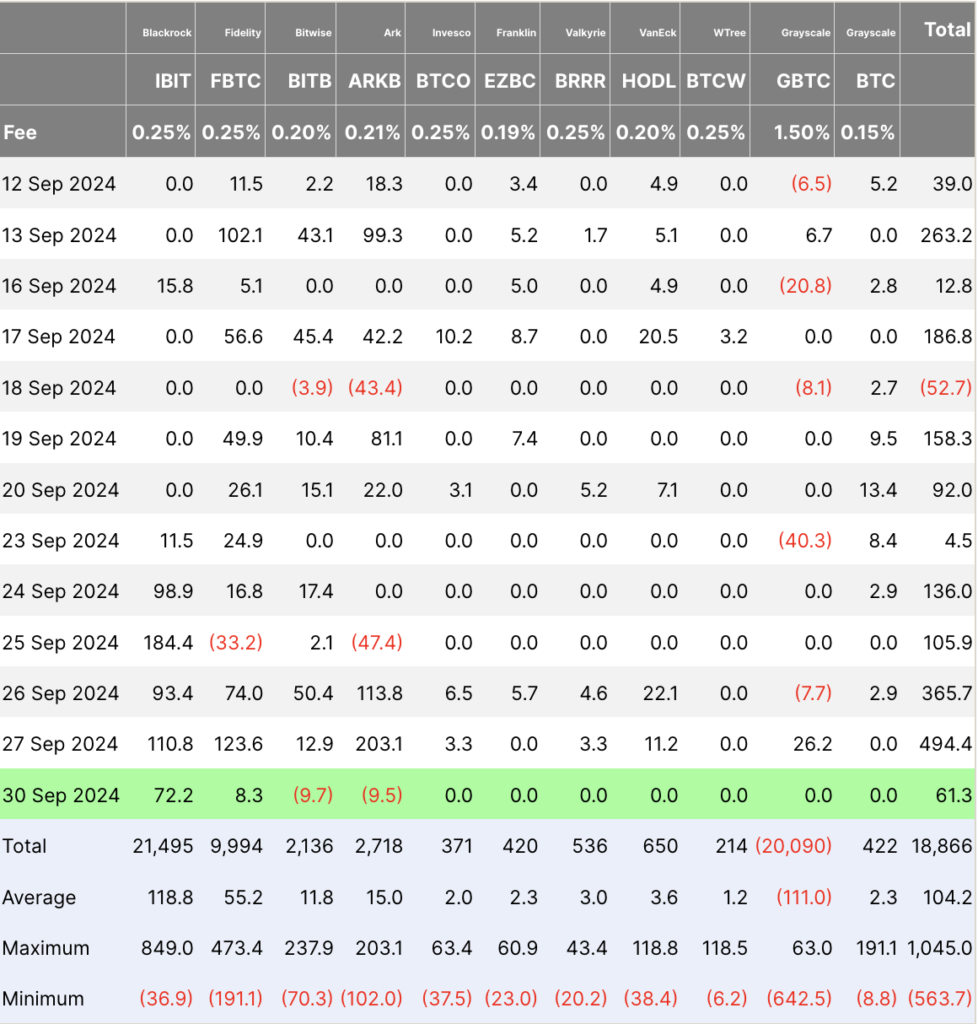

On Friday, Bitcoin ETFs recorded a significant inflow of $494.4 million, marking one of the highest single-day totals in recent months. Ark’s ARKB ETF led the charge with a substantial $203.1 million in new capital, continuing its strong momentum after a significant inflow on Sept.26.

Fidelity’s FBTC ETF saw $123.6 million, while BlackRock’s IBIT ETF contributed $110.8 million. Bitwise’s BITB added $12.9 million, while Grayscale’s GBTC posted $26.2 million in new flows. Minor inflows were seen in Invesco’s BTCO, Valkyrie’s BRRR, and VanEck’s HODL, which each reported around $3.3 million, and VanEck’s HODL saw an additional $11.2 million.

On Monday, Bitcoin ETFs saw a cooling in activity, with net inflows of $61.3 million. BlackRock’s IBIT ETF continued to attract capital with $72.2 million in inflows, but this was offset by outflows from Bitwise’s BITB and Ark’s ARKB ETFs, which saw withdrawals of $9.7 million and $9.5 million, respectively. Fidelity’s FBTC ETF also experienced a slowdown, adding only $8.3 million.

