The post Bitnomial Fights SEC Over XRP Futures – What Happens Next? appeared first on Coinpedia Fintech News

Bitnomial, a digital asset exchange, is pushing back against the SEC. The SEC says that XRP futures should be treated as securities. Bitnomial disagrees. This legal fight could have big consequences for crypto trading in the U.S. Let’s break it down.

The SEC vs Bitnomial: What’s the Fight About?

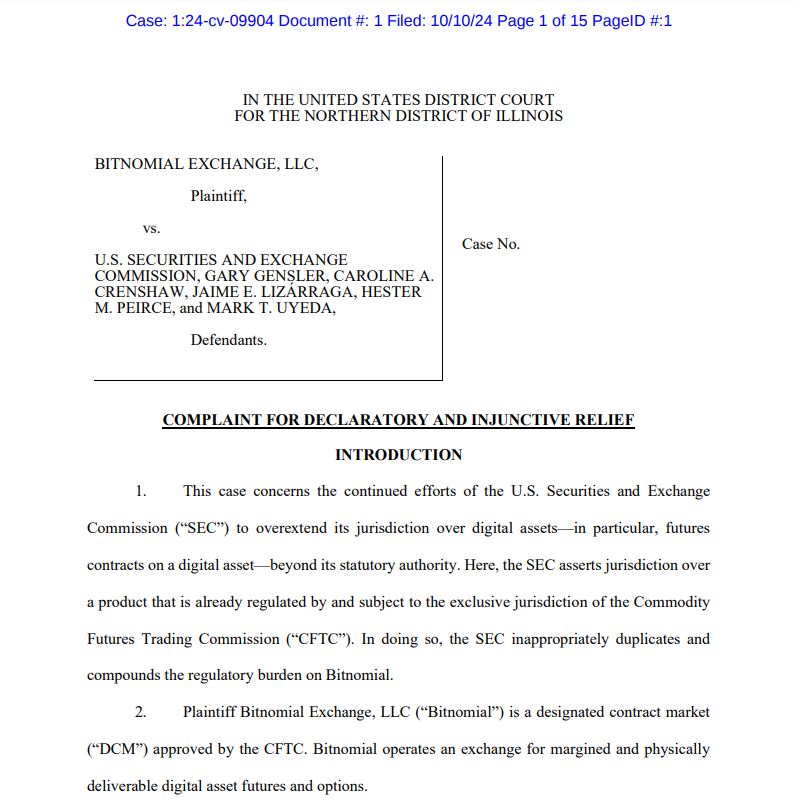

Bitnomial created an XRP futures contract and got it approved by the Commodity Futures Trading Commission (CFTC). But then the SEC stepped in. They said XRP futures are “security futures.” This means Bitnomial would need to follow extra rules, including registering as a national securities exchange before offering the contract. Bitnomial thinks the SEC is wrong.

The exchange argued that XRP futures should not be treated as securities but as commodities just like BTC and ETH. Also, the SEC is trying to slow the growth of crypto space by trying to control how XRP futures are handled. That is the reason why Bitnomial decided to file a lawsuit against the Commission.

Why Is This a Big Deal?

This is not the first time the SEC has messed with some crypto company. The Ripple case is long going and other firms like Binance and Coinbase are also facing similar issues. But Bitnomial’s case is different. They have a clean record, and their focus on XRP futures makes this case different. It could change the way crypto derivatives are regulated in the future.

Other crypto companies are also taking a stand. Last week, Crypto.com filed a lawsuit against the SEC, saying the agency is going beyond its legal power.

What to Expect Next?

This fight won’t be over anytime soon. Ripple is also fighting the SEC. After being told to pay $125 million, they filed an appeal. Both sides are ready to battle it out in court. Bitnomial’s lawsuit adds even more pressure on the SEC. More companies are challenging how the SEC handles crypto assets. So, it’s likely this legal battle will drag on for a while.

No matter how it ends, Bitnomial’s case will shape the future of crypto trading in the U.S. Whether they win or lose, everyone in the crypto world is watching closely.