Bitcoin’s recent market activity reveals significant shifts in demand and accumulation patterns among large holders, suggesting potential influences on its price trajectory. The top cryptocurrency’s price surged from around $40,000 in January 2024 to above $70,000 by March before retracing. It has recently begun to again threaten $70,000, coinciding with notable increases in apparent demand and whale holdings.

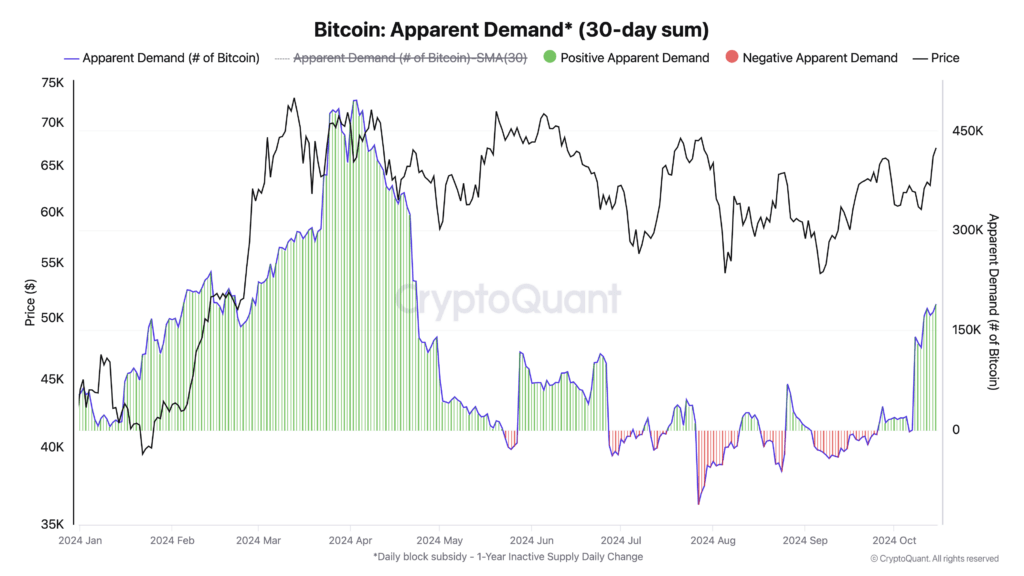

Data indicates that the apparent demand for Bitcoin rose sharply in early 2024, aligning with the price escalation. Positive demand periods, marked by increases in demand relative to previous intervals, were prevalent during this time. A renewed surge in demand appears to have again fueled the recent price hike, demonstrating a strong correlation between demand trends and market valuation.

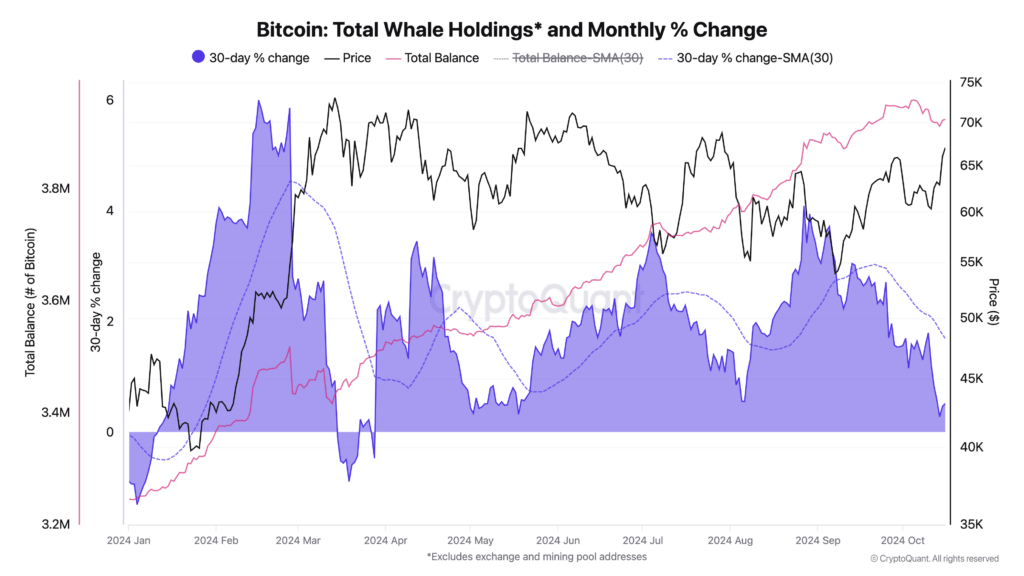

Whale holdings—accounts holding substantial amounts of Bitcoin—also exhibited significant activity. Total whale holdings increased steadily from approximately 3.2 million BTC at the start of the year to over 3.7 million by October.

The monthly percentage change in these holdings spiked between January and April, reflecting rapid accumulation as prices climbed. However, the middle of the year saw fluctuations, with steep drops in holdings during June, followed by a robust recovery approaching October.

