The post Sharpe Ratio Signals Low Risk for TON: What Investors Should Know? appeared first on Coinpedia Fintech News

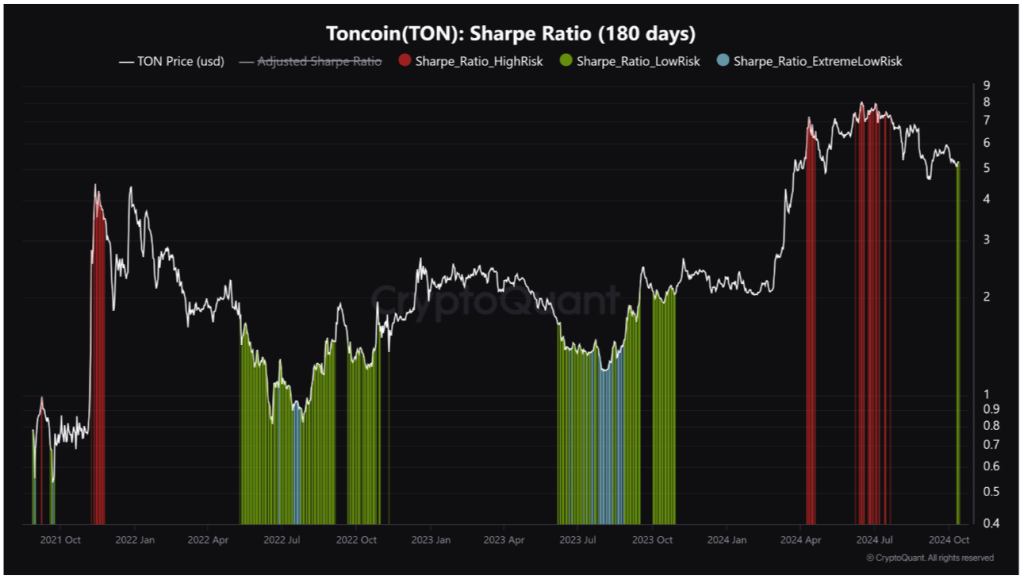

The Sharpe Ratio for TON has recently shifted into a low risk zone for the first time in a year. Although this might seem like a positive signal for potential buyers, it’s worth considering the broader context before making any decisions. TON’s price has fluctuated significantly over the past year, moving from $2 to $8 and now stabilizing around $5.26. But is this low risk signal really as encouraging as it appears?

Historically, when TON entered this “Low Risk” zone, it didn’t always translate into immediate gains. In fact, it often suggested that the market was nearing a bottom, but not quite there yet. If you’re looking for a clear and safe entry point, caution may be warranted. TON has shown unpredictable behavior, and further market movement could still be on the horizon.

Price Stability or Hidden Risk?

The cooling off of the Sharpe Ratio might suggest some level of stability, but the reality has been different for TON this year. Its price surged to $8 before retreating to $5.25, and while that seems less volatile, historical patterns show that “low risk” signals haven’t always prevented further price drops.

Another concern is the 20% decline in trading volume over the past two months, indicating reduced interest among traders. This drop in activity could signal wavering confidence in the market, which raises questions about the reliability of the low-risk indicator.

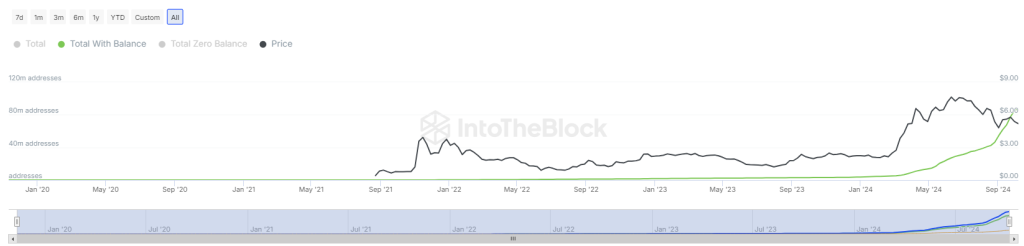

Growing User Base, But Price Remains Unaffected

On the positive side, TON’s user base has grown rapidly, surpassing 100 million unique users. However, it’s important to note that user growth does not always translate into immediate price increases. Despite this surge in users, TON’s daily transaction volume has remained stagnant for the past six weeks. This disconnect between user growth and price movement suggests that other factors may need to align before we see a significant price shift.

Conclusion: A Time for Caution

While the Sharpe Ratio’s low-risk signal may seem tempting, a closer look at TON’s price history and declining market volume suggests a cautious approach. It may be wise to keep this asset on your watchlist and wait for a more definitive low-risk signal before making a move. Patience could prevent potential losses, so staying informed and watching the data closely is essential.