Dogecoin increased in value by more than 12% in the historically bearish month of September but has not quite been able to replicate its excellent form this October. The DOGE price has been under significant bearish pressure in the past few days, reflecting the sluggish climate of the crypto market over the past week.

However, the latest on-chain revelation has pointed out that the price of Dogecoin might not be down for too long. Large investors of the meme coin have become increasingly active in the market — and here’s how it might impact price.

Are Dogecoin Whales Positioning Themselves For A Bullish Breakout?

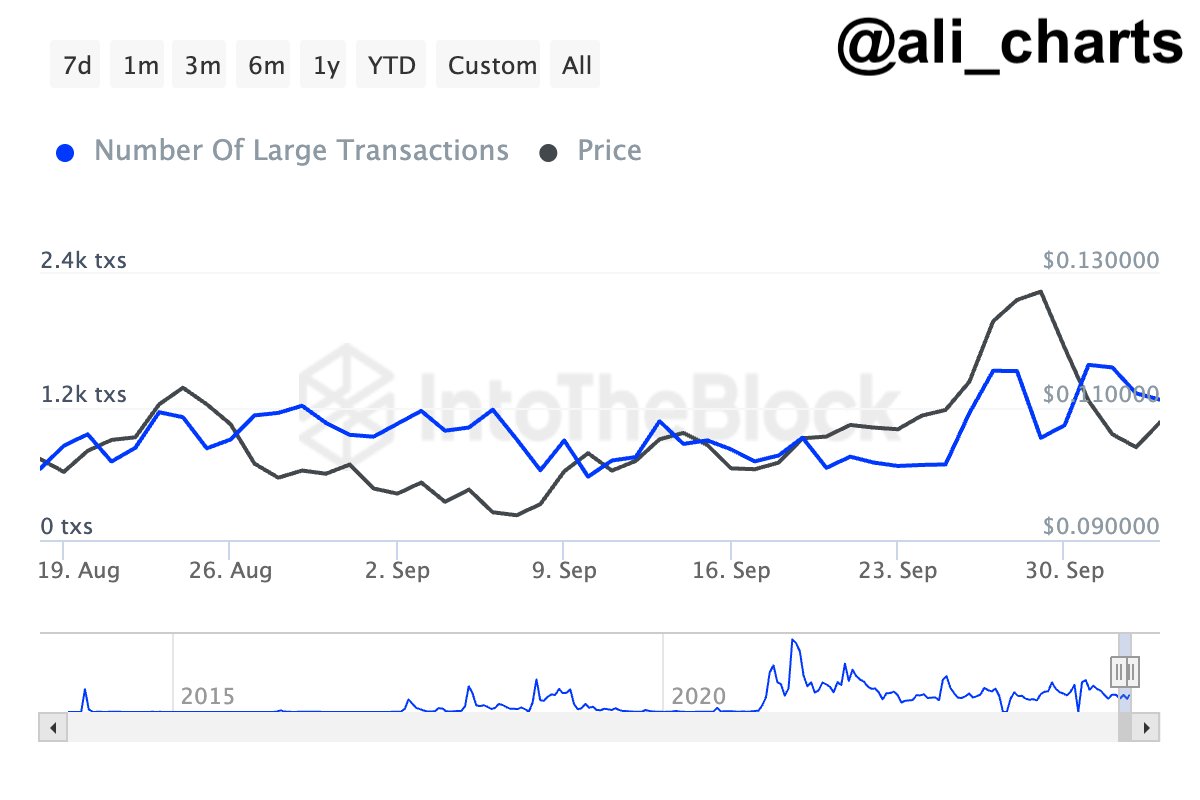

Prominent crypto pundit Ali Martinez took to the X platform to share an interesting on-chain insight into the activity of whales and other large investors in recent days. The relevant indicator here is the IntoTheBlock number of large transactions metric, which calculates the number of token transfers worth over $100,000.

The cohort of investors involved in this data point is the whales and institutional players, considering the magnitude of these transactions. Whales refer to entities (individuals and organizations) that hold substantial amounts of a particular cryptocurrency and, as a result, wield significant influence on the market dynamics.

According to Martinez, the number of large Dogecoin transactions has been steadily rising. A surge in large transactions often indicates that institutional players and whales are either accumulating ahead of a price upswing or distributing their assets. It is worth noting that the IntoTheBlock large transactions metric doesn’t offer enough insight into the direction of these transfers.

However, a recent data point revealed that Dogecoin whales (with at least $10 million) have bought over 1 billion DOGE (worth over $108 million) in one day. While this confirms that the large holders have been accumulating, it leaves other investors wondering what they know.

Nevertheless, the heightened activity of institutional investors and whales could push a bullish narrative for Dogecoin, reinforcing faith in the meme coin’s long-term potential. This could increase market volatility, setting the stage for significant upward price movements.

DOGE Price At A Glance

As of this writing, the price of Dogecoin stands at around $0.1088, reflecting a mere 0.6% decline in the last 24 hours. According to data from CoinGecko, DOGE is down by more than 16% in the past week.

While the meme coin’s recovery seems to be slowing down at the moment, investors might want to keep an eye out for bullish on-chain movements. Moreover, October is known to be a historically positive month for Dogecoin.