The crypto market recently suffered a significant downturn due to the escalating geopolitical tensions in the Middle East, with several large-cap assets shedding their recently-accrued gains over the past week. Specifically, the price of Ethereum crashed from above $2,600 to as low as $2,300 at some point during the week.

This represents a fresh setback for the “king of altcoins,” which has not had a particularly positive performance in the past few months. Interestingly, a popular crypto pundit on X has come forward with an on-chain observation into the behavior of Ethereum investors over the last quarter.

How Ethereum Whales Shaving Off Their Holdings Will Impact Price

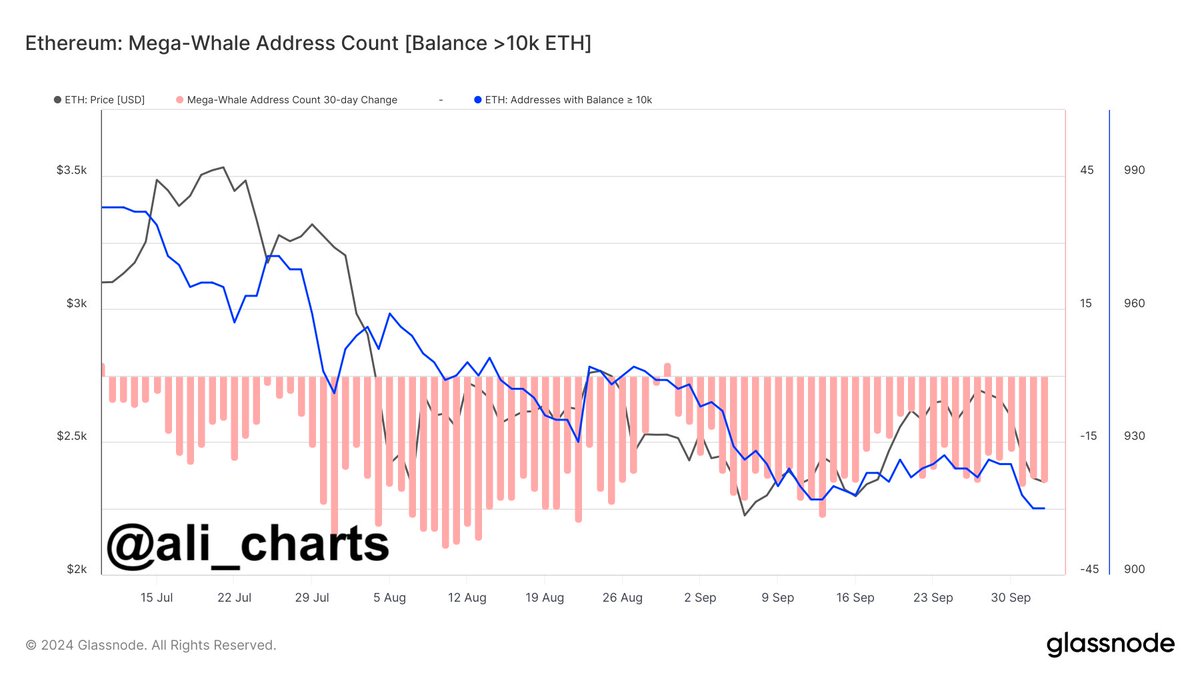

In a recent post on the social media platform X, crypto analyst Ali Martinez revealed that a particular group of Ethereum whales has been shaving their holdings over the past few months. This on-chain revelation is based on the Mega-Whale Address Count, which tracks the number of addresses holding more than 10,000 units of a particular cryptocurrency.

Whales refer to entities (individuals and organizations) that own significant amounts of a specific cryptocurrency (Ether, in this case). Investors usually pay extra attention to whale movements, as these large entities tend to wield notable influence on market liquidity and prices due to their substantial holdings.

According to Martinez, the number of whale addresses holding over 10,000 ETH has fallen by more than 7% since July 2024. This decline in the population of large Ethereum holders points to some redistribution or profit-taking and suggests a notable shift in market sentiment, especially among large-scale investors and institutional players.

Interestingly, this reduction in whale addresses coincided with a period where the Ethereum price struggled. Despite the approval and launch of spot ETH exchange-traded funds (ETFs), the altcoin’s price fell from above $3,500 in July to as low as $2,200 by August.

As already seen in the token’s price action over the last few months, the decrease in large Ethereum holders could diminish buying pressure on a grand scale, leading to sluggish price movement. Moreover, sustained profit-taking activities by these whales could potentiate downward pressure on the ETH price.

ETH Price At A Glance

As of this writing, the price of Ethereum sits just above the 2,400 mark, reflecting an insignificant 0.1% decrease in the past 24 hours. The cryptocurrency’s performance on the weekly timeframe is not so insignificant, as the ETH price is down by nearly 10% in the past seven days.