The 2024 US presidential election race remains highly competitive on prediction markets, with odds tightening recently on Polymarket, the leading blockchain-based prediction platform.

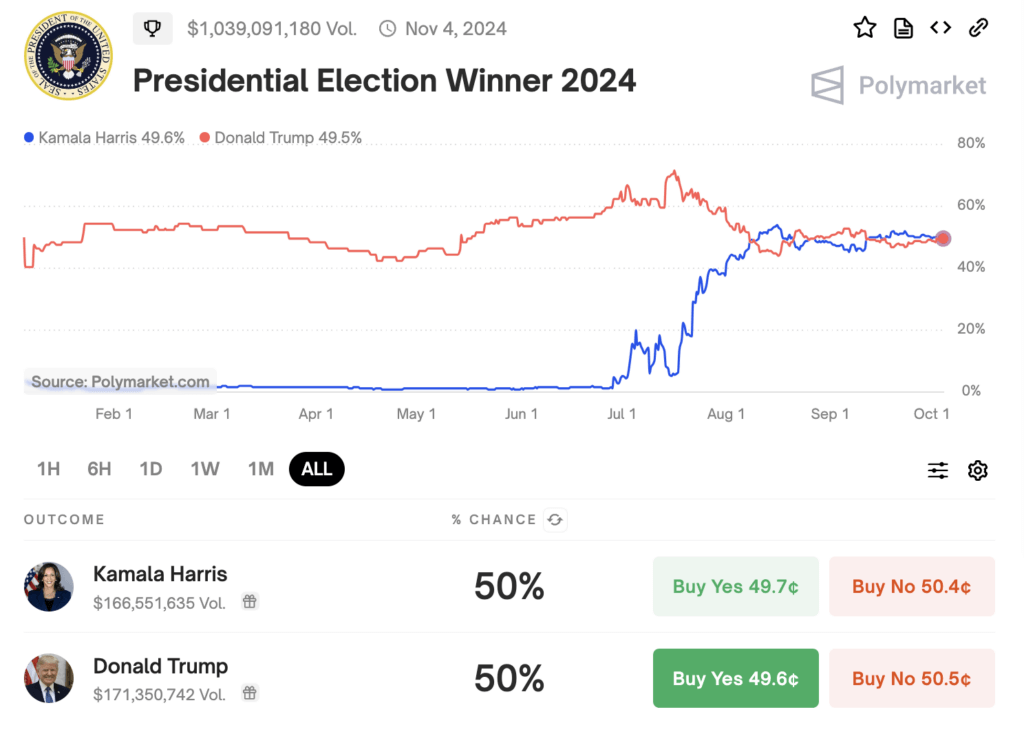

As of press time, the “Presidential Election Winner 2024” market on Polymarket shows an extremely close contest between the frontrunners. Donald Trump and Kamala Harris are currently in a dead heat, with each candidate receiving 50% of user predictions.

This represents the closest odds seen on the platform since mid-September, reflecting the volatile and unpredictable nature of the current political landscape.

Special Counsel Jack Smith submits private criminal charges against Trump

The tightening of odds comes amid a new development in the ongoing legal challenges surrounding the 2020 election. Special Counsel Jack Smith has filed new documents related to his investigation into attempts to overturn the 2020 election results, amending to navigate the Supreme Court ruling around Presidential immunity.

The filing presents a detailed account of Trump’s actions based on testimony from insiders within his circle. The filing alleges that Trump had planned to declare victory regardless of the election results, with the intention of excluding mail-in ballots that he believed favored Biden.

According to the filing, by Nov. 13, 2020, Trump was aware that he lacked evidence of election fraud and had lost legal challenges that could have altered the election outcome. The filing further details Trump’s interactions with Vice President Mike Pence, who repeatedly refused to participate in efforts to overturn the election results.

On Jan. 6, 2021, Trump allegedly encouraged his supporters to march to the Capitol, knowing that Pence would not reject the legally certified electors. The document suggests that even after the Capitol attack, Trump continued efforts to stop the certification process, hiring new lawyers who were willing to continue his plan.

However, the filing appears to have had little negative effects on Trump’s Polymarket odds. The platform has seen a surge in activity and user engagement in recent months as the 2024 election draws nearer.

Polymarket activity continues to thrive through election betting

In September, the platform reported $533.51 million in trading volume, an increase of $61.51 million compared to August. The number of active users also climbed to 90,037, representing a 41% rise from the previous month.

The “Presidential Election Winner 2024” market has been particularly active, generating $89 million in 30-day volume based on recent Dune Analytics data. This high level of engagement emphasizes Polymarket users’ intense interest in the upcoming election.

The platform’s growth has been driven by increased interest in decentralized prediction markets, particularly as global events like elections and geopolitical tensions have captured public attention. Polymarket’s blockchain-based technology offers users a transparent and secure environment for betting on event outcomes.

With the election just over a month away, demand for these prediction markets is expected to remain high. However, analysts are closely watching to see whether interest will taper off after November. Polymarket’s ability to diversify its markets beyond elections and focus on user experience could play a crucial role in maintaining momentum post-election.

The post US election Polymarket odds close to tightest since mid-September amid new 2020 election challenge appeared first on CryptoSlate.