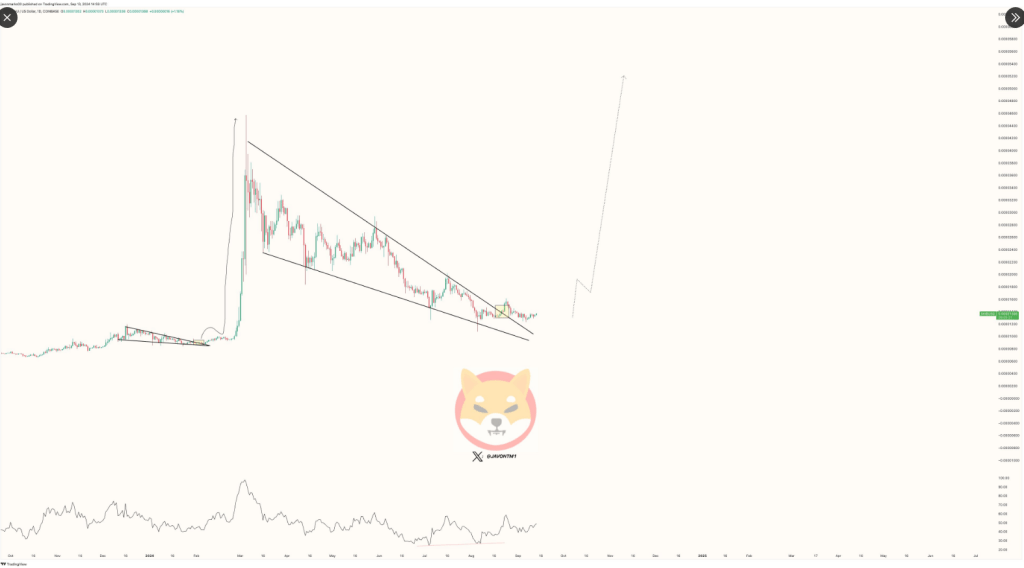

On 20 August, Shiba Inu came out of a falling wedge pattern–a sign that bearish momentum was dwindling. According to crypto analyst Javon Marks, this breakout is a highlight in his report. He believes SHIB can head straight for an enormous rally with a goal price in the region of $0.000081.

That will amount to a solid 430% increase from its current level of $0.00001327. Even with recent market declines, the breakout above the upper trendline has kept SHIB consistent. Analysts are hopeful that as market conditions calm, this technical change points toward a possible rally.

Santiment’s Take And SHIB Price Prediction

On the other hand, though, investor sentiment sends out contrary signals. On-chain market intelligence platform Santiment says there is a lot of fear, uncertainty and doubt for the Shiba Inu investors.

The population of holders with less than 1 billion SHIB has fallen to its lowest since last November. There’s a pretty sharp drop in social media interest in SHIB, as well. This may also signify a more negative mood among investors in general.

But the most recent estimate from CoinCodex indicates Shiba Inu’s short-term approach being more conservative. With SHIB, the negativity is reportedly low since it is predicted to drop to almost -0.46%. The October 18, 2024 amount will be $0.00001323.

The current Fear & Greed Index of 45 reminds investors that fear is on the high end. The past 30 days reflect a pretty meager number of green days at 16 and volatility in terms of price stands at 4.52%. So, it goes without saying that the prognosis in recent times for SHIB has been mixed and uncertain.

Shiba Inu: Mixed Signals

Optimism and caution appear to be mixed up with the current situation of the Shiba Inu. Market mood and the prospects over the short run are in a more pessimistic condition even as the technical indicators put forward the possibility of a strong rally ahead.

These mixed signals should be carefully taken into consideration by investors and may want to sit back and wait for a few more such signs before going ahead to make investments. As always, it is good to be informed and cautious to pull through the uncertain times effectively.

Featured image from Pexels, chart from TradingView