According to data from CoinMarketCap, Bitcoin (BTC) gained by 4.08% in the last 24 hours as it briefly traded above the $63,000 price mark. Notably, this price rise comes following a decline that saw the market leader trade below $59,000 on Thursday. While the market sentiment is currently bullish, certain conditions are needed to procure an actual bullish breakout.

Bitcoin On The Brink Of Short-Term Bullish Run

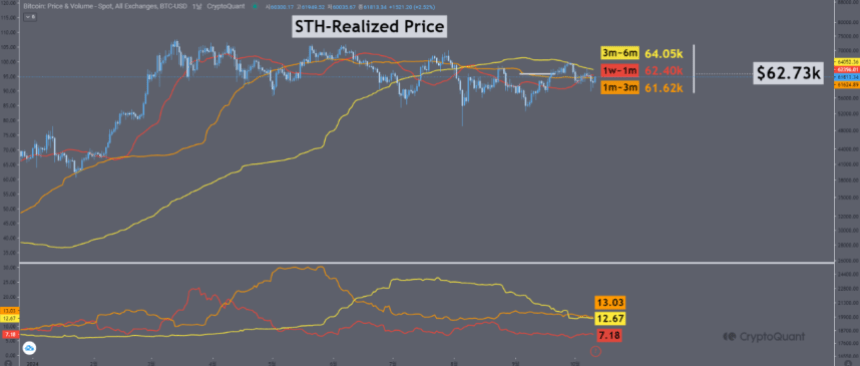

Following Bitcoin’s price ascent to around $62,000 on Friday, CryptoQuant analyst with the username Yonsei_dent shared a key insight on the asset’s potential price movement.

In a Quickake post, Yonsei_dent highlights $62,700 to be the key price level for short-term holders i.e. $62,700 represents the average price at which many short-holders acquired Bitcoin, which the analyst states has remained consistent for the last three months.

Therefore, this presents a critical price level for BTC, a movement above which signals a change in a market shift and can spur buying activity from short-term holders. However, Yonsei_dent notes that Bitcoin needs to rise above $63,000 to initiate a significant bullish momentum over the coming weeks.

Since this price commentary, Bitcoin has traded above $63,000, albeit temporarily before retracing to around $62,300. This brief breakout can be traced to a lack of significant trading volume, a condition critical to the short-term bullish breakout deceived by Yonsei_dent.

Currently, Bitcoin’s trading volume is valued at $30.75 billion, however, reflecting only a minor 2.94% gain in the last 24 hours. If the price of BTC returned above $63,000 with a marked increase in trading activity, the premier cryptocurrency could rise to around $67,000, at which lies its next significant price resistance level.

Bitcoin Approaches Critical November

In contrast to popular sentiments, Bitcoin has so far experienced a rather tumultuous experience in October. And while the crypto market leader may eventually pull off an “Uptober”, November is shaping up to potentially provide the needed bullish drivers for the BTC market. Firstly, investors expect the Federal Reserve to implement a 25 basis points cut which would avail more liquidity for volatile assets such as Bitcoin.

Furthermore, the upcoming US elections have also gained significant influence in the crypto market with digital asset regulation becoming a major policy discussion. If pro-crypto Republican candidate Donald Trump secures victory over Vice President Kamala Harris, analysts are hopeful the Bitcoin bull run will finally take off.

At the time of writing, Bitcoin trades at $62,697 reflecting a 1.07% gain in the last week.