The post Bitcoin Price Analysis: Can Historical Trends Predict a Surge in 2025 appeared first on Coinpedia Fintech News

Bitcoin has experienced a rise of 8.01% in the last three months; notably, in the last 30 days alone, it has witnessed a growth of 13.9%. Currently, the BTC market is trying to recover from the fall it suffered on the first day of October due to the Israel-Iran crisis. A recent post on X by cryptocurrency trading expert Bob Loukas urges traders to view the market from a different angle. It draws traders’ attention to the four-year cycle of Bitcoin. What his analysis of the cycle indicates is simply sensational. Could BTC be heading towards an ‘Explosive Growth’ Phase?

Bitcoin’s Four-Year Cycle and Its Significance Explained

Crypto expert Loukas’s post explains that the Bitcoin market is nearing the end of the second year of its 4-year cycle.

The previous year, the market recorded a price change of +155.4%. This year, as of today, the market has reported a +47.7% change. The expert claims that the third year of the cycle has historically seen explosive growth, suggesting that next year the market can expect ‘tremendous growth’.

In the third year of the previous cycle, the market reported a price change of +59.6%. In 2017 and 2013, the market displayed +1,369% and +5,435%, respectively. Since 2011, the market has seen at least three complete cycles, and the latest is the fourth one. Notably, in the first and the second cycles, the third year was the best performer in terms of price change. In the third cycle, the second year of the cycle, with +304.1%, and the first year, with +90.9%, outperformed the third. However, the previous cycle’s deviation from the pattern was not surprising, as that cycle occurred during the COVID-19 crisis.

Bitcoin Market Sentiment: About The 8-Month Base

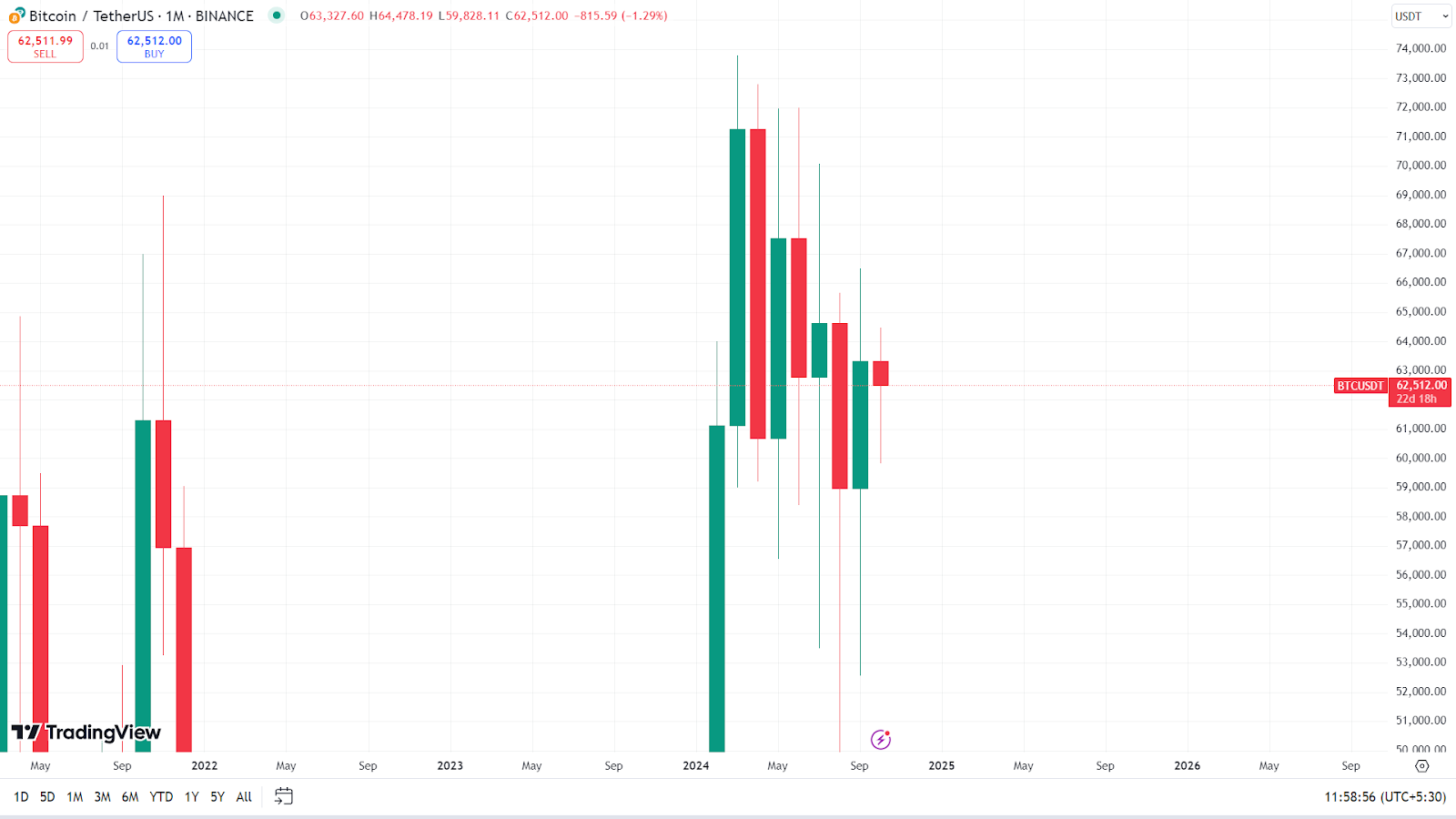

Loukas points out that over the past 8 months, the Bitcoin market has built a solid base.

The one-month chart of Bitcoin shows that this year the market has created at least four long bullish candlesticks; the longest one was formed in February. Since March, the market has been fluctuating between $71,319 and $58,938. The expert believes that the potential base the market has created will act as a support for its future upward movement.

The expert also highlights the favorable crypto market environment created by the new trend of easing interest rates.

In conclusion, Loukas’s post provides another reason to expect exceptional bullish momentum in the Bitcoin market in 2025.

(@BobLoukas)

(@BobLoukas)