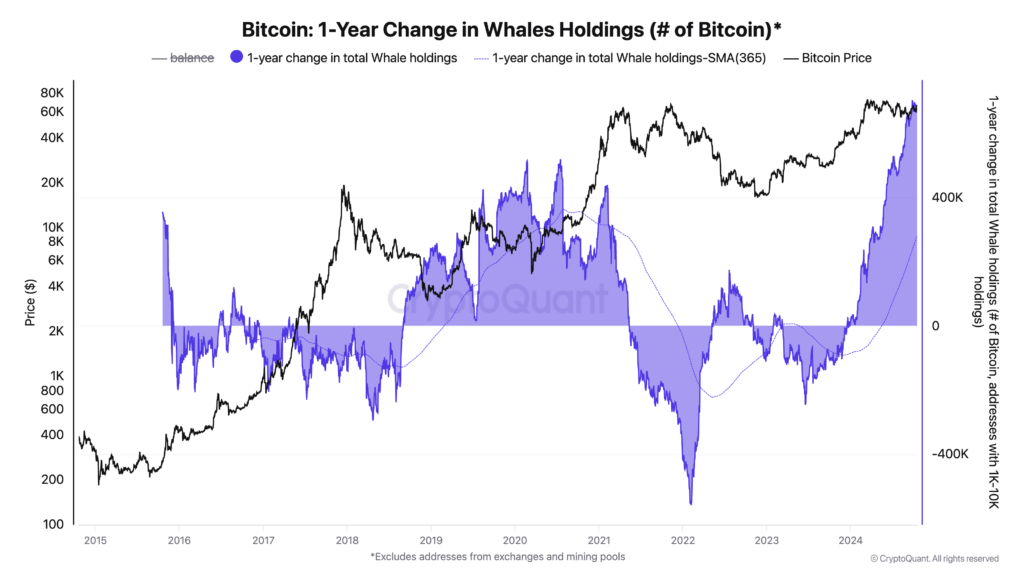

Long-term analysis shows that whale behavior often mirrors major market movements. Periods of increased whale accumulation have historically corresponded with significant upward price trends. For instance, substantial accumulation occurred during the 2020-2021 bull run, with whales adding to their holdings as Bitcoin’s price escalated. Conversely, after price peaks, whales tend to reduce their holdings, suggesting strategic profit-taking or market repositioning.

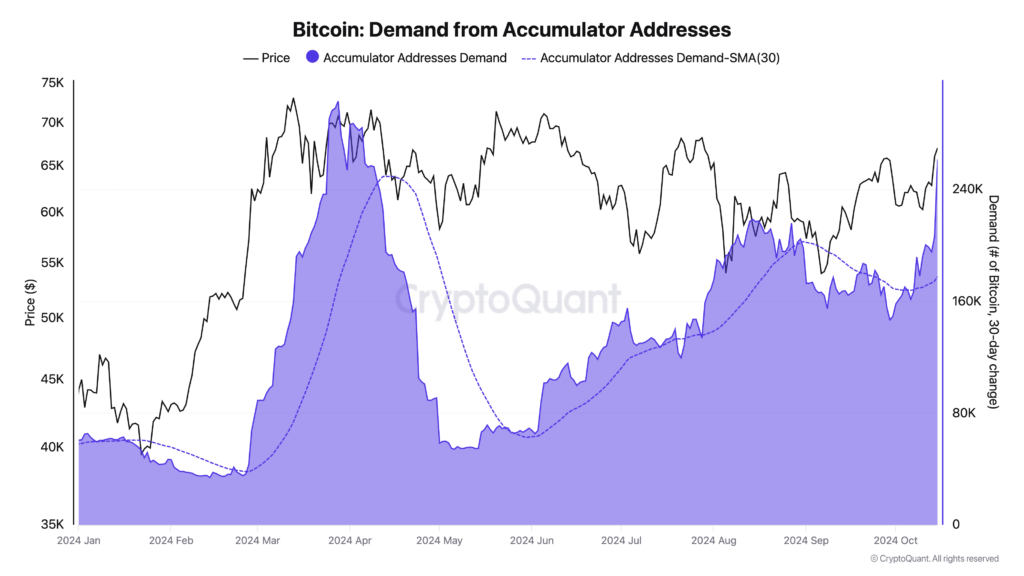

Accumulator addresses—wallets that hold or consistently increase their Bitcoin holdings—also play a crucial role in the market forces of 2024. Demand from these addresses has begun rising rapidly this month, closing in on the peak from Bitcoin’s all-time high price in late March.

The interplay between these factors highlights the influence of large holders on Bitcoin’s market behavior. Whales and accumulator addresses appear to act in anticipation of price movements, accumulating during upswings and adjusting holdings during downturns. Their activities reflect market sentiment but may also contribute to price volatility.

While the correlation between demand, whale activity, and price is evident, causation remains a complex topic. Market forces are influenced by a myriad of factors, including macroeconomic conditions, regulatory developments, and broader investor sentiment. However, the observed patterns suggest that monitoring whale holdings and accumulator demand can provide valuable insights into potential market trends.

As Bitcoin matures as an asset class, understanding the behaviors of its largest holders continues to be increasingly important. Their actions can signal shifts in market momentum and offer clues about future price movements. The accumulation patterns observed this month may indicate strategic positioning by large investors, potentially setting the stage for the next significant market phase.

The post Bitcoin accumulation fuels market uptick signaling potential surge in price appeared first on CryptoSlate.