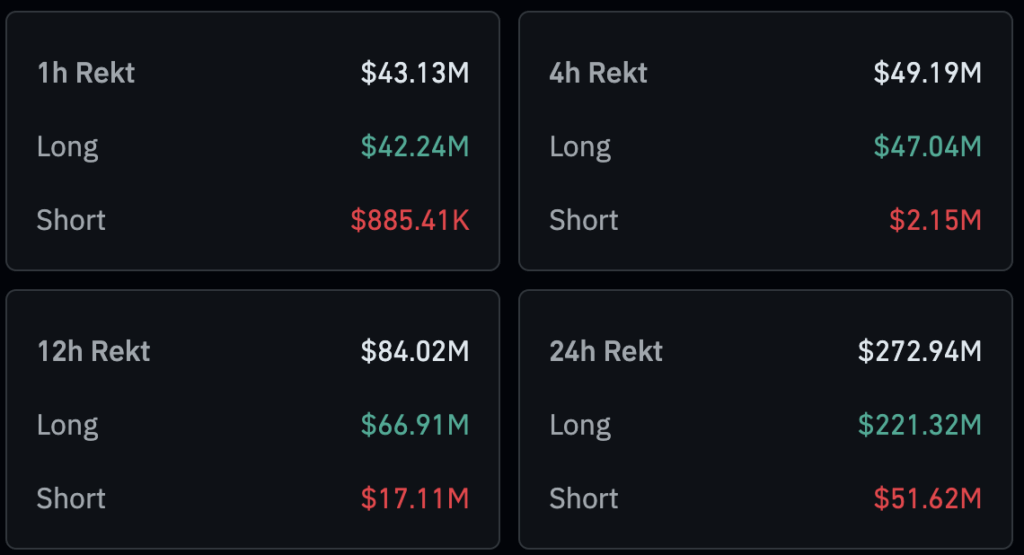

Bitcoin’s recent price movements have shown increased volatility, with $272 million in liquidations over the past 24 hours, reflecting broader market trends and trader behavior. Over the past 48 hours, Bitcoin fell from $62,000 to a low of $60,000, marking a roughly 3% decline. Following this drop, Bitcoin saw a slight recovery to $61,400 before retesting $60,000 again this morning amid the market’s ongoing uncertainty.

Coinglass liquidation data indicates significant long liquidations in the same period, with $221 million in positions cleared in the past 24 hours alone. This suggests traders faced pressure as the market briefly trended downward. Per Coinglass, 95,621 traders were liquidated during this period, with Binance witnessing the most significant single liquidation—an ETHUSDT order worth $12.24 million.

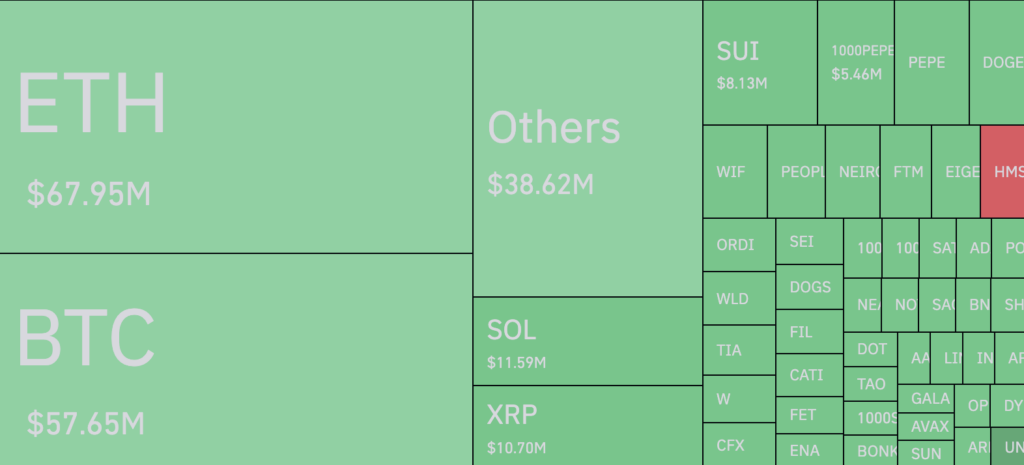

Exchange-specific data shows Binance accounting for $30.72 million of the $48.35 million in total liquidations within the last 4 hours, with longs making up the majority at 95.58%. OKX and Bybit followed, contributing $8.78 million and $5 million, respectively. Ethereum led in asset liquidations at $67.95 million, followed by Bitcoin at $57.65 million.

The concentrated long liquidation points to sentiment misalignment as traders were overly bullish amid fluctuating market conditions and global geopolitical instability. As price action stabilizes near $60,000, the market remains sensitive to short-term fluctuations and macroeconomic factors.

The market is again testing the bottom of a channel seen repeatedly throughout 2024. As CryptoSlate identified earlier in the year, Bitcoin has traded between several key areas notably, $71,500 to $68,000 (yellow), $66,900 to $61,800 (white), $60,400 to $56,600 (red), and $55,700 to $49,700 (blue).

Bitcoin has reentered the red channel for the fifth time in 2024. On just three occasions, it continued down into the blue channel before recovering into the white channel. Should Bitcoin stabilize within the red channel, the bottom support has been around $56,600. Notably, the channels align most accurately with the 30-minute timeframe.

The post Crypto market liquidates $272 million in 24 hours as Bitcoin drops to $60k appeared first on CryptoSlate.