According to the latest on-chain data, demand for Bitcoin, the world’s largest cryptocurrency, has been picking up pace over the last few days. The question here is — can this growing pressure jumpstart the Bitcoin bull run?

Can The Latest Demand Spike Restart The Bull Run?

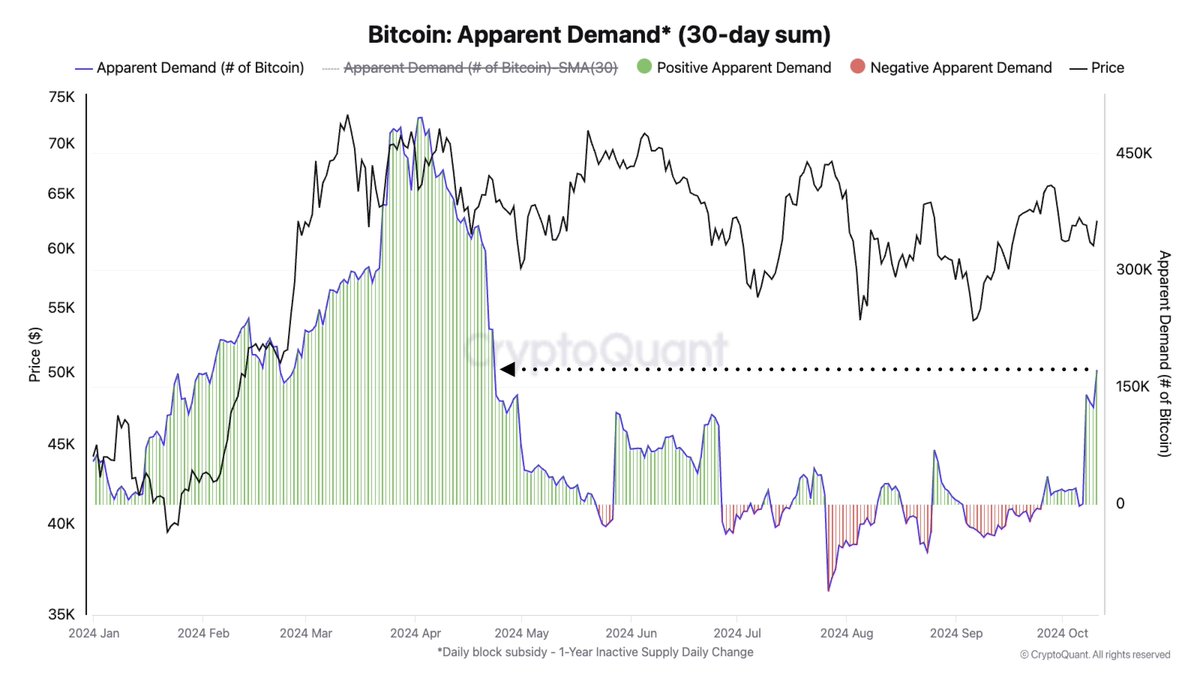

CryptoQuant’s head of research Julio Moreno took to the X platform to share an interesting on-chain observation about Bitcoin and investors’ appetite over the last few weeks. According to the on-chain expert, apparent demand for BTC is growing at its fastest monthly pace since April 22.

This on-chain revelation is based on the apparent demand metric, which measures the difference between the daily total Bitcoin block subsidy and the daily change in the amount of Bitcoin held for one year or longer. This metric reflects how much BTC is in active circulation and is being demanded by the market.

As earlier reported, the Bitcoin apparent demand has been in a steady decline since April when the price of Bitcoin hovered around the $70,000 mark. The Bitcoin demand has sometimes trended towards the negative over the past six months, precipitating a relatively quiet market climate.

In an October 2 report, CryptoQuant revealed that the flagship cryptocurrency might be entering a period of positive seasonal performance, especially as the Q4 of all halving years is historically bullish. However, the on-chain analytics firm highlighted that increasing demand is one of the critical factors that must align for the BTC price to resume its bull run.

With the pace of demand growth now back in the April levels, it appears that Bitcoin price might be gearing for a run to the upside. Hence, there is a higher likelihood of the premier cryptocurrency returning to its all-time high price and potentially printing a new one in Q4 2024.

However, Moreno noted in his post that the demand momentum remains in the negative at the moment. The CryptoQuant head of research said that although “there is still more selling than buying, the scale of this imbalance has eased.”

Bitcoin Price At A Glance

As of this writing, the price of BTC sits just above the $63,000 mark, reflecting a mere 1.1% rise in the last 24 hours. According to data from CoinGecko, the premier cryptocurrency is up by more than 2% in the past week.