On-chain data shows that Toncoin (TON) has recently become the number one cryptocurrency in this network activity-related indicator.

Toncoin Has Seen A Sharp Surge In Active Addresses Recently

According to data from the market intelligence platform IntoTheBlock, Toncoin has recently increased active addresses. The “Active Addresses” here refers to an indicator that keeps track of a given coin’s total number of addresses participating in some activity on the network.

Naturally, the Active Addresses only considers the unique number of such addresses. Also, the metric includes both sending and receiving addresses in its count.

When the value of this indicator is high, it means many users are making transactions on the blockchain right now. Such a trend implies investors may actively invest in asset trading.

On the other hand, the low metric’s value suggests users may not pay much attention to the cryptocurrency as they aren’t making many moves.

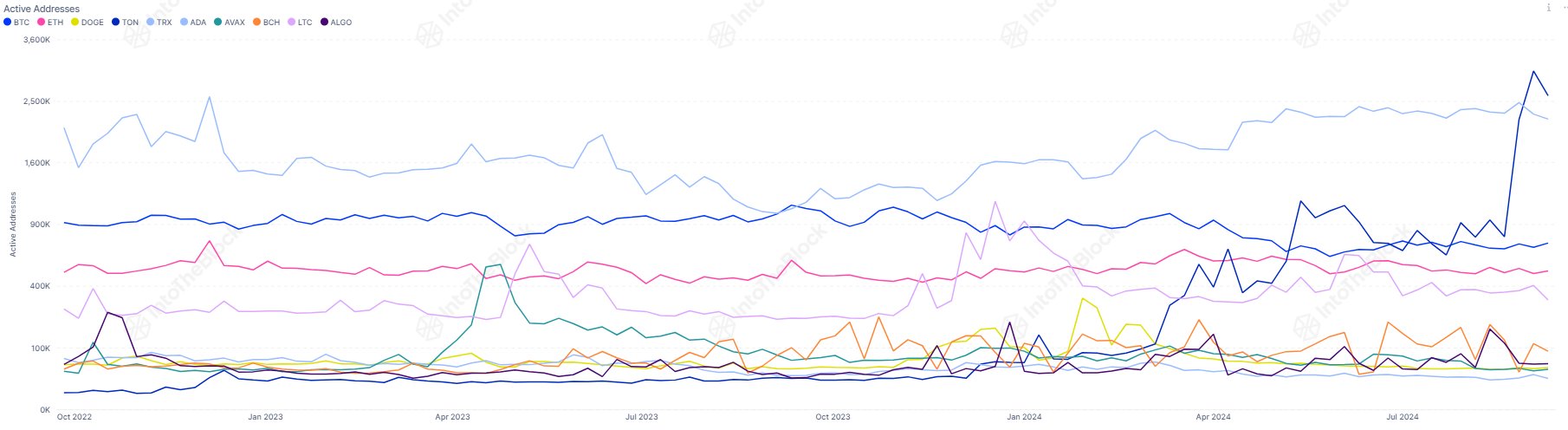

Now, here is the chart shared by IntoTheBlock, which shows how the trend in the Active Addresses has looked like on the major Layer 1 networks:

“Layer 1” networks refer to the blockchains that handle their security and aren’t dependent on another network. Such chains form the base on which subnetworks can grow.

As displayed in the above graph, Toncoin has enjoyed sharp growth in Active Addresses during the last several months, with an especially rapid climb in the past few weeks.

TON surpassed Bitcoin (BTC) and Ethereum (ETH) earlier in the year. Still, this latest continuation has also overtaken Tron (TRX) to become the number one network in this indicator.

At the peak of this latest spike, the Toncoin network had witnessed an average of three million unique addresses transacting daily. Since then, the metric has declined a bit, but it’s nonetheless still at very high levels.

The recent growth in Active Addresses for TON naturally suggests that the network has attracted many users. This activity, however, won’t necessarily translate to the asset’s value.

More users making trades, though, means that the price could see more action, but this volatility can take the asset in either direction, not just the bullish one.

It remains to be seen whether Toncoin will retain its spot as cryptocurrency king in terms of active addresses shortly and whether this activity will affect the price at all.

TON Price

Toncoin has surged alongside the rest of the market during the last 24 hours as its price is now trading around $5.7, up 4%.