The post FET Price Set for 20% Fall, Here’s Why appeared first on Coinpedia Fintech News

It appears that the Artificial Superintelligence Alliance (FET) is poised for a massive price decline as it has formed a bearish price action pattern on a daily time frame. In addition, FET’s on-chain metrics such as future open interest, Long/Short ratio, and liquidation levels are signaling bearish market sentiment and potential price decline.

FET Technical Analysis and Key Levels

According to expert technical analysis, FET is currently at a crucial support level of ascending trendline and the 200 Exponential Moving Average (EMA) on a daily time frame. If it breaches this support level and closes a daily candle below the $1.32 level, there is a strong possibility that the FET’s price could fall by 20%, reaching the next support at the $1.045 level in the coming days.

Apart from this, there is also a possibility of price reversal at the $1.26 level, as this level acts as the golden Fibonacci level, which may provide strong support for the FET token.

Bearish On-Chain Metrics

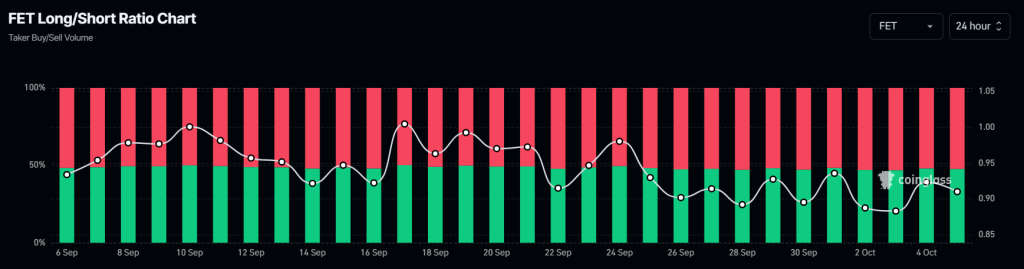

This negative outlook is further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, FET’s Long/Short ratio currently stands at 0.91, indicating a strong bearish market sentiment among traders.

Additionally, its future open interest has declined by 2.7% over the past 24 hours and 1.66% over the past four hours. This falling open interest suggests that traders are either liquidating their positions or are hesitant to open new ones.

Currently, 52.35% of top traders hold short positions, while 47.65% hold long positions, indicating that bears are dominating the asset and may drive a price decline in the coming days.

FET’s Current Price Momentum

Currently, FET is trading near 1.38 and has experienced a price decline of over 5.5% in the past 24 hours. During the same period, its trading volume has dropped by 40%, indicating lower participation from traders and investors amid ongoing confusing market sentiment.