The post American Singer Big Bet, Buys 1.66M SUNDOG Tokens appeared first on Coinpedia Fintech News

The popular American singer Ty Dolla Sign made a big bet on the Sundog (SUNDOG) meme coin. On October 8, 2024, Ty Dolla made a post on X (previously Twitter) that he had bought a significant 1.66 million SUNDOG tokens for $502,000, and added, “send SUNDOG to Moon.”

Ty Dolla Sign Purchases $502K in SUNDOG Tokens

Following his post on X, the prominent blockchain transactions tracker Lookonchain provided further details of the purchase. In their post on X, lookonchain noted that to acquire this substantial amount of SUNDOG meme coin, the celebrity spent over 3.2 million of TRX worth $502,000 in a single transaction.

Current Price Momentum

As this purchase came into the spotlight, the SUNDOG token price surged but later cooled off. At press time, the meme coin is trading near $0.2605 and has experienced a price surge of over 6.5% in the past 24 hours. During the same period, its trading volume increased by 4.5% indicating growing participation from traders and investors amid the celebrity purchases.

SUNDOG Technical Analysis and Upcoming Levels

According to expert technical analysis, the SUNDOG meme coin is currently facing strong resistance at the $0.272 level and has been struggling to break through this level for the past week.

Based on the historical price momentum, if the meme coin breaks through this resistance level and closes a daily candle above $0.30, there is a strong possibility that SUNDOG could soar by 25% to reach $0.36 in the coming days.

However, this celebrity purchase is a positive sign for SUNDOG holders and has the potential to influence the price in an upward direction.

Bearish On-Chain Metrics

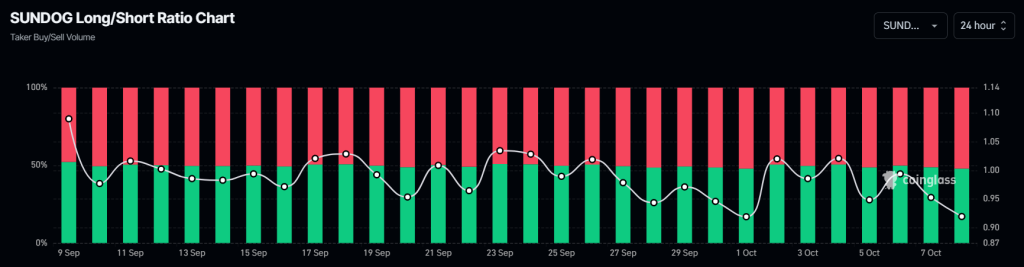

In addition to the technical analysis, on-chain metrics flash a bearish sentiment among the traders. According to the on-chain analytics firm Coinglass, SUNDOG’s long/short ratio currently stands at 0.919, indicating a bearish market sentiment.

Additionally, its open interest has increased by 3.9% over the past 24 hours and has been steadily rising. This rising open interest indicates traders’ shorts positions are currently increasing, which is a negative sign for SUNDOG holders. Currently, 52.11% of top traders hold short positions, while 47.89% hold long positions.