On Monday, the National Bank of Bahrain (NBB) announced the launch of its first Bitcoin-linked structured investment fund. The product, developed in partnership with digital asset firm ARP Digital, is designed specifically for institutional investors in the Gulf Cooperation Council (GCC) region, which includes Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE.

National Bank Of Bahrain Pioneers First Bitcoin Fund

The fund marks a significant milestone in the region’s financial landscape, as it is the first time a national bank in the GCC has introduced a Bitcoin-focused investment product. It aims to provide accredited investors with exposure to Bitcoin while ensuring capital protection. Investors will be able to benefit from Bitcoin performance, but “capped at a predefined threshold, while enjoying 100 percent capital protection on the downside”, according to a local media report.

In a statement, Hisham AlKurdi, Group Chief Executive – Markets & Client Solutions at NBB, emphasized the innovative nature of the investment offering. “We are proud to introduce this bespoke structured investment, which blends the appeal of digital asset exposure with the security of capital protection. This product underscores our focus on offering our wealth management clients innovative and secure avenues to diversify their portfolios in an evolving investment landscape. It is a testament to NBB’s continued leadership in financial innovation within the region.”

The introduction of the Bitcoin-linked structured investment is part of NBB’s broader strategy to expand its wealth management product portfolio. This product is particularly targeted at risk-averse investors who seek exposure to the potential growth of Bitcoin without subjecting their principal capital to the volatility.

The collaboration between NBB and ARP Digital is set to redefine the regional market. Abdulla Kanoo, Co-founder and Co-Chief Executive Officer at ARP Digital, noted: “Our collaboration with NBB is poised to be a game-changer in the regional market. By leveraging our expertise in digital assets and NBB’s extensive reach in the financial sector, we have created a product that introduces Bitcoin exposure within a highly secure framework. This structured investment opens new doors for investors seeking a calculated approach to digital assets.”

With Bitcoin’s volatility serving as a key concern for many investors, the capital-protected structure of this fund provides a novel solution for clients looking to participate in the digital asset market without taking on excessive risk. Dalal Buhejji, Executive Director of Business Development for Financial Services at the Bahrain Economic Development Board, hailed the launch as a significant achievement.

“The launch of this Bitcoin-linked Structured Investment is a prime example of the true potential of Bahrain’s robust financial services ecosystem, which provides an attractive and streamlined environment that gives rise to innovative solutions. This initiative embodies a seamless fusion of traditional financial practices and inventive blockchain-based solutions, and we are proud to witness local institutions like NBB driving cutting-edge advancements and diversification to the sector,” Buhejji stated.

In Bahrain, recent developments in Bitcoin and crypto regulation highlight the nation’s proactive stance in fostering fintech innovation while ensuring investor protection. In September this year, Crypto.com received a Payment Service Provider (PSP) license from the Central Bank of Bahrain (CBB). This license enables the platform to offer e-money services and prepaid crypto cards in Bahrain. In April 2022, Binance received a license to operate in the country.

Bahrain’s regulatory framework is also well-regarded for its balance between innovation and regulatory compliance. Since 2019, the CBB has implemented comprehensive guidelines for crypto-asset services, ensuring businesses operate with transparency while adhering to anti-money laundering (AML) and combating the financing of terrorism (CFT) protocols.

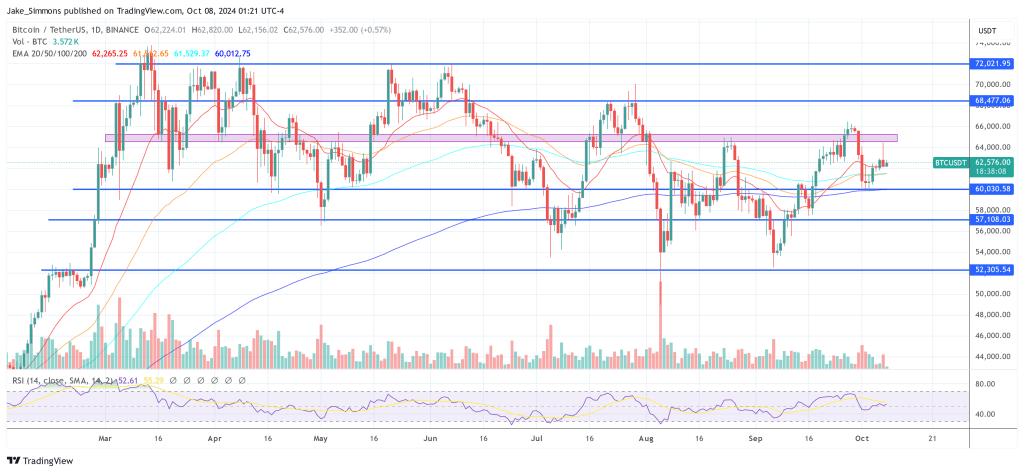

At press time, BTC traded at $62,500.