Bitcoin is back to red at press time, looking at the performance in the daily chart. After the close of the unexpectedly bullish September bar, the coin started on a weaker footing in October, dropping nearly 5% from the $65,000 and $66,000 resistance zone.

Will Bitcoin Follow Global M2 Money Supply Growth To $90,000?

Despite the contraction, traders are confident of what lies ahead, expecting the coin to turn the corner and print higher. In a post on X, one analyst predicts Bitcoin will reach $90,000 in the next two months, especially if it continues tracking the global M2 money supply trend.

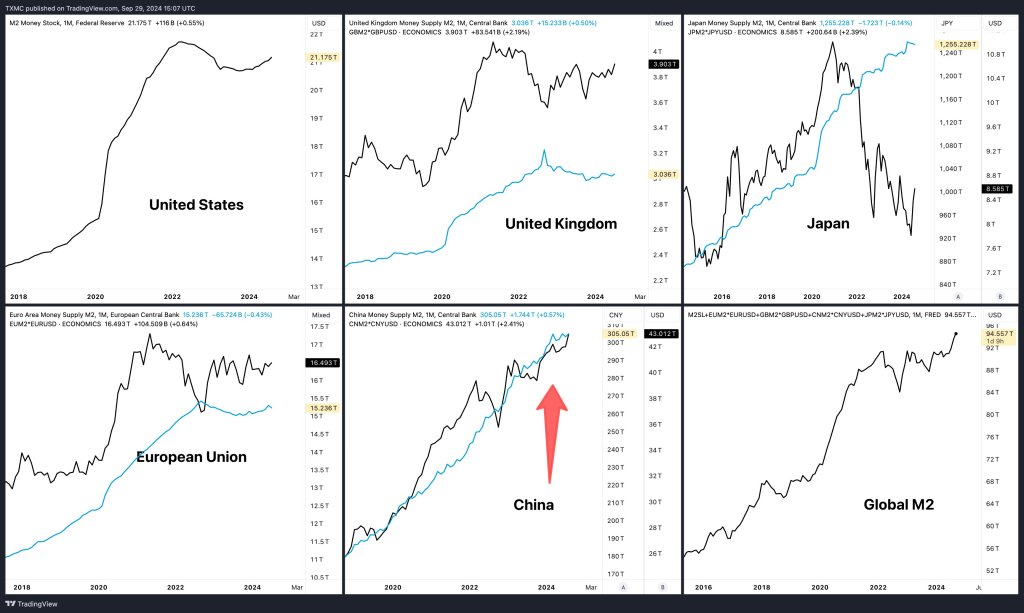

In the analyst’s findings, the global M2 money supply directly correlates to Bitcoin prices. That means whenever there is an uptick in global money supply, BTC’s prices also edge higher.

Currently, the global liquidity is rising. Therefore, if the past correlation leads, there is a high possibility that the coin will not only break above March highs but also soar to $90,000, per the analyst’s prediction.

Presently, the local resistance zone lies at September 2024 highs at around $65,000 and $66,000. If bulls flow back, lifting sentiment and prices, Bitcoin might soar.

In the short term, strong resistance exists between $70,000 and $72,000. A breakout above this level could spark a short squeeze that may see the world’s most valuable coin break above March highs.

China Driving Global Liquidity, Federal Reserve Plans To Further Drop Rates

While technical considerations may support Bitcoin bulls, analysts closely monitor the global M2 money supply. In a post on X, one observer explains that global liquidity is rising partly because of the weakening USD.

As expected, whenever the Japanese, Chinese, or even the European Union’s money supply increases in USD terms, the greenback’s value tends to decline, leading to a valuation change in the global M2 money supply.

The uptick in global liquidity in recent weeks, the analyst says, is primarily due to monetary policy changes in China. The PBoC slashed interest rates and plans to inject billions to stimulate the economy.

Its M2 money supply is larger than that of the United States in USD terms. Subsequently, it is the primary driver in global M2 money supply expansion.

With the United States Federal Reserve easing after suppressing the growth of its M2 money supply from 2022 to curb runaway inflation, Bitcoin and risk-on assets will likely benefit.

After slashing rates by 50 basis points in September, Jerome Powell, the Federal Reserve chair, has hinted that the central bank might cut rates even more in Q4 2024.