Popcat (POPCAT), yet another memecoin that recently gained momentum, is making headlines as it closes in on an all-time high. In this context, whale activity is peaking for big investors buying millions of tokens. As the market buzz grows, many people are asking what the future holds for this whimsical cryptocurrency.

Whale Activity Generates Interest

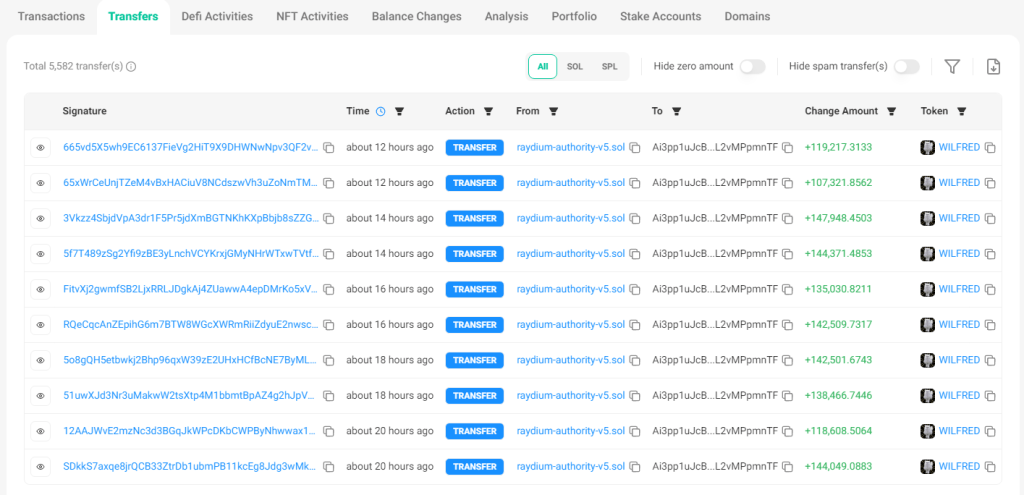

Popcat has recently gained attention due to major purchases made by whales. One investor made news by purchasing 2.36 million tokens for approximately $1.75 million, at an average price of $0.68. This investor had previously liquidated their shares but chose to re-enter the market with a large purchase. Another whale has gone on a purchasing binge, collecting 5.67 million tokens worth almost $3 million in just three days.

These trades have resulted in a remarkable 25% increase in Popcat’s daily trading volume, which is now $151 million. As these whales stock up on POPCAT, the token has risen 20%, reaching approximately $0.067 earlier today. Popcat is now one of the top gainers among memecoins, fueling investor optimism.

Positive Outlook And Market Sentiment

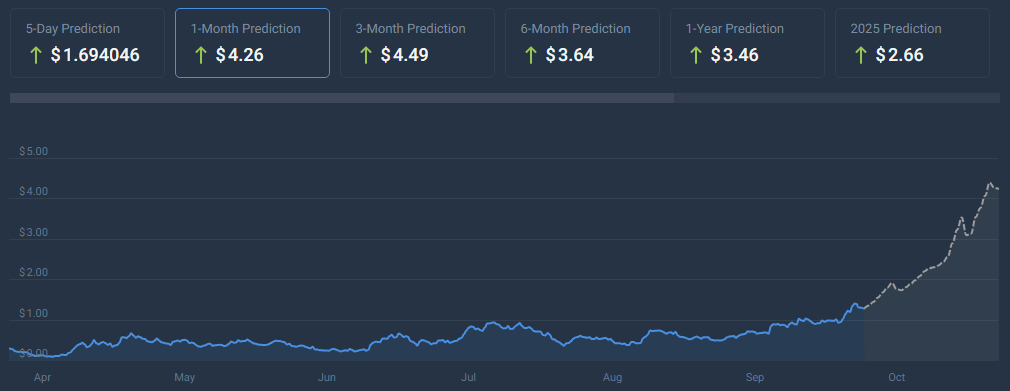

According to CoinCodex, Popcat’s current price projection indicates a potential 220% increase, with a rise to roughly $4.26 by November 7, 2024. Technical indications point to a bullish market attitude, but the Fear & Greed Index is at 49, indicating a neutral investor stance. Popcat has performed well on 20 of the last 30 days, resulting in a strong 67% success rate.

The considerable price volatility of 23%, in conjunction with the persistent upward trend, suggests that investors are in an opportunistic trading environment. The current market atmosphere and Popcat’s exceptional past performance make it a favorable time to contemplate purchasing, according to market analysts.

Navigating Volatility

The future of Popcat looks good, although experts advise to tread carefully as the token is very volatile. The price movements are fast, and among the very important supports set around the levels of $0.50 and $0.40-0.45; a bounce from those levels could be an indication that the bullish momentum is still intact.

Many believe Popcat is well-positioned for growth despite some risks, given its leadership role in the current “Cat Season,” the colloquialism for growing popularity in cat-themed cryptocurrencies. The meme coin also has exhibited a solid 6-month result with an increase of 17% in the given timeframe.

This still sounds rather optimistic when talking about Popcat, given the whale activity and positive predictions. The investor needs to be watchful of market volatility here. Therefore, entry points have to be carefully assessed and a balanced approach has to be maintained. Any investment in the cryptocurrency space, especially memecoins, like Popcat, does call for tempering enthusiasm with prudence and serious research before any commitment is made.

Featured image from Vecteezy, chart from TradingView