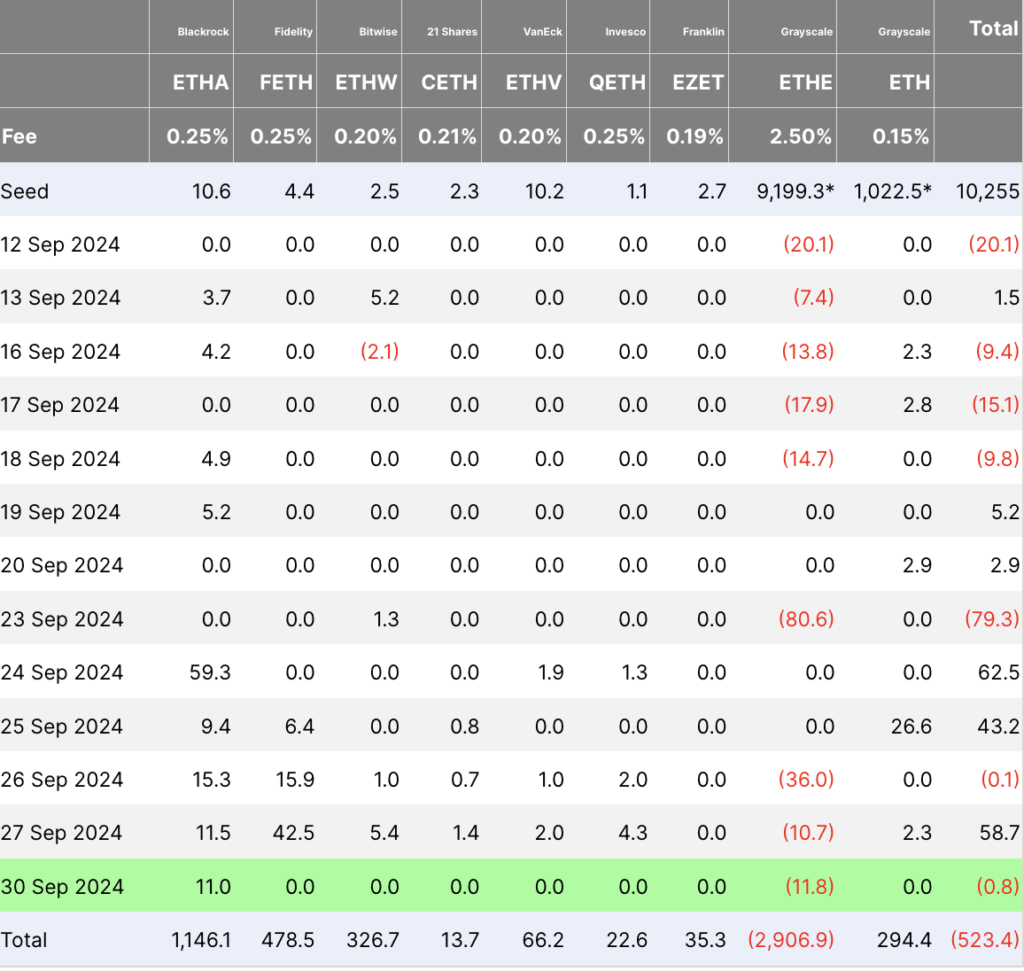

Ethereum ETFs followed a similar pattern. On Sept. 27, total inflows reached $58.7 million, led by Fidelity’s FETH ETF with $42.5 million and BlackRock’s ETHA at $11.5 million. Bitwise’s ETHW and Invesco’s QETH added $5.4 million and $4.3 million, respectively, while Grayscale’s ETHE ETF posted outflows of $10.7 million, partially offset by $2.3 million in inflows to Grayscale’s mini ETH fund.

On Sept. 30, Ethereum ETFs faced minor outflows totaling $0.8 million, driven by $11.8 million in outflows from Grayscale’s ETHE fund, while BlackRock’s ETHA ETF added a modest $11 million. No significant activity was reported across the other Ethereum ETFs, suggesting a quiet start to the week for institutional interest in Ethereum-backed products.

Substantial inflows into Bitcoin ETFs on Friday emphasized continued institutional confidence, with Ark and Fidelity leading the charge. Monday saw a more tempered market reaction, possibly indicating short-term profit-taking or reallocation heading into the new week. Despite strong Friday inflows, Ethereum ETFs also saw a mixed start on Monday, with Grayscale’s outflows continuing to weigh on the overall market sentiment for Ethereum-backed funds.

The post Bitcoin ETFs see over $500 million inflows in past 2 days appeared first on CryptoSlate.