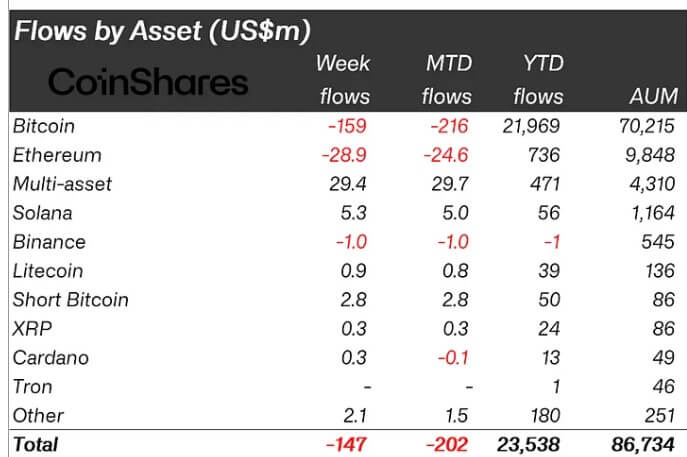

Digital asset investment products globally faced $147 million in net outflows last week, according to the latest weekly CoinShares report.

This marks the first net outflow week in the past four weeks after a period of consistent inflows.

Despite the outflows, digital asset products experienced a 15% increase in trading volumes, even as the broader crypto market saw reduced activity.

James Butterfill, CoinShares’ Head of Research, attributed the outflow to stronger-than-expected economic data released in the United States. He noted:

“Higher than expected economic data last week, reducing the probabilities for significant rate cuts are the likely reason for the weaker sentiment amongst investors.”

Regionally, Canada and Switzerland maintained a bullish trend, recording inflows of $43 million and $35 million, respectively. Conversely, the US, Germany, and Hong Kong experienced significant outflows, with $209 million, $8.3 million, and $7.3 million, respectively.

Investors focus on Bitcoin and Ethereum

The report noted that Bitcoin remained a key focus, with outflows of $159 million for Bitcoin-related products, coinciding with recent price fluctuations.

However, short-Bitcoin products saw inflows of $2.8 million, reflecting bearish sentiment toward Bitcoin’s price movement.

According to CryptoSlate’s data, Bitcoin is trading at around $63,000, a 2% increase over the past 24 hours. Last week, the leading digital asset dropped to a low of less than $60,000 before rebounding to its current value.

Ethereum, which had just ended a five-week outflow streak, returned to outflows totaling $29 million last week. Butterfill commented that investor interest in Ethereum remained subdued. In contrast, Solana was the only altcoin to attract notable inflows, reaching $5.3 million for the week.

Meanwhile, multi-asset investment products, offering exposure to multiple digital assets, defied the overall trend with net inflows of $29.4 million.

This marks their 16th consecutive week of positive flows, bringing their total to $431 million. Butterfill added that multi-asset products have become a favorite among investors since June, representing 10% of assets under management at global crypto fund managers.

The post Digital asset products globally see $147 million outflow but trading surges 15% appeared first on CryptoSlate.