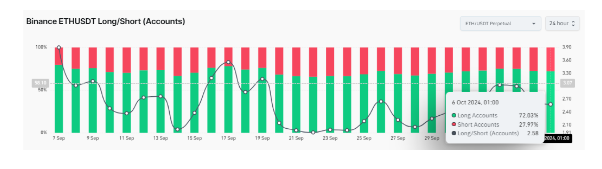

In a recent trading activity on the crypto exchange Binance, 72% of ETHUSDT traders have taken long positions. This interesting sentiment is revealed through the trading analytics platform CoinGlass. This surge in long position is more notable as it comes after a week of Ethereum trending downwards.

The strong tilt toward long positions suggests that most traders are confident Ethereum’s price will rebound in the coming week. On the other hand, 27.97% of Binance traders are still holding short positions on ETHUSDT.

ETHUSDT Long Positions Soar: What’s Behind It?

According to data from CoinGlass, the ETHUSDT traders are currently leaning toward a bullish price for Ethereum in the coming weeks. Notably, the data is mainly confounded by the ETHUSDT perpetual traders.

The data reveals that the number of traders currently opening long ETH positions on Binance significantly outweighs those opening short positions by a ratio of 2.58, highlighting the bullish sentiment among some cohorts of traders.

At the moment, it is unclear why the majority of Binance perpetual traders are going long on Ethereum, except for just a general bullish sentiment on the longer term, as there are no expiration dates for their positions. 72.03% have long ETHUSDT positions opened in the past 24 hours.

Meanwhile, 27.97% of ETHUSDT traders remain cautious and have taken short positions within the same timeframe. These traders may be skeptical about Ethereum’s price recovery in the long term. In comparison, 58.15% of BTCUSDT traders are going long, while 41.85% have short positions opened in the past 24 hours.

However, looking beyond Binance and at the wider crypto market, the sentiment appears to be less bullish. Data from aggregated crypto exchanges shows that spot traders are adopting a more neutral stance on Ethereum, and market participants are equally split between buyers and sellers. Particularly, the Exchanges ETH Long/Short Ratio shows 49.05% of market participants are buyers, while 50.95% are sellers in the past 24 hours.

What’s Next For Ethereum Price?

While the long positions on Binance suggest confidence in a rally, the neutral sentiment among spot traders points to a more cautious outlook. At the time of writing, Ethereum is trading at $2,420. According to data from Coinmarketcap, the altcoin is currently down by 8.38% in the past 24 hours.

Technical analysis shows that Ethereum is retesting a bottom trendline and is on the verge of breaking to the downside. If the bulls are unable to hold this trendline, it could cascade to a further 10.7% fall towards $2,150. On the positive side, a rebound on this trendline could push the crypto to the upside and retest $2,700 as October continues to play out.

Featured image from Pexels, chart from TradingView