The post Trump-Backed WLF Launches Despite Website Crash – What’s Next? appeared first on Coinpedia Fintech News

World Liberty Financial (WLF), a crypto project backed by the Trump family launched on October 15 with high expectations. However, soon after the launch the project website struggled to handle a flood of traffic. This led to a few unexpected technical hiccups. But despite these early challenges, token sales for the platform’s governance token, WLFI, took off. Let’s dive deeper into what went down.

A Rocky Start, but the Tokens Keep Selling

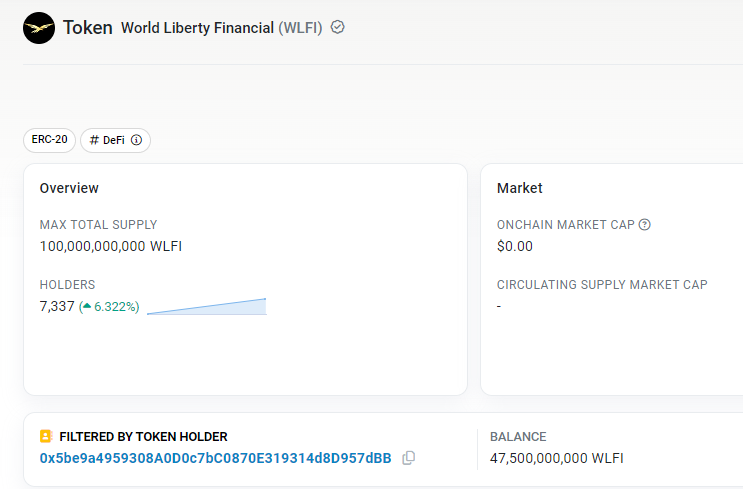

As soon as WLF launched on Tuesday, the website couldn’t cope with the number of visitors, crashing multiple times. Still, that didn’t stop around 3,000 eager investors from snatching up 344 million WLFI tokens in the first hour. That might sound like a lot, but it’s just 1.7% of the 20 billion tokens up for public sale. The project aims to raise a massive $300 million, and despite these bumps, they’ve already raised $5.7 million in ether (ETH), $1.6 million in tether (USDT), and $300,000 in USD Coin (USDC) by the day’s end. Currently there are 7,337 holders of WLFI token.

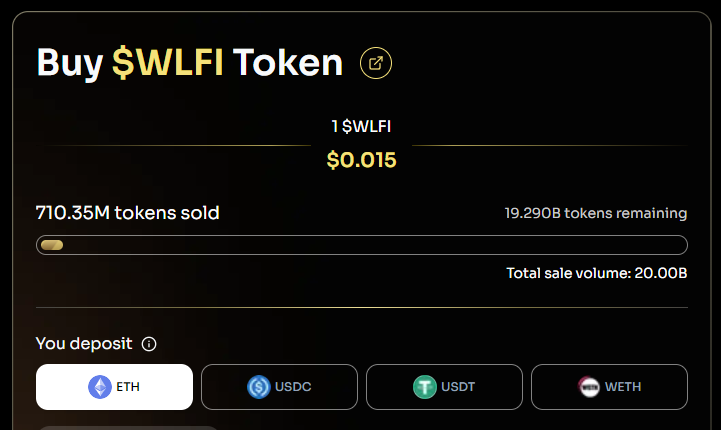

The project has sold 710.26 million tokens out of the 20 billion for sale. The purchase price for 1 $WLFI is set to $0.015, that means the project has raised over $10 million at the time of writing.

What Makes WLFI Tokens Different?

The WLFI token is not just a thing to buy and sell, it bears more purpose. The token bears the voting power in WLF’s governance. This allows the holders to cast their votes on important decisions for the platform. The decisions might be for protocol upgrades, partnerships or changing security measures. The WLFI token holders will have a say in all that. However, there’s a catch: these tokens are non-transferable and locked in a smart contract unless the rules change in the future.

What’s Next for World Liberty Financial?

WLF has big plans. The platform hopes to carve out a niche in the decentralized finance (DeFi) space by offering services like borrowing, lending, and creating liquidity pools. Supporting U.S. dollar-based stablecoins, they also want to keep the U.S. Dollar as a dominant global currency through decentralized financial tools. Their “gold paper” promises compliance with U.S. financial laws and lays out their strategy for the future.

The project has also leveraged the Trump name, with Donald Trump acting as the “chief crypto advocate” and his sons as “Web3 ambassadors.” Their goal? Use their influence to bring Web2 users into the world of Web3. It’s still early days, but the team is off to an ambitious start.

What to Expect

Even though the launch of WLF faced several technical difficulties, investors’ interest is at peak. The project raised millions within hours of its launch. It focuses on DeFi services and follows U.S. laws. WLF aims to make a lasting mark in cryptocurrency. Stay tuned for updates as the platform adds new features and works to stabilize.