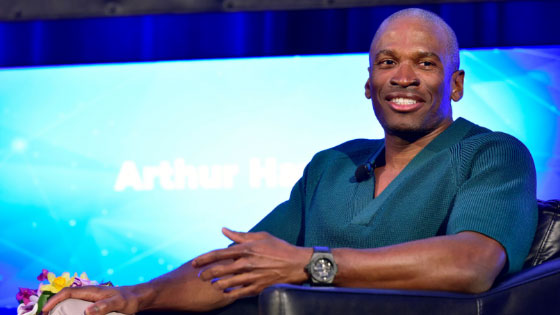

Better times for Bitcoin may lie ahead as the co-founder of BitMEX feels that the current geopolitical tensions in the Middle East may only push the cryptocurrency to rise higher. According to Arthur Hayes, the effects of war would resonate intensely in the US economy in the form of increased government spending and inflationary levels of monetary policy.

Hayes believes more borrowing will ensue with increasing military spending and that this borrowing will be serviced by more balance sheet expansion by the Federal Reserve and commercial banks, all ultimately to the detriment of the US dollar.

Hayes is quick to note that in times when traditional fiat currencies are weakening, Bitcoin stands to gain because it acts as a hedge against inflation. The recent increase of the US Producer Price Index to 1.8% over market expectations resonates against inflation concerns and goes in favor of the investors seeking safety from declining fiat money.

The War’s Impact On Bitcoin & Monetary Policy

Hayes draws on history to support his hypothesis, saying US intervention in wars tends to lead to money printing, which can benefit Bitcoin’s price. He then continues to state that there is an analogy to be drawn between the ’73 energy crisis and how gold behaved as a hard asset at growing inflationary levels. Hayes says Bitcoin, often dubbed “digital gold,” can soar significantly because of inflationary forces and money printing stemming from war-time expenditures.

He also highlights the likelihood of higher energy prices if Middle East conflicts turn more deadly, especially if there are strikes or even moderate damage to crucial infrastructure such as oil fields or other key facilities. In this scenario, inflation would worsen and tend to drive up demand for Bitcoin as a “stored energy” form in the financial markets. Hayes, naturally enough, cautions that if more macro-level instability takes hold, it will also cause market volatility.

Strategic Considerations For Investors

While he is optimistic about Bitcoin, he cautions and manages his risk prudently as he has been pulling his exposure on the smaller cryptocurrencies, hoping this will minimize losses when geopolitical tensions rage out of control.

He indicates that debt-financed, spending-friendly policies will not only continue funding long-term growth in Bitcoin but will also continue the historical trend exhibited throughout history. He notes that if Bitcoin can outpace the Federal Reserve balance sheet growth along historical time frames, it does the job of a hedge against weakening fiat currencies.

Hayes is cautious about impulsive trading due to political news: “You must preserve yourself and your capital.” People should invest capital in a store of value like Bitcoin, saving from the debasement of currency and purchasing power during uncertain times. As geopolitical instability continues, Bitcoin is still in a good position for further growth.

Featured image from DALL-E, chart from TradingView