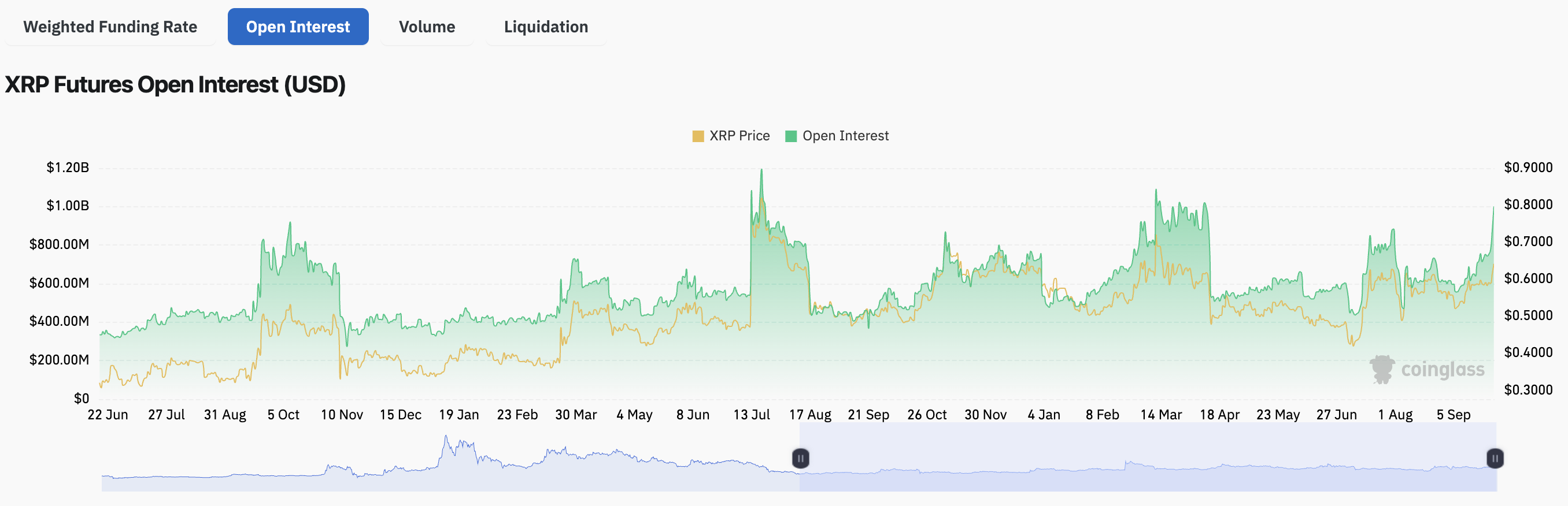

Ripple’s XRP token amassed close to $1 billion in open interest over the weekend, while its price hovers around $0.61 at press time, data from CoinGlass shows.

What’s Different About XRP Price Action?

While the top two cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH), have been down 1.5% and 2.3% over the past week, XRP has been up 4.1% during the same period. Several factors could explain XRP’s counter-trend price action.

For example, digital asset manager Grayscale Investments recently launched a closed-end XRP Trust in the US, enabling institutional investors to gain exposure to one of the top ten cryptocurrencies by reported market cap.

Grayscale’s Trust surged by more than 11% within a week, hinting at strong institutional demand for the seventh largest crypto-asset.

The launch of the Trust has also fuelled speculations about the potential approval of an XRP exchange-traded fund (ETF) shortly. If the US Securities and Exchange Commission (SEC) approves an XRP-based ETF, it would become only the third digital asset with its own ETF.

Another key development in the Ripple ecosystem is the anticipated launch of its USD-pegged stablecoin, RLUSD. Currently, crypto analysts on X are closely watching the stablecoin in private beta testing on both the XRP and Ethereum networks.

According to a recent update, 480,000 RLUSD was minted at RLUSD Treasury, signaling active development of the stablecoin before its integration into Ripple’s services, including its cross-border payment products. The stablecoin can also be used in decentralized finance (DeFi) protocols across blockchains.

Implications Of Rising Open Interest

Data from CoinGlass indicates that open interest in XRP surged to more $1 billion over the weekend before it tumbled to roughly $945 billion at press time. Spot trading volume in the last 24 hours stands slightly above $2 billion.

A rise in open interest typically indicates increased market activity, suggesting that more contracts are being opened. This may signal expectations of a price move in either direction, depending on the prevailing market sentiment. Notably, XRP’s open interest was last recorded around the $1 billion mark in March 2024.

As for price action, crypto analysts have divided opinions on XRP. Ripple Labs’ recent legal victory over the SEC provided optimism for the altcoin bulls, with one analyst predicting that if the token overcomes key resistance levels, it could surge to between $16 and $20.

Meanwhile, another crypto analyst, Carl Runfelt, highlighted a multi-year bullish triangle pattern on the token’s chart. He noted that if XRP breaks the pattern and goes parabolic, it could rise by more than 200% within weeks.

On the contrary, XRP’s inability to break through the $0.60 resistance level decisively could lead the token to retest the $0.55 support level. XRP trades at $0.61 at press time, down 1.6% in the past 24 hours.