The post U.S Election 2024: Why Trump’s Crypto Moves Could Lead Him to Victory in 2024 appeared first on Coinpedia Fintech News

The odds for Donald Trump in the 2024 U.S. presidential election are looking stronger than ever. On Polymarket, a decentralized prediction platform, Trump is pulling ahead of Kamala Harris by a solid 16%. With his pro-crypto stance and involvement in decentralized finance (DeFi), Trump’s popularity is growing rapidly, especially among cryptocurrency enthusiasts. So, what’s really behind this surge, and could it be a sign of things to come?

Trump vs. Harris: A Surprising Lead

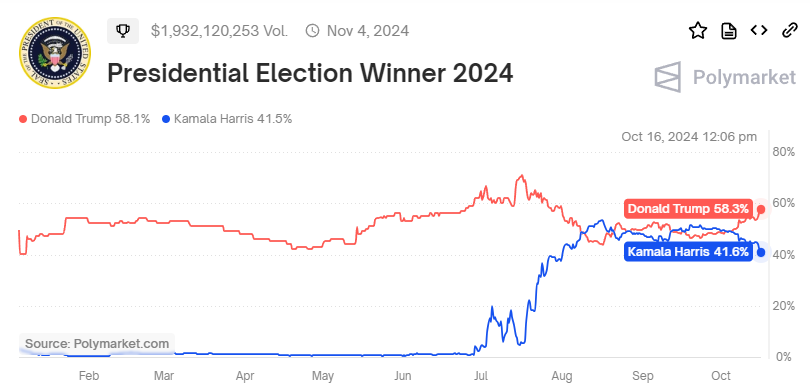

As this week started, the odds of Trump winning started to rise on Polymarket. Currently he has a 58.3% chance of winning while Harris just has 41.5%.The betting volume related to the U.S. elections is massive. It has reached $1.9 billion. On October 3, Kamala Harris and Donald J. Trump had the odds of 49.7 and 49.5 respectively.

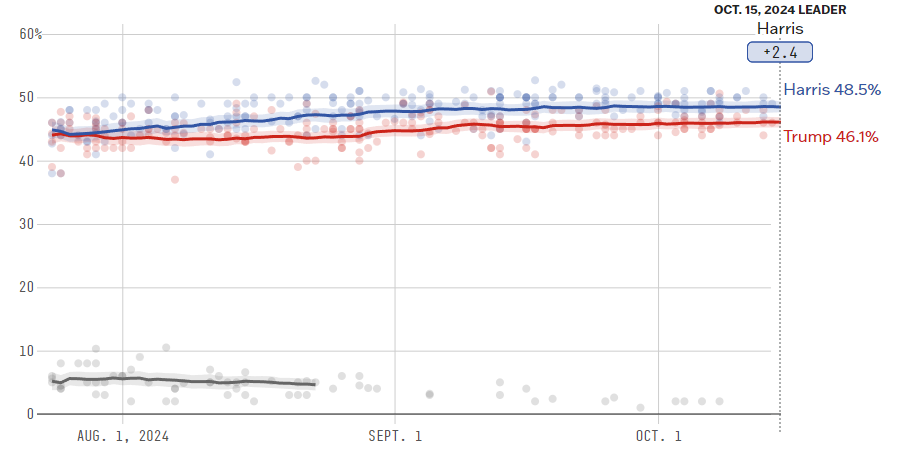

However, it is worth noting that these predictions offer a glimpse into public opinion and the national polls tell a different story. However, according to website FiveThirtyEight, Harris is leading the stage by 2%, where Harris has an odds of 48.5 while Trump is at 46.1%. There arises a question if the polymarket users are biased for Trump? Experts suggest that because real money is on the line, the people are betting on actual outcomes.

Crypto’s Role in Trump’s Popularity

Trump has started to receive a massive support and fan following since he started talking in support of crypto. His support towards a recently launched World Liberty Financial (WLFI) has brought him in the good eyes of crypto investors. The project has sold around 710 million tokens, raising $10 million in funds. This success has likely played a part in raising his odds on Polymarket. The Republican candidate has been very vocal about Bitcoin and how he wants to make a nurturing environment for crypto in the U.S. This brings major support from crypto people.

What to Expect

The real results for this race between Trump and Harris will arrive in 19 days. As the day is approaching, the market is filled with excitement. The race between the two Presidential candidates is very tight. While Trump has huge support from crypto people, Harris is concentrating on regulations and minority investors.