Arbitrum recently made headlines by breaking 1 billion transactions, a monumental number for decentralized finance. Data coming in from GrowThePie reveals that operations in DeFi alone make up over 20% of all transactions; the layer 2 scaling solution proves to be widely relevant to Ethereum. This feat not only demonstrates Arbitrum’s rapid expansion, but also its ability to transform the DeFi environment.

The Rise Of Arbitrage

Arbitrum, developed by Offchain Labs, is intended to address Ethereum’s scalability difficulties via a mechanism known as Optimistic Rollup. This enables for speedier transaction processing and lower fees, making it a popular choice among developers and consumers alike.

Arbitrum One just hit 1 billion transactions!

Onwards to the next billion. pic.twitter.com/OvXzUYYCuf

— Arbitrum (

,

) (@arbitrum) September 30, 2024

The platform has grown since its inception, from a venture capital-backed concept to one of the ecosystem’s most active layer 2 chains. Arbitrum has already established itself as a popular venue for a variety of DeFi applications, including lending platforms and yield farming procedures.

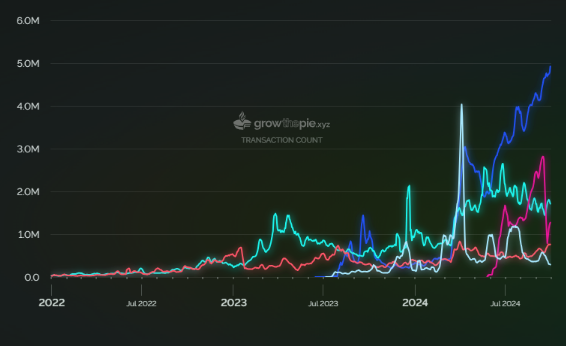

The transaction data illustrate an absolutely commendable trajectory of growth. Arbitrum started with a volume of less than 100,000 transactions per day and has since grown to do over 2 million transactions daily. That is largely due to the interoperability with Ethereum’s programming language, Solidity, which enables it to shift current Ethereum projects to Arbitrum with minimal alterations.

Arbitrum: DeFi Activity Flourishes

DeFi activity on Arbitrum is flourishing, with lending and borrowing platforms gaining popularity. These platforms enable users to lend their assets in exchange for income, while borrowers can use the cash for trading or investing. The lower gas expenses relative to Ethereum’s mainnet make these services more accessible, especially for individual investors who may have been put off by high costs previously.

In addition, other new protocols like Pendle Finance saw an increase in Arbitrum activity. Pendle focuses on yield trading and liquidity availability, rewarding customers to use its platform with highly lucrative rewards. The bigger outcome of this is that Arbitrum has attracted huge liquidity- over $3.29 billion-with more minor DeFi projects that survived alongside large ones such as Aave V3.

Future Prospects

Looking ahead, the future of Arbitrum remains bright with all the efforts it made into the integration of its newer features and an extensification of its ecosystem. The latest integration of DIA oracles has enhanced further the platform’s possibilities of providing both transparent price data for numerous assets, which, basically, improved the existing functionality of the bridge, making all the existing DeFi applications more useful and even encouraging new projects to debut on Arbitrum.

Featured image from Gadgets 360, chart from TradingView