The post SUI Price Falls Under $2, Will a Reversal Top $3 Amid Strong Network Activity? appeared first on Coinpedia Fintech News

With a 2.66% pullback in the past 24 hours, SUI has lost its dominance over the $2 psychological mark. Currently, the SUI price is trading at $1.92 with a market cap of $5.30 billion.

Will the pullback in SUI result in an intense correction, or will the next support ignite the $2 breakout rally? Check out our price analysis and a reflection on the SUI network to find the breakout chances.

SUI Price Analysis

In the daily chart, the SUI token reveals a rounding bottom reversal, reaching the neckline at $2.07. However, the higher price rejection near the neckline results in an evening star pattern, starting with the 1.51% drop yesterday.

The 50-day, 100-day, and 200-day EMA maintain a positive trend in a bullish alignment, heading higher to provide dynamic support. Meanwhile, the MACD and signal lines take a sideways shift and remain uncertain.

SUI Network Health

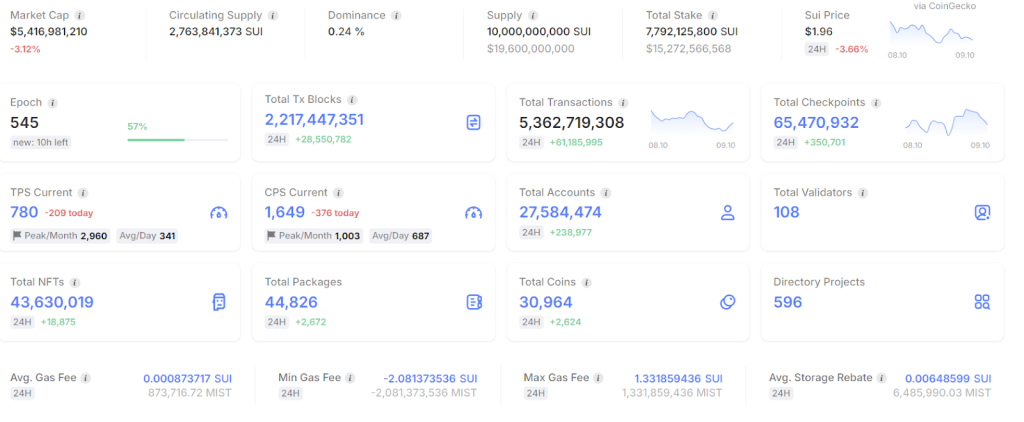

Despite the minor intraday pullback in SUI price, SUIscan reveals an overall healthy network activity. The total transaction blocks have increased by 28.55 million in the past 24 hours and currently stand at 2.21 billion blocks.

Meanwhile, the total transactions in the past 24 hours have increased by 61.185 million, hitting 5.362 billion transactions.

However, the number of transactions per second has dropped by 209 today, with the average transactions per day standing at 341. Surprisingly, the total NFTs in the SUI ecosystem have increased by 18,875 in the past 24 hours to hit the 43.63 billion mark.

The total volume logged over the SUI blockchain stands at 1.05 billion. Meanwhile, the number of new accounts over the past seven days has increased by 14%.

Will SUI Price Cross $1.75?

The intraday candle has a 3.50% drop, as the SUI price action has revealed a bearish candle. Based on the Fibonacci levels, the overhead reversal is approaching the next crucial support at 78.60% at $1.74. The following support for the altcoin stands near the $1.50 psychological mark.

In a bullish continuation, the neckline breakout will likely result in a 50% hike to reach the 1.618 Fibonacci level at the $3.00 mark.

Wondering if the bull run in SUI will surpass $2 in 2024? Find out now in Coinpedia’s well-rounded SUI price prediction!