Solana is testing a crucial level after weeks of volatile price action and market uncertainty. Following the Federal Reserve’s interest rate cut announcement, Solana surged 26% but quickly retraced 17%, reflecting the ongoing turbulence in the broader crypto market. This rollercoaster price movement has left many investors on edge as they wait for the next clear signal.

Amidst this uncertainty, top analysts are closely monitoring Solana’s next move, with one in particular pointing to the $160 mark as the decisive level that could determine its direction. A breakout above this level could reignite bullish momentum, while failure to do so may lead to further downside pressure.

The coming days will be critical for Solana as investors assess the market’s trajectory and brace for potential volatility. With SOL standing at a pivotal point, both bulls and bears are watching closely to see whether the price can break through key resistance or succumb to further correction.

Solana Testing Liquidity Below $160

Solana has experienced significant ups and downs over the past couple of weeks, leaving investors uncertain after the latest dip. Many were anticipating further gains before the retrace, which has now sparked caution in the market. With Solana trading in this volatile environment, the focus has shifted to key technical levels that could determine the next big move.

Top crypto analyst Daan has shared his insights on X, noting that Solana has formed three nearly equal highs around the $160 level. He also highlights that SOL is consistently making higher lows, a sign of potential bullish momentum building up.

According to Daan, this gradual upward drift suggests that Solana could eventually break through the $160 resistance level, which would be a pivotal moment for the cryptocurrency.

The reaction at $160 will be crucial. If Solana manages to break above this level, it could signal a push to new highs and reignite bullish sentiment in the market. However, if the price fails to maintain momentum, Solana might remain range-bound between $120 and $160, continuing its sideways movement. Investors are closely watching these levels as Solana’s next direction could define its performance for the rest of the year.

Price Action: Supply Levels To Break

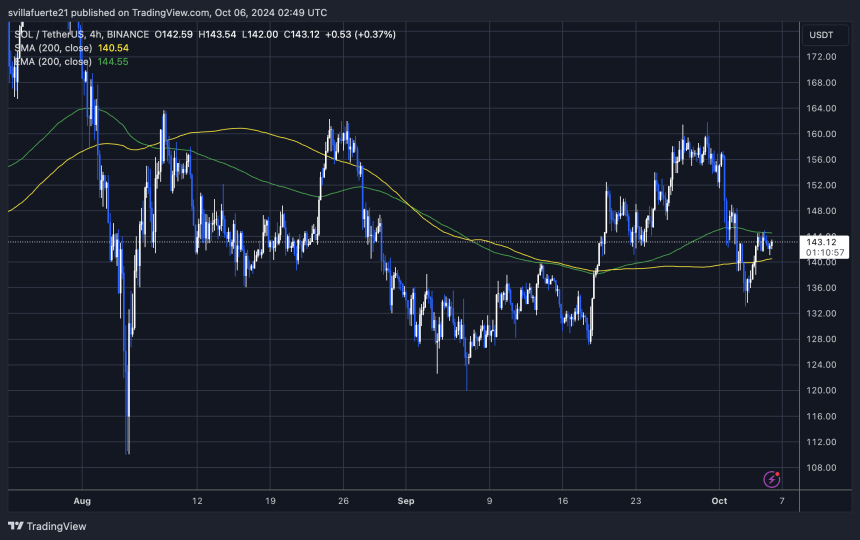

Solana (SOL) is currently trading at $143 after experiencing a few days of choppy price action. The market has been volatile, and SOL is now testing the critical 4-hour 200 exponential moving average (EMA) at $144.55. This level serves as a key resistance point, and a breakout above it could signal a bullish continuation for Solana.

If SOL manages to break and hold above the 4-hour 200 EMA, the next target for bulls would likely be the $160 level. A move above $160 could reignite positive sentiment, potentially setting the stage for further gains. However, if SOL fails to break above the $144.55 resistance, a retrace to lower demand zones is expected.

In the event of rejection at the 4-hour 200 EMA, Solana could dip to the $127 support level, where traders and investors will closely monitor for signs of strength or further downside risk. The price action over the next few days will be crucial in determining whether SOL can resume its bullish trajectory or if a deeper retracement is on the horizon.

Featured image from Dall-E, chart from TradingView