Data shows Bitcoin has been becoming increasingly correlated with Gold, a potential sign that the digital Gold narrative is making a return.

Bitcoin Correlation With Gold Has Risen To 0.75 Recently

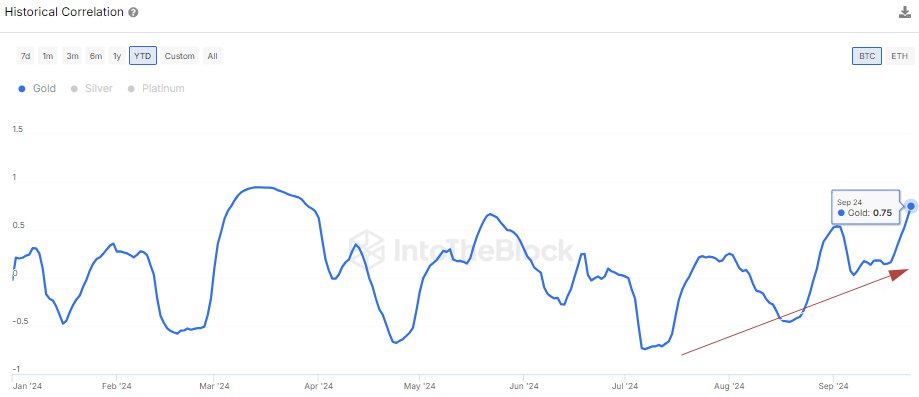

In a new post on X, the market intelligence platform IntoTheBlock discussed the latest trend in Bitcoin’s Correlation to Gold. The “Correlation” here is a metric that tracks how closely related the prices of two given assets are. In the current case, of course, the assets are BTC and Gold.

When the value of this metric is positive, it means BTC is reacting to movements in the Gold price by moving in the same direction. The closer is the indicator to the 1 mark, the stronger is this relationship.

On the other hand, the metric being under zero suggests that, although there is some correlation present, it’s a negative one. In other words, the two assets are moving in the opposite direction to each other. The -1 level plays the role of the extreme in this case. The Correlation can also assume a value exactly equal to zero, indicating that there is no relationship between the prices of the assets whatsoever. In statistics, the variables satisfying this condition are said to be independent.

Now, here is a chart that shows the trend in the Bitcoin Correlation to Gold since the start of the year 2024:

As displayed in the above graph, the Bitcoin Correlation to Gold had slumped to the lowest point for the year in July, but since then, the metric has been steadily moving up. The indicator now has a value of 0.75, which suggests there is a notable positive relationship between the assets. From the chart, it’s apparent that this is the highest that the metric has been since March.

“Bitcoin’s rising correlation over the past months aligns with investors’ recession fears and lack of confidence in the dollar,” notes the analytics firm. “This flight to safety highlights Bitcoin’s evolving role in macroeconomic hedging.”

The Correlation can be a useful indicator to follow for investors looking for diversification options for their portfolios. In general, assets with a high value of the indicator may not be ideal options to keep together, like Bitcoin and Gold right now.

IntoTheBlock has pointed out, however, that Ethereum‘s Correlation to Gold is still minimal at the moment, implying that ETH’s role in the market is different from BTC’s.

As for what it is, the analytics firm comments:

Ethereum’s limited correlation with gold points to its position as a more speculative, growth-driven asset. Its price movements are less influenced by external economic factors and more driven by the underlying ecosystem such as DeFi activity & staking.

BTC Price

Bitcoin has continued to show stale action recently, as its price is still trading around $63,500.