The post Neiro Jumps 52% While Bitcoin Struggles: Will the Rally Last? appeared first on Coinpedia Fintech News

Neiro is surprising everyone right now. While most of the crypto market, including Bitcoin and Ethereum, is down, Neiro has surged by 52.65% in just the last 24 hours. It’s currently trading at $0.089. Pretty wild, considering how things have been for other cryptos. Let’s dive deeper and analyze what is happening.

Why is Neiro Surging?

Neiro’s price is climbing, and it’s turning heads. So, what’s behind the surge? Well, first, its daily trading volume just shot up to $62.04 million in the past 24 hours. That’s a massive 277.85% increase from the day before! A lot of this activity is happening on popular exchanges like Uniswap V2, Bybit, HTX, Gate.io, and Kucoin, which shows people are paying attention.

Also, Neiro’s market cap has jumped to $87.31 million. Just a few days ago, it wasn’t nearly this high. Though it’s still not near its peak of $0.2906 from early August, this recent jump has given Neiro a nice push forward. If Neiro keeps going, it could see even more gains.

The price of Neiro token has been moving in a symmetrical triangle since it started moving down from its all time high on August 7. It is forming lower highs and higher lows. This suggests that the token is gearing up for a potential breakout in the upcoming days. However, it would be very difficult to say which direction the breakout will open.

Should We Worry About the Whales?

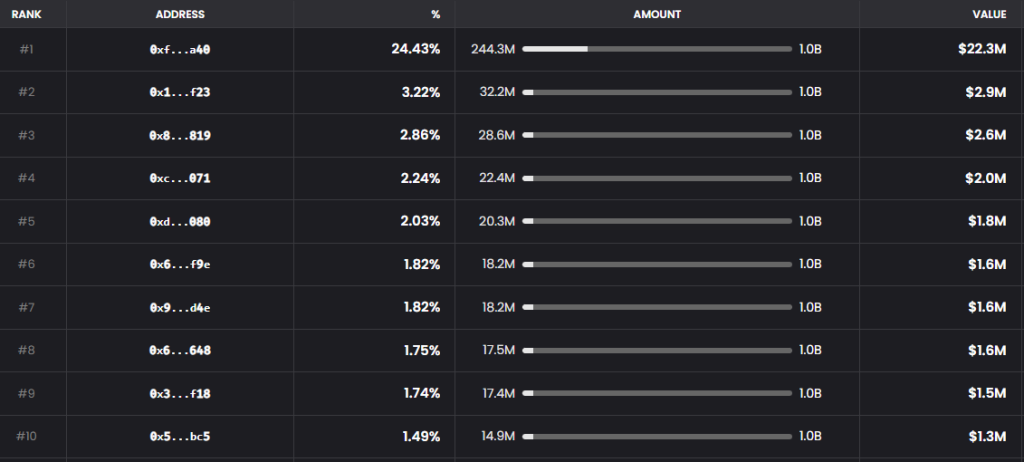

Now, here’s where it gets tricky. While a lot of people are excited about Neiro’s rise, some are a bit worried. Why? Because more than 44.64% of the total supply is controlled by just 10 holders—whales. The top holder has 24.43% of the total supply according to dexscreener. That’s a lot of power in a few hands, and it could lead to some price manipulation if these big players decide to move their coins around.

It’s not just the whales causing concern. Major algorithmic trading firms, like GSR, have been quietly accumulating large amounts of Neiro. According to recent data, GSRMarkets recently bought 15 million $NEIRO tokens, which increased their holding from $939K to $1.17 million in just three days. Other whales have also been active. One account withdrew 4.065 million Neiro from Bybit nine hours ago, while others swapped large amounts of Ethereum for Neiro, raising some eyebrows about the token’s future.

What Happens Next?

Neiro’s rise is part of a larger trend in meme coins. According to CoinGecko, the total market cap of meme coins has surpassed $52 billion. That’s a huge amount of money in a sector that many consider risky. While Neiro’s growth is exciting, there are some things to be cautious about. With so much of the supply in the hands of just a few players, the risk of manipulation is real. It’s tough to say what’s next—whether Neiro keeps climbing or if the whales will make their move. Only time will tell.