Yet another reason that has given the rocket fuel to the price of Bitcoin is the rapidly approaching US presidential elections. Several analysts are keenly observing whether political dynamics will take their toll on the cryptocurrency in the near future with the election date nearing.

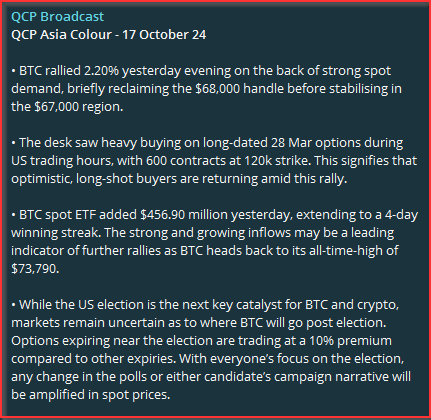

QCP Capital believes that the result of the presidential election might have significant influence on the trajectory of Bitcoin. This should be relayed in the current trading patterns as options contracts associated with the election are trading at a 10% premium, thus indicating increased market sensitivity towards political developments.

Who Is More Advantageous For Bitcoin: Trump Or Harris?

Former President Donald Trump has revealed that he now supports cryptocurrencies. This is a very significant U-turn since he used to outright bash the existence of cryptocurrencies. In his latest speech, he pushed how much it was essential to embrace digital currencies, stating that crypto was moving out of the United States because nobody appreciates it.

He advises the creation of a national Bitcoin stockpile and prevent the Federal Reserve from launching a digital currency. This approach aims to attract supporters and contributors of cryptocurrencies, hence maybe raising the value of Bitcoin should he be successful.

As for Vice President Kamala Harris, she hasn’t said much about it yet, but she is talking to some in the crypto community. That the campaign would seek to obtain crypto votes signifies that she is willing to reconsider her stance on digital currencies.

Although she may not fully embrace crypto as Trump has, her willingness to discuss the matter could indicate a more favorable regulatory environment in the event that she were to win.

Market Predictions And Reactions

Currently, Bitcoin is trading at approximately $67,685, and some analysts anticipate that it will shortly surpass its all-time high of nearly $74,000. Bitcoin ETFs have registered a decent amount of inflows in the last few weeks, which may have been a major factor to the recent increase in Bitcoin prices.

The Bitcoin ETFs experienced a $457 million inflow on October 16, which culminated in four consecutive days of advances. This favorable momentum implies that institutional investors are becoming more optimistic about the potential of Bitcoin.

Nevertheless, there is still a degree of uncertainty regarding the crypto market’s future, as the policies of both candidates could result in varying outcomes. Harris’s changing stance throws open possibilities of speculations on the future regulations that are likely to be made and Trump’s pro-crypto stand being seen as a positive for Bitcoin.

The Bitcoin market capitalization, which is still a figure of $1.3 trillion, according to some analysts, may make it less susceptible to high volatility by any verdict.

Meanwhile, QCP Capital believes this US presidential election will affect Bitcoin. Political changes are already affecting election options contracts, which trade at a 10% premium. As traders await policy changes from any candidate, QCP expects the election to influence Bitcoin’s future.

Featured image from Sky News, chart from TradingView